Rai Sahi winning the short game

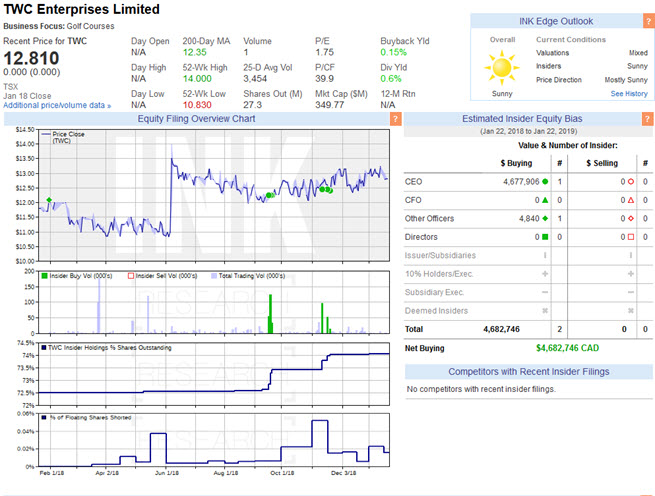

In the mid-January short report released by IIROC Monday, it caught our eye how little attention the shorts give to Rai Sahi's TWC Enterprises (Sunny; TWC). A minuscule 0.016% of the gold course operator's share float is shorted. Meanwhile, insider commitment is strong with insiders holding over 70% of the shares outstanding. The bulk of those insider shares are held by Mr. Sahi, who is also the CEO.

Indeed, the large insider position results in a tiny float, estimated by Thomson Reuters to be 7,522,041 shares. The small float is probably a key reason why shorts have been reluctant to take a position in the company. Given the stock's 8.5% return over the past year, the shorts were well served by focusing elsewhere.

A similar story can be told with Mr. Sahi's larger Morguard Corporation (Sunny; MRC) which is a member of the INK Canadian Insider Index. Only 0.142% of the real estate operator's share float is shorted, an amount well below average. The stock is down (-3.9%) over the past year, but that beats the S&P/TSX Financials which is off twice that amount (-7.8%).

Once again thanks to Mr. Sahi's large holdings (6,691,000 shares), the stock has a relatively small float of 4,507,318 shares. The strong insider commitment by the CEO is likely part of the story as to why the shorts have set their sights on other targets.

The post first appeared on INKResearch.com