RANKED: World's top 10 copper projects

For decades, the global demand for copper has been rising steadily, having tripled over the past half-century according to the International Copper Study Group. Demand for copper - a metal key to the green energy transition - is expected to keep rising over the coming years as emerging economies led by China continue to ramp up industrial activity.

According to the USGS, roughly 700 million tonnes of copper has been produced around the world so far, while identified deposits contain an estimated 2.1 billion tonnes of additional copper that have yet to be mined.

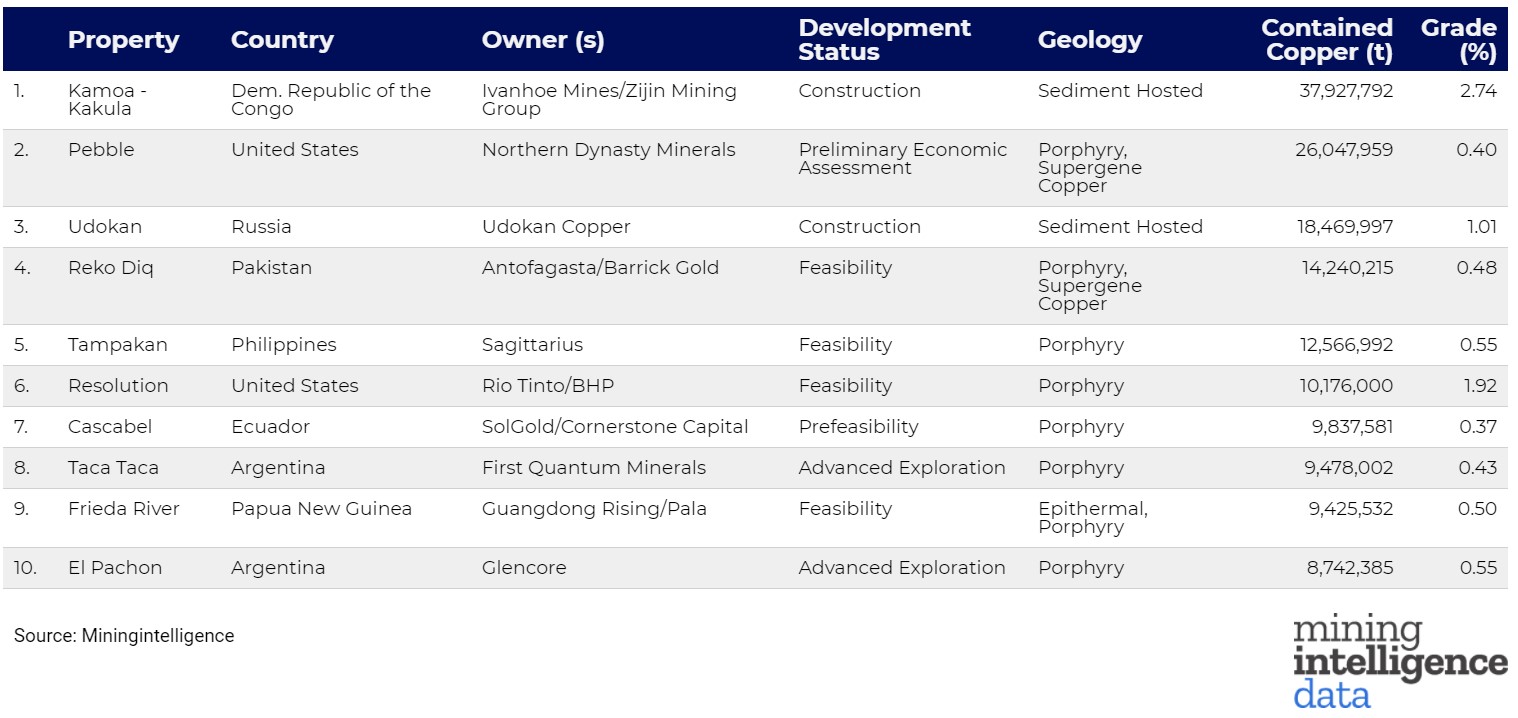

To provide a glimpse of the copper supply chain of tomorrow, MINING.COM and sister company MiningIntelligence compiled a list of the top 10 largest copper deposits currently under development and ranked them according to copper resources in the measured and indicated categories.

Leading the way is the Kamoa-Kakula underground project being developed by an Ivanhoe-Zijin joint venture in the Kolwezi district of Lualaba, Democratic Republic of Congo. Initial production at Kakula, the first of many high-grade mining areas, is expected to begin in July 2021. With an expected production rate of 18 million tonnes per annum, the project is expected to become the world's second largest copper mine, with an estimated production of 700,000 tonnes of copper a year.

The Kakula copper mine in the DRC is on track for first production in Q3 2021. Credit: Ivanhoe Mines.

In second place is the proposed Pebble mine located in the Bristol Bay region of Southwest Alaska, the status of which is still "up in the air" following rejection of the project's key water permit by US federal regulators in November. That decision is being appealed by project owner Northern Dynasty Minerals.

The third-biggest copper project is the Udokan deposit in Russia's Zabaikalye region, which, despite its early discovery in 1949, mostly remained idle due to technical challenges until recent years. Like Kamoa-Kakula, the Udokan project is also undergoing construction, with commercial production expected in early 2022.

Next up is the Reko Diq project in Pakistan, which has been in limbo for nearly a decade as the Government of Baluchistan said it considered the mining lease application to be incomplete and unsatisfactory.

This is followed by the Tampakan deposit found on the Philippine island of Mindanao. Sagittarius Mines, a joint venture involving Glencore, is currently seeking local and national approval for the proposed mine. If approved, it is estimated to yield an average of 375,000 tonnes of copper a year over a 17-year mine life.

Rounding out the top 10 list are: Rio Tinto-BHP's Resolution project in Arizona, SolGold's majority-owned Cascabel project in Ecuador, the Taca Taca deposit in Argentina held by First Quantum Minerals, the Frieda River project backed by the Chinese state and Pala Investments, and Glencore's El Pachon in Argentina.

Wafi-Golpu is located in the Morobe Province of Papua New Guinea (PNG). Image courtesy of Wafi-Golpu Joint Venture.

Falling just outside the top ten list are the Los Helados discovery made by NGEX Minerals in Chile and the Wafi-Golpu joint venture between Newcrest and Harmony Gold in Papua New Guinea.

Click here for an excel download of the Top 10 biggest copper projects from the MiningIntelligence database.