RANKED: World's top 10 gold projects

With gold prices hitting record highs over the past year, the question becomes whether the world can produce enough of the precious metal to keep pace with its rising demand.

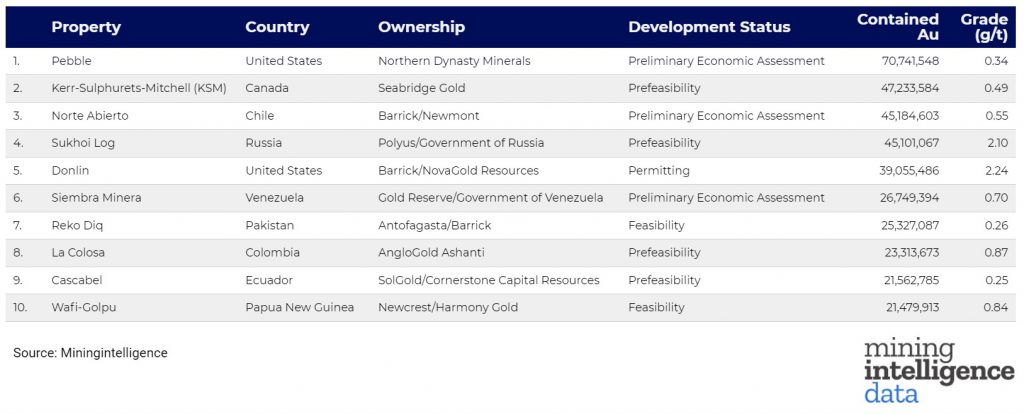

To give a better picture of the size and potential of the world's gold supply, MINING.com and sister company MiningIntelligence collaborated to provide a ranking of the largest undeveloped gold deposits around the globe that could one day become integral to the global gold supply chain.

While the ranking is based on the projects' total measured and indicated resources, many companies include proven and probable reserves that can be economically extracted in resource estimates.

Topping the list by a wide margin is the Pebble mine project located in the Bristol Bay region of Southwest Alaska, which contains nearly 71 million gold ounces, about 23 million ounces more than the next biggest deposit.

However, it remains to be seen if Pebble mine will eventually materialize, as the project's key water permit was formally rejected by the US Army Corps of Engineers last November. This decision is currently being challenged by project owner Northern Dynasty Minerals (TSX: NDM).

Should we consider only those that are actively being developed, then Seabridge Gold's (TSX: SEA) KSM project would move into the top spot, followed closely by the Norte Abierto project in Chile, jointly owned by mining giants Barrick Gold (TSX: ABX; NYSE: GOLD) and Newmont (TSX: NGT).

Most of these projects listed are porphyry deposits and therefore have large endowments of other metals such as copper (i.e. Pebble). In terms of "pure" gold projects, Polyus' Sukhoi Log in Russia would be considered the biggest, followed by the Donlin project, another Barrick joint venture, which is completing the biggest drill program in Alaska in 12 years.

Sukhoi Log is the world's largest gold deposit among both greenfield and developed mines. (Image courtesy of Polyus.)

Sukhoi Log is the world's largest gold deposit among both greenfield and developed mines. (Image courtesy of Polyus.)Rounding out the list are: the Siembra Minera project in Venezuela, Reko Diq in Pakistan, La Colosa in Colombia, Cascabel in Ecuador and Wafi-Golpu in Papua New Guinea. Four of these gold projects are currently stalled, with SolGold's (TSX: SOLG) Cascabel being the only active operation. Work at the Wafi-Golpu project, co-owned by Newcrest Mining (TSX: NCM) and Harmony Gold, was originally scheduled for last year, but is now facing delays due to an ongoing dispute with the PNG government.

All projects in the top 10 list are surface mining operations sitting at over 20 million ounces of contained gold. Four are currently at prefeasibility stage (KSM, Sukhoi Log, La Colosa, Cascabel), two at feasibility (Reko Diq, Wafi-Golpu), three at PEA (Pebble, Norte Abierto, Siembra Minera), with Donlin being the lone project at the permitting phase.

The Cascabel copper-gold project, 180 km north of the capital Quito, is SolGold's flagship asset. (Image: Screenshot from SolGold corporate video 2017.)

The Cascabel copper-gold project, 180 km north of the capital Quito, is SolGold's flagship asset. (Image: Screenshot from SolGold corporate video 2017.)Closely watched projects outside the top 10 include Chesapeake Gold's (TSXV: CKG) Metates project in Mexico, the Rosia Montana project in Romania, which remains on hold due to local protests, and the Elang advanced exploration project in Indonesia.

It is important to note that the size or type of a deposit is not always a good indication of the future output of a mine. Projects ranked in the top 10 are all at various stages of development, three of them with economic assessments that project widely differing annual production numbers.

Gold grades also do not necessarily push mine plans in a certain direction either - in this ranking grades range from 0.25 grams gold per tonne (Cascabel) to 2.24 grams gold per tonne (Donlin).

Click here for an excel download of the Top 10 biggest gold projects from the Mining Intelligence database.