Rare earths deja vu: Chinese crackdown = higher prices / Commodities / Rare Earths

Ina scene awfully familiar to those who follow the rare earths market, China isonce again threatening to hatchet production of the valuable minerals used inhigh-tech, renewable energy and military applications.

Ina scene awfully familiar to those who follow the rare earths market, China isonce again threatening to hatchet production of the valuable minerals used inhigh-tech, renewable energy and military applications.

Lastweek it was reported that the Chinese government published new guidelines designed to eliminate illegal mining and encourage more high-end processing. Those sterilewords are code for “less polluting”.

Shuttingdown illegal rare earth mines is nothing new to the Chinese, who have foundthat the process of extracting rare earth oxides from ore and refining theminto useable products has come at a high price to the environment.

(Formore about the poisoned lake and rare earth mining near Baotou, Inner Mongolia, read this excellent story by the BBC.)

Breaking Free fromChina. "Dependencyon one country or source for rare earths is dangerous. Right now the situationis fairly dire in the industry because we are being held captive by the Chinesefor these materials." BravoSolution's Paul Martyn

Whatis news, is the effect that limiting Chinese production will have on rare earthoxide prices; we only need take a look back to know this to be true.

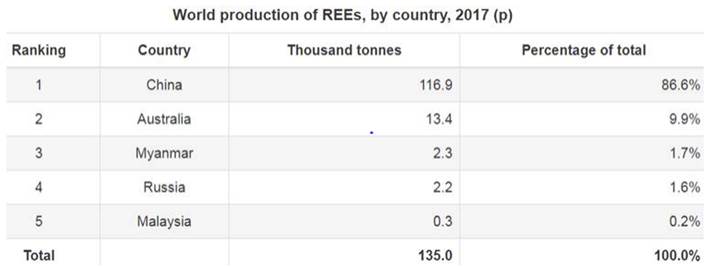

Chinacontrols about 90% of the rare earth market so any export restrictions will befelt in countries that buy them, including the United States and Canada. Theonly REE mine in the United States, Molycorp’s Mountain Pass, went bankrupt in2015 - although it is making a comeback,having been purchased by a US-led consortium.

In2009 China launched a crackdown on illegal REE mining. At the time authoritiessaid the unregulated industry was driving down global prices, making itimpossible to cover the huge environmental clean-up costs.

The Chinese government imposed export controls on its rare earths,meaning a 40% drop in exports. Beijing said it had to implement quotas toprotect the environment, but critics saw them as naked protectionism.

A year later, an international incident sent rare earth oxideprices into the stratosphere. In September 2010 a Japanese naval vesselinterdicted a Chinese fishing boat near the Senkaku Islands, which Japan andChina both claim ownership of, and detained the captain. The response hardlyseems balanced in retrospect, but the Chinese decided to ban all rare earth exports toJapan, then an industrial powerhouse and China’s largest REE customer.The rare earths market panicked, and within months, all of the rare earthoxides gained in price.

While the spike in rare earths prices was good for miners likeMolycorp and the numerous exploration companies that sprang up in search forthem, buyers of products made from rare earths balked and pressured governmentsto do something about it. The US, European Union and Japan brought a case tothe World Trade Organization to try and settle the dispute and get China tolift the restrictions.

In 2015 it did, resulting in a torrent of Chinese rare earthexports into the market and the inevitable collapse in prices.

While rare earth prices have never taken off to the extent theydid between 2010 and 2015, intermittent crackdowns by China have seen pricerises. We saw it happen in 2013 and in 2017.

Couldthis latest crackdown be China’s attempt to manipulate the REE market again? Wecan almost certainly bet on it. But we have another factor that could play intoa rare earth revival, and that is a new high-tech arms race that is developingbetween the superpowers.

DonaldTrump’s threat to withdraw from the 1987 INF Treaty with Russia may be thecatalyst that starts a new arms race between the United States, Russia and China as each projects military power indefense of spheres of influence outside their borders.

If the US Military deploys missiles to places like Guam and Japan,it would deter China from a first strike against US ships and bases in theregion, and also force Beijing into a costly arms race.

Not being party to the INF Treaty would also allow the UnitedStates to counter Russian aggression in Eastern Europe.

Why is this important? Because an arms race requires rare earths -something the US is in very short supply of. Not only that, the United Statesis wholly dependent on China for the mining and refining of rare earths itneeds to expand and modernize its military.

China Is Beating the US in theRare-Earths Game

The need for a North American rare earths industry,complete with a “mine to magnet” (as in permanent magnets made from rareearths) supply chain, has never been more crucial - considering theaforementioned arms race and the continuing trade tensions between the US andChina.

The first step is finding the elements, and that’s whereexploration comes in. While the US has some deposits, for example in Alaska andWyoming, none are yet mineable. Same with Canada.

At Ahead of the Herd, we are focused on finding early-stagecompanies with the potential for adding shareholder value in growing sectorslike rare earth mining.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.