Rebounding Crude Oil Gets Far Away from the Bearish Side / Commodities / Crude Oil

Demand for crude oil is accelerating –a bullish sign for its prices. What may the current energy market environmentsay about the black gold’s outlook?

AChinese Panda’s Appetite

On the Asian continent, the lifting ofhealth restrictions in China could signal resuming oil demand for the world’stop consumer. Given the context of tight supply, this has partially triggered arebound in crude while driving prices higher.

GeopoliticalScene

The Libyan National Oil Company (NOC)warned that they could declare a state of "force majeure" on thefacilities in the Gulf of Sirte – blocked due to the political crisis that hasbeen hitting the country for months.

In Ecuador as well, the spectre of a haltin oil production is becoming clearer following the blockades anddemonstrations initiated by a movement protesting the rise in the cost ofliving.

OPEC+Struggles to Increase Volumes

The United Arab Emirates assured thatthey were at maximum capacity, while Saudi Arabia stated it could pump anadditional 150,000 barrels per day. It is important to note that these twoproducing countries are indeed the two OPEC+ members perceived to have the mostspare oil production capacity. The 23 members of OPEC+ are just starting aseries of two-day e-meetings on Wednesday (they should also meet on Thursday byvideoconference) to decide on a new adjustment to their total volume ofproduction of black gold. However, analysts expect the status quo despite numerouscalls for action.

Fed’sRecession Denial?

The US economy is slowing down, but notto the point of falling into recession, the president of the New York branch ofthe Federal Reserve (Fed) said to CNBC Tuesday. The mighty Federal Reserve hasraised rates three times since March. The latter are now in a range between1.50% and 1.75% after remaining close to zero during the COVID-19 pandemic.

FundamentalAnalysis

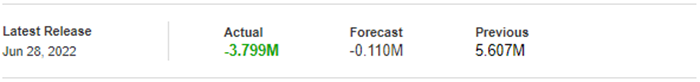

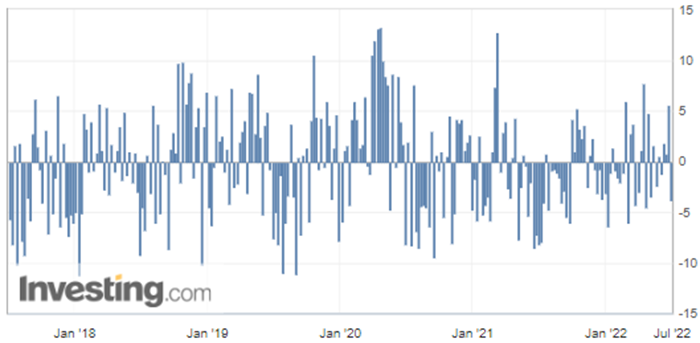

On Tuesday, the American PetroleumInstitute (API) released their weekly oil stock figures.

U.S.API Weekly Crude Oil Stock

The weekly commercial crude oil reservesin the United States dropped to -3.8M barrels while the forecasted figure wasjust about -0.110M, according to figures released on Tuesday by the US AmericanPetroleum Institute (API).

US crude inventories have thus decreasedby over 3.799 million barrels, which firmly shows accelerating demand and couldbe considered a strong bullish factor for crude oil prices. This figure wouldindeed signal a rise in fuel consumption. As a result, demand is now holding upwell as the peak of the summer driving season approaches with many trips.

(Source: Investing.com)

WTI Crude Oil (CLQ22) Futures (Augustcontract, daily chart)

RBOB Gasoline (RBQ22) Futures (Augustcontract, daily chart)

Brent Crude Oil (BRNQ22) Futures (Augustcontract, daily chart) – here it is represented by its Contract for Difference(CFD) UKOIL

That’sall, folks! Happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.