Rebutting SPDR Gold Shares Outperformance

Some readers have commented that the Gold ETF has outperformed the S&P 500 over its existence.

That analysis erroneously takes into account only the price change of the two instruments, and does not take into account the dividend yield of the stock index.

Gold can be thought of as a negative yielding asset that is bid up in times of stress. Gold prices have correlated highly with the stock of negative yielding debt.

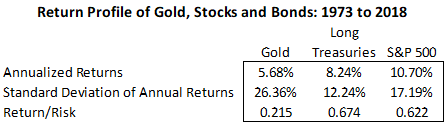

I have published a pair of recent articles on Gold. In Gold vs. Stocks, I calculated the long-run total return of Gold (GLD), the S&P 500 (VOO), and an index for long duration U.S. Treasuries (TLT). As seen below, Gold has generated lower absolute returns with higher variability.

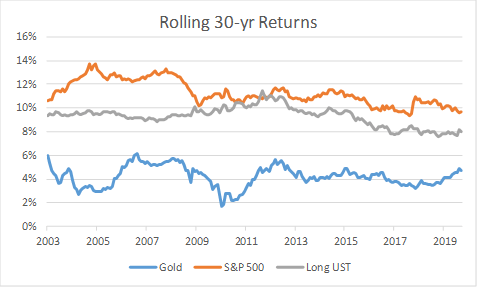

In Rolling Returns: Gold vs. Stocks and Bonds, I illustrated that over rolling 30-year periods that Gold had failed to outperform stocks or bonds over this long sample period, but that the precious metal has had some episodic periods of outperformance over shorter horizons.

There have been a number of good comments from readers across these articles. Some believe we are late in the business cycle, and that a tactical bet on gold is warranted. Others believe that a structural allocation to Gold is still warranted as a portfolio risk mitigant. Some readers have noted that the ability to source Gold through financial instruments like SPDR Gold Shares as opposed to the expense of owning physical gold has structurally boosted demand. They reason that this increased financial demand could be a forward return driver, and boost the ability to tactically position in Gold in risk-off environments.

These are all valid arguments. Differences of opinion are what make markets, and I value the discourse. I have had a few readers note that SPDR Gold Shares has meaningfully outperformed the S&P 500 since its 2004 inception, and I want to take some time to rebut that misconception.

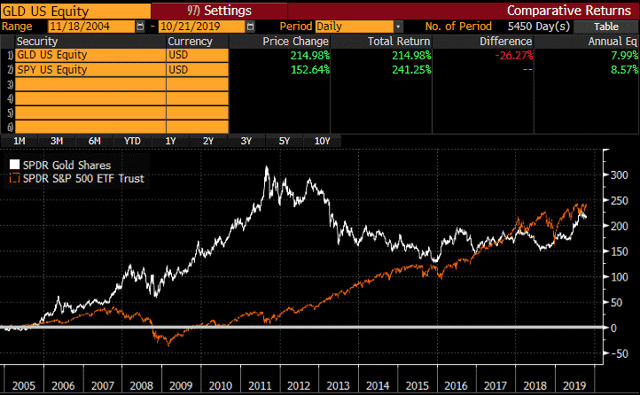

Below I have graphed the total return of the SPDR Gold Shares and the S&P 500 since the November 18th, 2004 inception of the Gold ETF.

This has been a solid period for Gold. The financial crisis provided a boost to havens. Extraordinary monetary accommodation from global central banks has led some to favor gold over fiat currencies. Indeed, spot gold and the Gold ETF have had a better price return than the S&P 500. What I think some readers might be missing though is that the S&P 500 has paid meaningful dividends over this fifteen year period.

More than one-third of the return to stocks has been from the dividend yield (over this 15-year period and the modern history of the stock market). When you add in the reinvestment of those dividends, the total return to holding stocks has been higher by about 0.6% per year than the return to holding gold over this 15-year period. This has been over a historically good period for Gold and a subnormal period for stocks that featured a historically large equity market drawdown. Investors did very well in Gold over the first half of this investment horizon, but have lagged over the full 15-year period, consistent with my previously stated view that Gold is best used for tactical bets and not as a long-term structural holding.

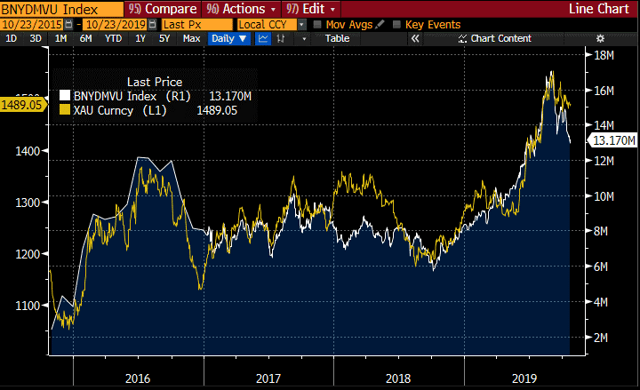

Some readers have commented that they value Gold in a world where the stock of negative yielding assets is growing. To me, Gold is the original negative yielding asset. It pays no cash flow or dividend yield, and it costs to store physically and securely, or it costs to own via financial instruments. In fact, the price correlation of Gold (left axis) and the stock of negative yielding assets in trillions (right axis) has been quite high over the last several years as the amount of negative yielding assets has expanded. The amount of negative yielding assets might have driven gold's return, and may not be a reason that gold could move higher in the future as some readers surmise.

Investors should consider that the stock of negative yielding debt may not be a reason that gold could move higher in the future. I would care more about the flow into and out of this figure moving forward. Both gold and ultra high quality sovereign bonds are haven assets, and it makes sense that they would share return drivers.

Seeking Alpha is an excellent place to exchange ideas. There will absolutely be periods where my aversion to Gold will look foolish as the metal rallies in risk-off environments. There will also be quiet periods where this negative yielding asset produces inflation-like growth with high volatility and holders generate negative alpha. I value the opinions of readers, but wanted to ensure that I set the record straight on the performance of the Gold ETF and the S&P 500 since the former instrument's inception.

Disclaimer:

My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon.

Disclosure: I am/we are long SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Ploutos and get email alerts