Reduced cobalt electric car batteries delayed amid price fall

The cobalt blues

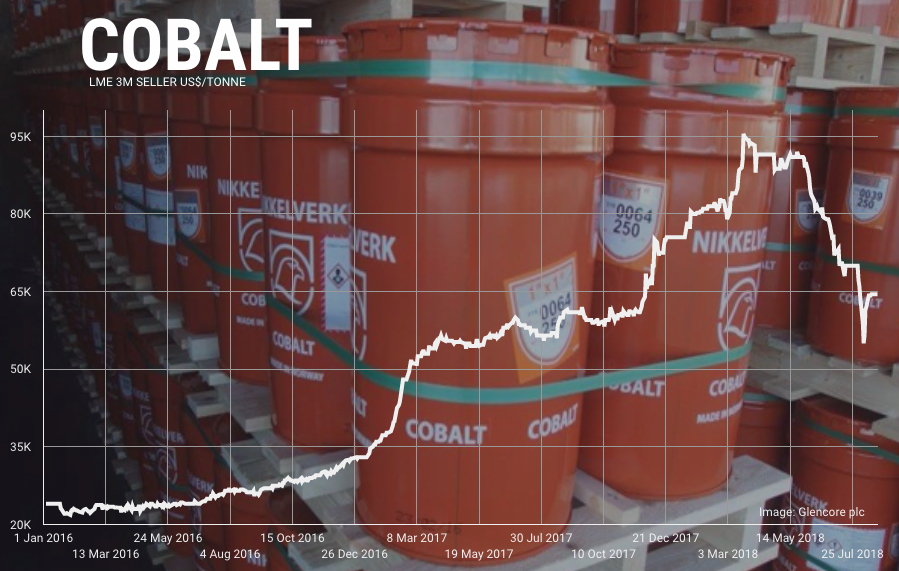

Since hitting near decade highs in March, battery raw material cobalt is down by more than a third as new supply from the Congo, responsible for the bulk of cobalt mining, enter the market.

Cobalt sulphate prices, the refined form commonly used in the battery supply chain, has also succumbed and is trading at its lowest level since November 2017.

Cobalt is by far the priciest component in electric vehicle batteries and manufacturers have been working hard to find a substitute, or at least reduce the required loading to as little as possible; a process called thrifting.

Poorer life cycle, reduced safety and misrepresented relative cost savings are all major concerns for electric vehicle producersLithium-ion batteries using nickel-cobalt-manganese (NCM) cathodes favoured by most vehicle makers contain around a third cobalt with a chemical composition of 111 - 1 part nickel, 1 part cobalt and 1 part manganese.

Battery manufacturers (with ample pressure from the auto industry) are hard at work to get the mix to 811 or better. NCM batteries with 622 and 523 (20% cobalt) chemistries are already being mass-produced.

In batteries with 622 chemistries, nearly half the raw material costs typically come from the cobalt component (nickel constitutes around 23% of the cost, and lithium and graphite both 9%). Cobalt costs falls to around 27% of the total in 811 batteries. Tesla claims its nickel-cobalt-aluminum (NCA) technology has cobalt content equivalent to 811.

This month provided further evidence that cobalt bulls may rest a little bit easier - rapidly rising global battery production volumes should more than make up for ongoing cobalt thrifting.

South Korean battery giants SK Innovation and LG Chem have both announced delays in the roll-out of NCM 811 batteries which were promised for the second half of this year. SK will stick to 622 batteries for EVs like the popular Kia Niro while using 811 for energy storage units. LG Chem will use 811 in e-buses only.

Simon Moores, MD of Benchmark Mineral Intelligence, a provider of price information and research on battery supply chains, says the firm has been "consistently advising that 811 cathode usage in electric vehicles is some years away from major adoption."

"Our forecast models begin seeing a material impact of 811 Cathode after 2021 so any expectation for this high nickel, low cobalt technology in the next 18 months was misplaced.

"Poorer life cycle, reduced safety and misrepresented relative cost savings are all major concerns for electric vehicle producers.

"811 will have its day, but it won't be before 2021."

The London-HQ firm forecast 811 will not exceed 5% of total NCM cathode production until after 2020 and reducing the cobalt would not necessarily lower cost:

Current technology dictates that 811 cathodes need to be produced in an inert environment as to prevent any reaction with the atmosphere. Therefore, any new cathode plant producing this material will need to build a new, dedicated, inert atmosphere, production line specific to 811.

Benchmark calculates that even with the most ambitious roll-out of 811 battery technology - 40% market share by 2026 - output of battery grade cobalt would have to more than triple from last year's production of 50,000 tonnes (out of total cobalt production of just over 100,000 tonnes).