Regulus Resources: A Great Copper And Gold Exploration Company In Peru

Regulus owns the AntaKori copper-gold project in Peru, which currently holds eight billion pounds of copper equivalent.

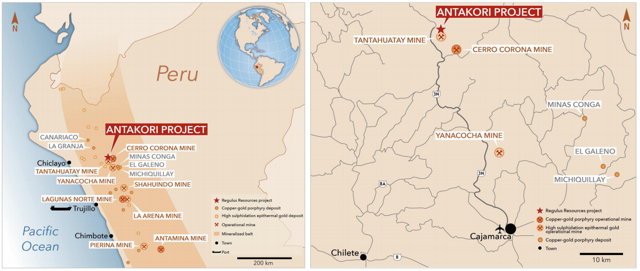

The project is adjacent Tantahuatay and Cerro Corona.

The exploration potential looks great and the only issue I see for the project is arsenic content, which is expected to decrease to the north.

Introduction

Regulus Resources (OTC:OTC:RGLSF) owns the massive AntaKori copper-gold project, which currently holds eight billion pounds of copper equivalent or over 16 million ounces of gold equivalent. The strategy of the company is finding under-explored assets that have the potential to become large deposits, drill them out and de-risking them and then selling them. The management team behind Regulus has experience with this strategy. They were previously in charge of Peru-focused copper exploration company Antares Minerals, which was sold to First Quantum (OTCPK:FQVLF) for around C$650 million in cash and shares back in 2010.

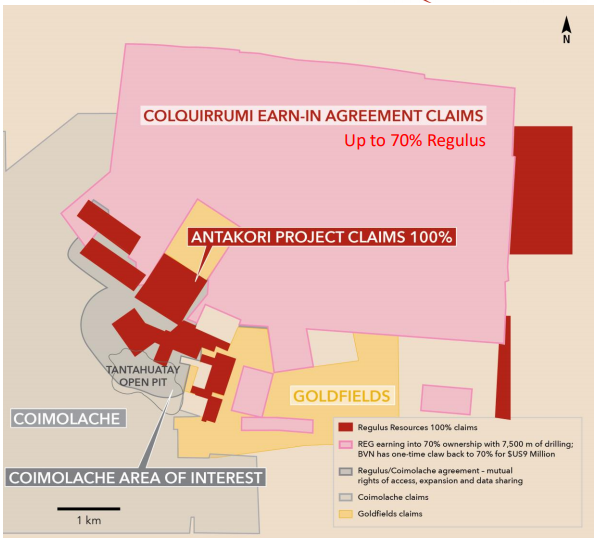

The projectAntaKori is located around 4,000 meters above sea level in the Yanacocha-Hualgayoc mining district of northern Peru. It covers 212 hectares and another 49 hectares are pending to be added. The property is adjacent the Tantahuatay and Cerro Corona mines:

Tantahuatay is a heap leach oxide gold operation owned by Buenaventura (BVN) and Southern Copper (SCCO) and the two are mining the oxide cap of a very large sulfide copper-gold project. The latter has more than 900Mt of copper-gold sulfide mineralization and that same type of mineralization extends over Regulus' property. In 2018, Tantahuatay produced 173koz of gold equivalent and it's difficult for either Buenaventura or Regulus to proceed with exploration without mutual agreements. Therefore, the two companies are advancing AntaKori together.

Cerro Corona, in turn, is a copper-gold sulfide project owned by gold major Gold Fields (GFI). In 2018, it produced 314koz of gold equivalent.

(Source: Regulus Resources)

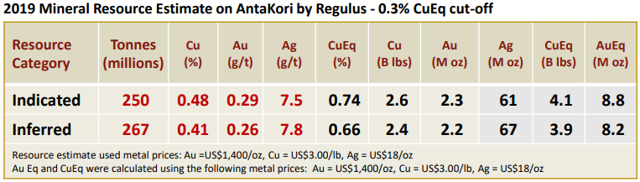

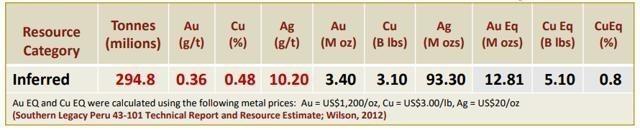

Regulus got AntaKori when it had around 17,000 meters of drilling and 5.1 billion pounds of copper in the inferred category. After another 23,000 meters, the company released a new mineral resource estimate in March 2019, which significantly boosted both tonnage and contained metals.

The company is in the middle of a new 25,000-meter drilling campaign and it plans to update the resources estimate in the middle of 2020. This will be followed by a PEA study around 2021.

I think the main issue for the project is that there's high arsenic content, but the company expects this to decrease as it moves to the north.

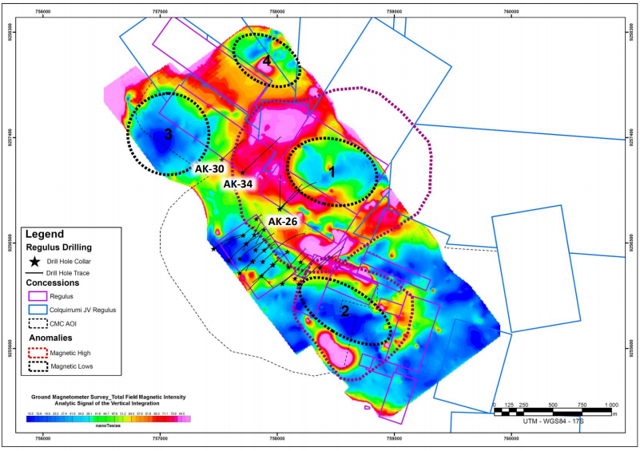

The exploration potential is great with a hole drilled 500 meters stepped out to the northwest, intersecting extensive low to moderate grade copper-gold mineralization in porphyry dykes and skarn with very low arsenic content. Also, there are several areas at AntaKori where there are magnetic lows surrounded by magnetic highs, which could be indicative of skarn mineralization surrounding an intrusive center. To date, Regulus has tested around 20% of those areas:

(Source: Regulus Resources)

Valuation

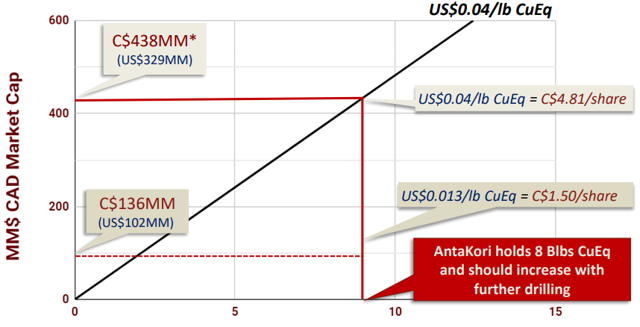

According to Regulus, there have been 23 deals for projects similar to AntaKori between 2010 and 2018 and the median sum paid for those has been around $0.04 per pound of copper equivalent in the ground:

(Source: Regulus Resources)

Taking into account only the current resource estimate, this means that the company has an upside potential of around 175% at the moment.

Conclusion

Regulus is led by a solid management team that successfully managed to monetize the Haquira project in 2010. The latter bears similarity to AntaKori as it's also located adjacent to a large operating copper-gold mine, namely Las Bambas.

AntaKori already is very large and it has an amazing exploration potential. Perhaps its main problem is the arsenic content, and Regulus hopes the northern part of the project has significantly lower quantities.

I think that AntaKori could start attracting significant interest from mining majors around the middle of 2021 after the release of the PEA. The main listing of the company is in Canada and the current market capitalization is just C$159 million, which seems very cheap for a company with a Tier 1 copper-gold project. Regarding likely bidders, I think that a lot of synergies could be realized through the combination of AntaKori with Tantahuatay or Cerro Corona, but the project also could attract attention from other major mining companies. For example, some gold majors have been looking at diversifying into copper lately and AntaKori could be a great fit for them.

If you like this article, consider joining The Gold Commonwealth.

There's a two-week free trial and the service will focus on long ideas, takeover targets, turnarounds, exploration stories and under-followed gems in the mining space, particularly gold. Omnis Quis Coruscat Est Or!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Follow Gold Panda and get email alerts