Reliable Buy Signal Just Flashed for Fiat Chrysler Stock

FCAU recently bounced from its 80-day moving average

FCAU recently bounced from its 80-day moving average

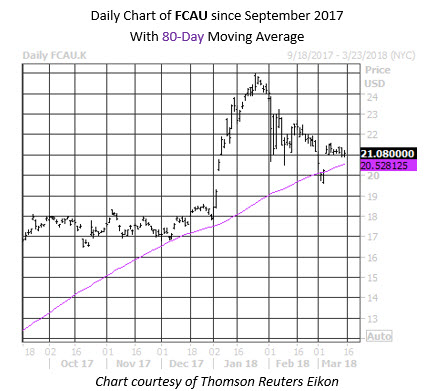

Fiat Chrysler Automobiles NV (NYSE:FCAU) notched a record high of $24.95 on Jan. 25, before pulling back during the broader stock market correction. These losses accelerated recently on concerns over President Donald Trump's tariffs on steel and aluminum. However, the shares are now trading near a trendline that has had bullish implications, and if past is precedent, it could be time to bet on FCAU's next leg higher.

According to Schaeffer's Senior Quantitative Analyst Rocky White, there have been three other times in the past three years that Fiat Chrysler stock has come within one standard deviation of its 80-day trendline after a lengthy stretch above it. FCAU went on to average a one-month gain of 9.07%, with positive returns all three times.

The stock could get an extra boost, should short sellers continue to unwind their bearish bets. Short interest fell by 9.6% in the most recent reporting period to 22.02 million shares. This represents 6.4 days' worth of pent-up buying demand, at the security's average pace of trading.

This would certainly please options traders, who have been accumulating bullish bets over bearish at an accelerated clip recently. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows FCAU with a 10-day call/put volume ratio of 44.84, ranking in the 100th percentile of its annual range.

Options traders looking to speculate on FCAU's' short-term trajectory can do so at a relative discount, too. The stock's Schaeffer's Volatility Index (SVI) of 34% is higher than just 24% of all other readings from the past year, indicating muted volatility expectations are being priced into near-term options.