Repo Rumpus Foreshadows A Short Squeeze on the Dollar

The Fed's so-far $128 billion intervention in the repo market slipped off the Wall Street Journal's front page by evening, hardly a concern. Don't be surprised if, years from now, the squeeze on short-term borrowers that caused this flurry of excitement is cited as an early warning sign of the banking system's coming collapse. On Tuesday, there simply weren't enough dollars around to keep short-term loans rolling. This implies that the dollar short-squeeze I first wrote about in Barron's and the San Francisco Examiner more than two decades ago may have begun.

This time the Fed handled the problem without breaking a sweat. The next time, however, the cost might run into the trillions. Which is to say, more money than even the central bank can come up with on short notice. The banks won't open the next day, nor will credit card transactions clear. There is no way that even a very prudent person can completely protect him or herself from the fallout, but it seems likely that those who hold Treasury paper and bullion as insurance will fare better than those who don't.

A Curious Thing

Regarding the run on repos, it is curious that a dollar shortage developed in one specific market at a time when dollars remain almost inexhaustibly available in so many others. Mortgage money is not tight, nor are 0% teaser loans for any credit card holder who is not in prison. Big companies have no trouble borrowing billions of dollars to buy back their shares. But borrowers in the repo market? They are potentially like short sellers of a stock that has suddenly become unavailable. Which is to say, they will be dead ducks on that inevitable day when even a slight whiff of panic wafts through the Battery.

Although these paper-shufflers probably don't give much thought to the aggregate size of the borrowing they do, it amounts to something like a quadrillion dollars. That is the notional size of the derivatives market, and every dollar of it is tied in some way to all the other dollars. But why even worry about such things? To calm everyone's nerves if there's a run on bank reserves, the Fed can simply sacrifice Goldman Sachs or some other financial biggie the way it did Lehman on September 15 (!), 2008.

Bullion Will Move

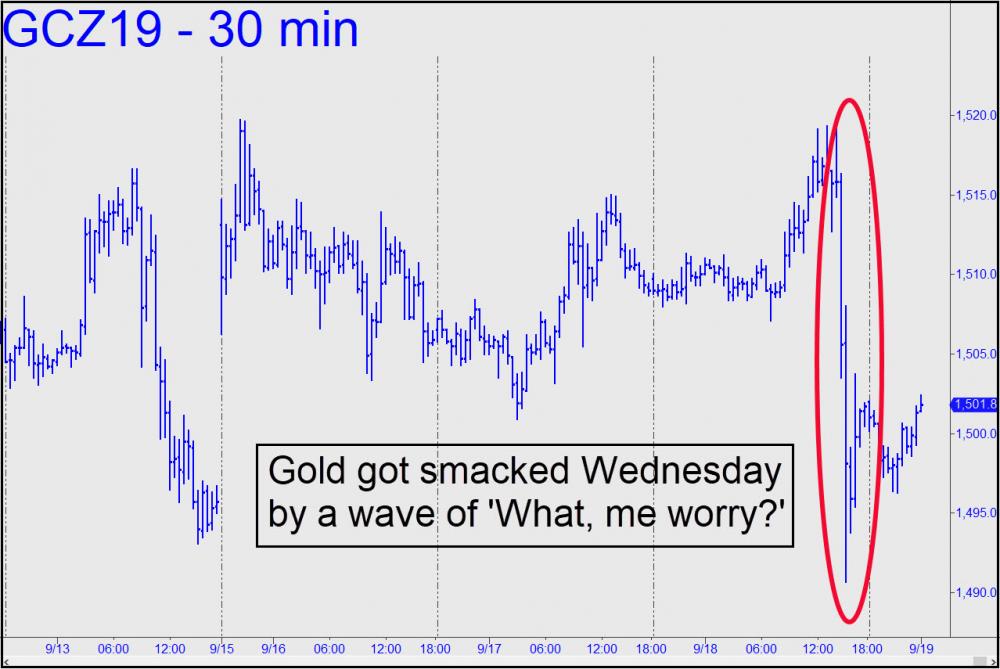

It's hard to imagine that gold will sit still when this drama unfolds. Usually a rising dollar weighs bullion down. But notice that the two have been ascending in tandem since June. Is this very unusual dynamic foreshadowing a crisis ahead? Regardless, gold looks like bargain-priced insurance at current levels. It actually went down Wednesday as Wall Street smugly contemplated a rescue seemingly well done by the Federal Reserve. We kid ourselves to think this will be the last of it.