REPORT: McKinsey outlines climate risks

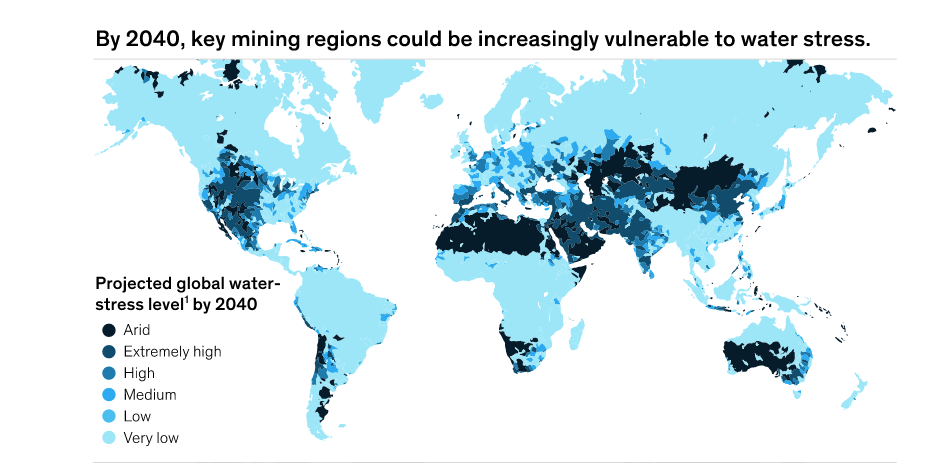

An image from the McKinsey & Co. report Climate Risk & Decarbonization depicting areas projected to be under water stress in 2040. Credit: McKinsey & Co.

A new report by global consultancy McKinsey & Co. looks at three key questions the mining sector needs to address in light of climate change. Entitled Climate risk and decarbonization: What every mining CEO needs to know, the report details the potential physical risk to mining assets, outlines how a low-carbon economy will shift demand for minerals, and looks at how mining companies can reduce emissions at their own operations.

Physical risk

First, companies need to determine which mining assets are most at risk physically from climate change.

Water stress and flooding are both concerns for mine operations that are expected to worsen with climate change. McKinsey found that a large proportion (30-50%) of copper, gold, iron ore and zinc production is concentrated in areas where water stress is already high. Moreover, mining regions that have not traditionally experienced water stress are also projected to become more vulnerable. To cope, all operations will have to reduce the water intensity of their operations.

In terms of flooding risk, McKinsey found that iron ore and zinc operations are the most exposed. To deal with flooding risk, companies can adopt mine designs that improve drainage, build roads with different materials, or use conveying methods to move material instead of relying on trucking.

Demand for key minerals

Demand for the raw materials needed for low-carbon technologies will affect what the mining industry produces. McKinsey looked at a commodity demand scenario that assumes warming is limited to 2 ? Celsius. Under those assumptions, demand for nickel, cobalt, lithium and rare earths is seen as growing the most dramatically, with copper and uranium also seeing significant growth. Increased recycling of some minerals, such as iron ore, bauxite, lead and chromium, would somewhat temper greater demand, while coal demand would decline by more than 50%.

Reducing GHG emissions

While the mining sector is only beginning too look at ways it can reduce emissions at mine sites, pressure to do so from investors, regulators and communities will continue to grow. The mining sector responsible for 4-7% of greenhouse gas (GHG) emissions globally, although only 1% of the total is actually from mining operations and power consumed by the industry while 3-6% is from fugitive methane emissions from coal mining.

Energy efficiency, electrification, the use of renewable energy, and the use of more fuel-efficient diesel engines are all options to reduce mining emisssions.

The report ends with five key actions mining executives should take, including performing an end-to-end diagnostic of climate change's effects on the business, and building decarbonization into their commodity forecasts.

Read the full report here.