Resideo Technologies: All That Glitters Is Not Gold

The sell-off in Resideo stock has intensified since the spin-off.

Resideo has an extremely attractive valuation which hints significant upside.

The growth story is not in lines with what is expected from a growth company.

Indemnity payments to Honeywell are weighing down the company's ability to generate FCF.

It is almost 6 months since my previous article on Resideo Technologies (REZI), "The Good, the bad and the ugly in Resideo Technologies". When I wrote before, I highlighted how REZI stock lost approximately 30% of its value post spin-off due to institutional selling. Moreover, my neutral thesis was at the time was due to the high debt and fiercely competitive landscape.

Since then, the stock has lost another 30% of its value. Through this article, I aim to understand current valuation of this company and REZI's progress post spin-off.

Valuation

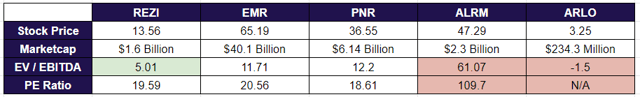

Due to overlap in products across different segments, I chose to compare Resideo with Emerson (EMR), Pentair (PNR), Alarm.com (ALRM) and Arlo Technologies (ARLO).

Data Source: Wall Street Journal

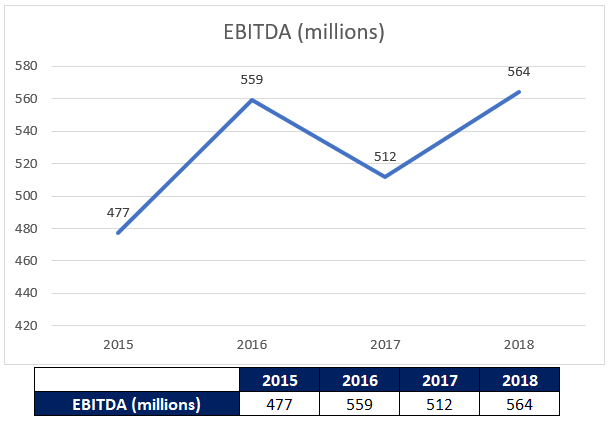

Resideo is currently valued at 5x EBITDA. Based on comparison with other players in the space and the revenue growth discussed below, I believe REZI could achieve an 8x EBITDA valuation.

An 8x valuation implies a market cap of ~$3.35 Billion, providing a target stock price of $27 indicating a 100% upside from current prices.

There is no doubt REZI is undervalued. But the growth numbers discussed below add more color on why REZI cannot be given a premium valuation like the growth stocks in this sector (ARLO or ALRM)

Growth

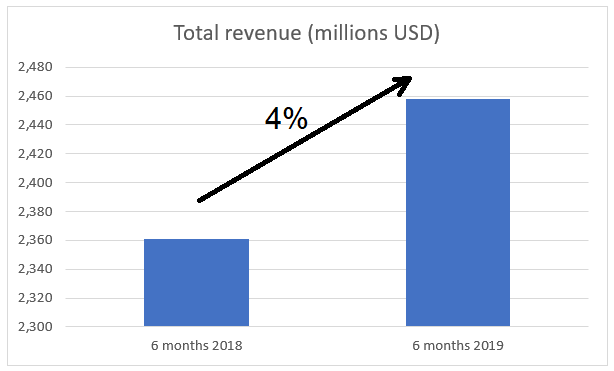

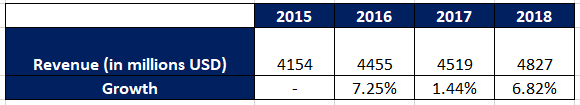

We have seen a 4% increase in revenue in the 6 months of FY2020. Up to now, Resideo has had 3 full quarters as an independent company.

Data Source: Resideo Technologies FY2020 Q2 Form 10Q

Data Source: Resideo Technologies FY2019 Form 10K

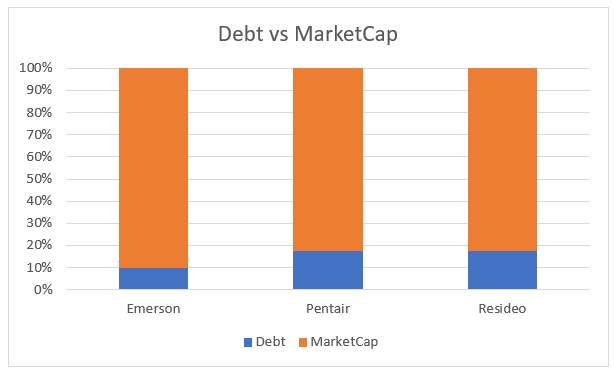

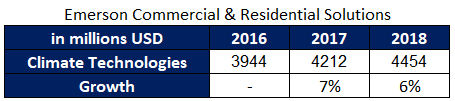

It's not a direct comparison here, but Emerson Electric (EMR)'s Commercial & Residential Solutions is one of the key competitors for Resideo's comfort product segment. The climate technologies unit showed a 7% and 6% growth in 2017 and 2018 respectively.

With a $40 Billion market cap, Emerson would qualify as a stalwart accordingly to the categories defined by Peter Lynch. One of the primary benefits of a spinoff for investors is that the separated company has the ability to grow at a pace that wouldn't have been possible when part of a large cap company.

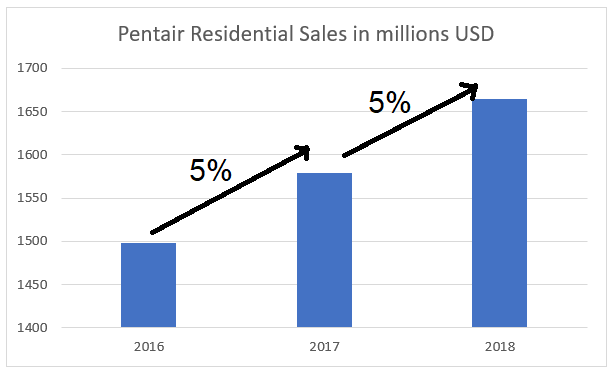

Pentair (PNR) is a mid-cap water treatment company with a diverse product and service offerings. Among these, residential water solution products have some overlap with the offerings from Resideo. Residential sales of Pentair have grown 5% YoY for the past two years.

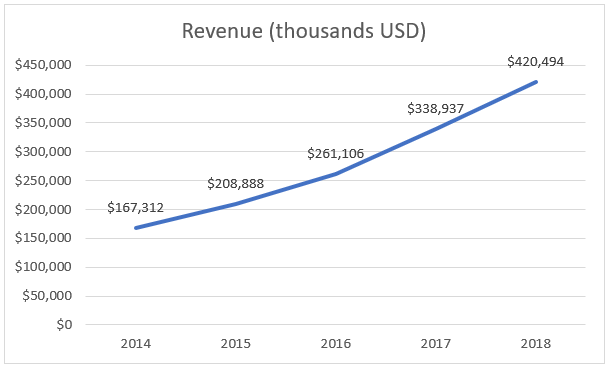

Alarm.com is a small-cap home automation company with a CAGR revenue growth of 25% in the past 5 years.

Data Source: Wall Street Journal

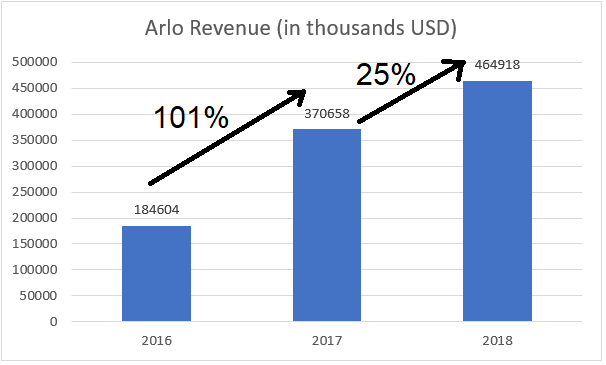

Arlo Technologies (ARLO) is a small-cap home automation company which competes with DIY Home security space. Arlo has demonstrated rapid revenue growth in the past two years.

Data Source: ARLO FY2019 Form 10K

In order for Resideo to be a growth story, I would be interested in seeing REZI's revenue growth to be somewhere between Arlo, Alarm.com and Emerson / Pentair.

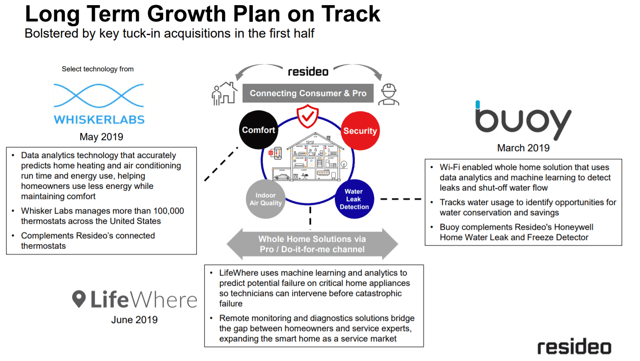

Resideo's top line growth is not sufficient to consider it a fast grower. Management has talked about making tuck-in acquisitions as part of their long term growth plan.

Source: Investor Presentation

Though these acquisitions come through additional weight on the balance sheet, they are likely to help the company achieve stronger growth numbers through. It would be interesting to see Resideo's performance in the next few quarters. If the acquisitions are accretive to enable Resideo to grow like Alarm.com or Arlo Technologies, the valuation gap is likely to be bridged quickly.

Indemnity Payments

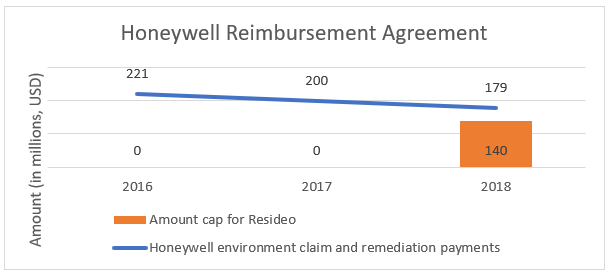

During the Spin-Off Resideo Technologies entered into an indemnification and reimbursement agreement with Honeywell (HON). Resideo has an obligation to make cash payments to Honeywell in amounts equal to 90% of payments for certain Honeywell environmental-liability payments. The amount payable by Resideo in respect of such liabilities arising in respect of any given year will be subject to a cap of $140 million.

Historically, Honeywell's environmental claim and remediation payments in respect of the sites that are within the scope of the Honeywell Reimbursement Agreement for the years 2018, 2017 and 2016, including any legal fees, were approximately $179 million, $200 million and $221 million.

Honeywell's 10Q report mentions the following: "As of June 30, 2019, Other Current Assets and Other Assets includes $140 million and $438 million representing the short-term and long-term portion of the receivable amount due from Resideo under the indemnification and reimbursement agreement

This means, while Resideo will pay up to $140 million to Honeywell every year, the remainder gets accrued for the future. Resideo will have this overhead expense till 2043 (or until the reimbursement payments are below $25 million for three consecutive years)

$140 million per year is almost 25% of Resideo's FY2019 EBITDA. Based on the current no. of shares outstanding, it comes to $1.14 per share. These payments are weighing down Resideo's ability to generate Free Cash Flow.

Conclusion

Resideo stock is undervalued and presents a value opportunity for investors. However, the indemnity payments seem to weigh down on the company's ability to increase shareholder value. I will be keeping a close watch on how Resideo grows with the tuck-on acquisitions in the next few quarters. At this time, I am not convinced to take a long term position.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Hidden Opportunities and get email alerts