Resolute Mining: 400,000 Ounces Of Gold At A Production Cost Of Less Than $1000/Oz

Resolute Mining produced just over 175,000 ounces of gold in H1, the majority in Africa.

The operating expenses in Africa continue to trend down, while Resolute is taking action to bring the Ravenswood mine expenses down.

The acquisition of another low-cost gold mine in Senegal in August will push the annualized production to 450,000 ounces of gold from next year on.

If Resolute plays its cards right, it will be firing on all cylinders the next few years as even the high-cost Ravenswood mine in Australia would become cash flow positive.

Introduction

Resolute Mining (OTCPK:RMGGF) (OTCPK:RMGGY) is an Australian mining company focusing on its gold producing operations in Africa where it's represented in Ghana, Mali and Senegal. In Mali, the company has successfully transitioned its existing open pit mine to an underground mine plan which has now reached the commercial production phase with a total production of around 150,000 ounces of gold in the first semester. As it has been almost 4 years since discussing Resolute Mining here on Seeking Alpha, it's time for an updated view on the Africa-focused gold producer.

Source: Yahoo Finance

Resolute's primary listing is on the Australian Stock Exchange where the company is trading with RSG as its ticker symbol. The average daily volume of in excess of 11 million shares makes the ASX the preferred trading venue for this company which still has a market capitalization of just A$1.5B. As Resolute is trading in Australia and reports its financial results in Australian dollars, I will use the AUD as the base currency throughout this article (unless otherwise indicated). For reference, the current gold price of US$1540/oz is the equivalent of A$2280/oz.

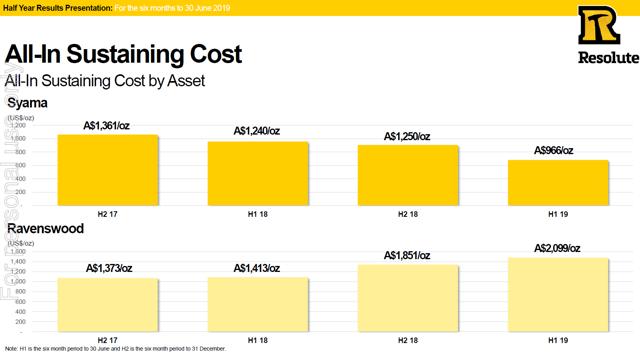

An exceptionally low all-in cost for the first half of the year bodes well for H2

Resolute Mining has done an excellent job in converting the Syama project from an open pit operation to an underground mine, and the extremely low all-in sustaining cost of A$966/oz in the first half of the year is a testament to that achievement. Unfortunately, the consolidated AISC was a tad higher as the Ravenswood gold mine in Australia remains a high-cost gold producer as its performance is going the other way, as you can see on the next image:

Source: company presentation

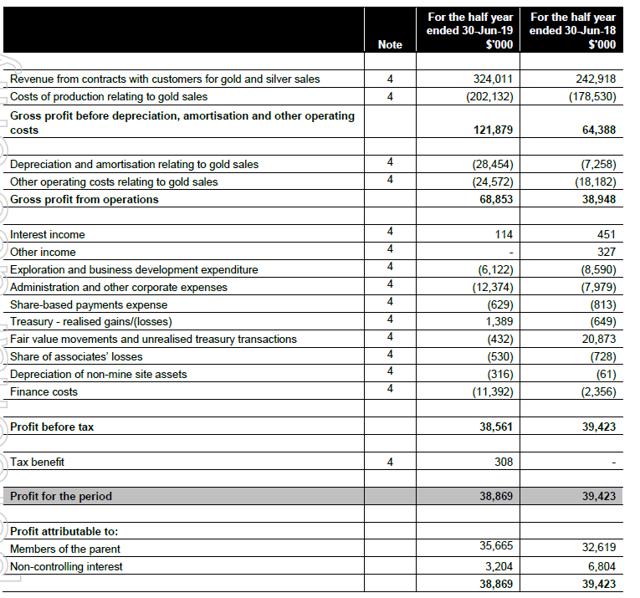

Unfortunately, the gold price only started to move towards the end of the semester and the average gold price received by Resolute in the first half of the year was just A$1800/oz (and the gold price is now trading 25% higher when expressed in AUD).

The total revenue from the gold (and silver) sales was A$324M, and Resolute reported a net income of A$35.7M attributable to the shareholders of Resolute, which works out to be almost A$0.05 per share. That's indeed not much compared to the current share price of A$1.65, but keep in mind the Resolute share price was trading around A$1 for the majority of H1 and Q2, so the current share price is more a reaction to the gold price than to the H1 results.

Source: financial results

Resolute generated A$94.5M in operating cash flow but despite this achievement, it wasn't free cash flow positive as the company was still working on the underground development of the Syama project. Now Syama has entered the commercial production phase and considering the gold price is trading 25% higher than in the first half of the year, this situation should easily be reversed as the operating cash flows will increase while the investment level should decrease now that Syama underground is up and running.

Further growth can be expected next year - and Ravenswood will be redeveloped

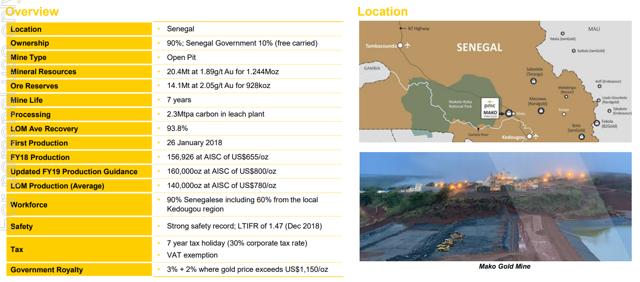

Resolute also pursues non-organic growth as it signed an agreement to purchase Toro Gold for US$130M in cash and 142.5M shares of Resolute Mining. The final few shares of Toro Gold will be acquired by Resolute Mining within the next week or so, and once completed, Resolute will add another producing mine to its asset base. This will be the first step in Resolute's pursuit of additional growth.

The Mako mine in Senegal is an open pit mine which produced 157,000 ounces of gold in 2018 at an AISC of US$655/oz. At the current gold price, the net operating margin (pre-tax) would be around US$850/oz, which is around A$1250/oz. The operating costs will trend up (as 2018 was an exceptional year), but Resolute expects the mine to produce 160,000 ounces of gold at an AISC of US$800/oz while the remaining mine life calls for 7 years of 140,000 ounces of gold per year at an AISC of US$780.

Source: company presentation

In other words, for a total consideration of around A$425M, Resolute will acquire an attributable production of 126,000 ounces of gold (RSG is entitled to 90% of the production, 10% of the output goes to the Senegal government) at an AISC margin of in excess of A$1000/oz (using a gold price of US$1500/oz). The payback period will be just 4 years while the mine life is estimated at 7 years while there is an additional 6.3 million tonnes of gold-bearing rock in the resources. An infill drill program could convert these resources into reserves which could keep the mill up and running for an additional 3 years. A good deal for Resolute, that's for sure.

Additionally, Resolute has finally made a decision about its Ravenswood gold mine in Australia as well. Considering the all-in production costs continued to rise, making the mine unviable (and just marginally viable at the current gold price of A$2280/oz), Resolute had to decide whether it would shut down the mine or invest more money in an attempt to make the mine profitable again due to a revised mine plan.

The board of directors has now approved Stage 1 of the expansion plan, which calls for the third mill to be recommissioned to increase the total processing capacity to 5 million tonnes per year. This should boost the production rate to 80,000 ounces per year, but more importantly, it should result in a 25% decrease of the AISC which is now expected to drop to A$1600/oz. So at the current gold price and assuming Resolute's AISC estimate will prove to be correct, Ravenswood's Phase I will generate a net operating cash flow (pre-tax but including sustaining capital investments) of A$52M per year while the required investment for Stage 1 is estimated to be just A$6M. A no-brainer in the current gold climate that's for sure.

Source: company presentation

But it won't end there as Resolute is also wrapping up the studies related to a more aggressive expansion project that would more than double the production rate to 200,000 ounces per year from 2022 on. No additional details (like all-in sustaining production costs and the required investments) are available at this point, but it looks like the redevelopment of the Ravenswood mine could generate quite a bit of free cash flow for Resolute - but the gold price will have to continue to cooperate.

Investment thesis

Resolute is now guiding for a full-year production of 400,000 ounces of gold at an AISC of US$960/oz (or around A$1420/oz) which should result in a net operating margin (including sustaining capital expenditures) of A$850/oz. Even after taking taxes into consideration, Resolute Mining will generate in excess of A$250M in free cash flow this year which makes the current market capitalization of A$1.5B more than acceptable.

Resolute should thrive in the current gold climate, and the company appears to be overlooked by the market, perhaps due to a certain Africa-discount as that's where the majority of its free cash flow is being generated. I have a long position in Resolute Mining and plan to add on weakness.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Take advantage of the TWO WEEK FREE TRIAL PERIOD and kick the tires!

Disclosure: I am/we are long RMGGF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow The Investment Doctor and get email alerts