Resurgent Iran to impact copper, zinc prices through 2020

While not expecting a boom, BMI Research in a new report is positive about the medium-term growth outlook for Iran's mining industry following the lifting of decades old Western sanctions at the beginning of the year.

Over the next five years, new investment from Europe and Asia will accelerate the growth of the Middle-Eastern nation's mining sector, which contains vast underdeveloped reserves but is in dire need of modernization and new technology.

BMI cautions progress will be slow given that the industry remains dominated by state-owned companies despite two rounds of privatization of state-owned copper producer Nicoco (shares were taken up other government enterprises and banks).

The country's inefficient bureaucracy, corruption, inadequate infrastructure and low mineral prices will also drag on development limiting growth of Iran's mining industry value to an annual average rate of 4.2% through the end of the decade reach a total of $26.6 billion. Output growth across the sector will slow to 4.9% from 2016-2020 compared to 6.6% during the previous five years.

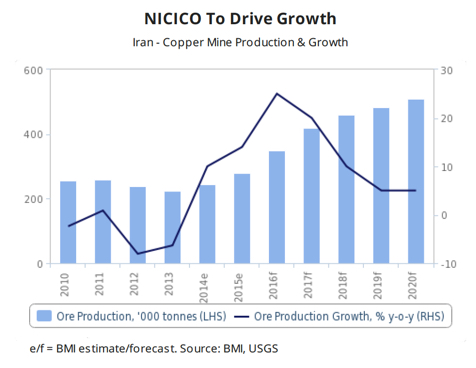

According to BMI Iran's copper output will outperform in the coming years, averaging yearly growth rates of 13% through 2020, compared to just 2.1% during the past five years.

According to BMI Iran's copper output will outperform in the coming years, averaging yearly growth rates of 13% through 2020, compared to just 2.1% during the past five years.

Copper production is expected to top 500,000 tonnes by the end of the decade despite Nicoco's virtual monopoly over the copper supply chain in the country.

Nicoco operates the country's three major copper mines of Sarcheshmeh, Sungun and Miduk which has combined reserves estimated to be 3.4 billion tonnes (bnt) of ore containing an average of 0.6% copper. The Sarcheshmeh copper mine, located in Kerman Province, is the world's second largest.

Copper production is expected to top 500,000 tonnes by the end of the decade despite Nicoco's virtual monopolyThe mine holds over 826 million tonnes of proven and 1.2 billion tonnes of estimated copper reserves with 0.7% average grade alongside substantial amounts of other minerals including molybdenum, gold, silver and rare metals. The Sungun mine is Iran's second largest copper operation with over 470 million tonnes of proven and 1 billion tonnes of potential reserves grading 0.6%.

The third major copper mine is Miduk, an open pit mine that holds 170 million tonnes of proven copper reserves with an average grade of 0.25%. In 2015, Nicoco added about 300,000 annual capacity to its total copper concentrate production capacity by commissioning two ore beneficiation units at Sarcheshmeh and Sungun.

BMI notes that a year ago Nicoco signed an investment agreement with a consortium of Middle-east companies for the construction of the 100,000 Chah Firouzeh copper concentrate plant in Kerman Province, expected to start operations in 2019.

Iran has the world's largest proven zinc reserves estimated at roughly 300 million tonnes, but the sector is vastly underdeveloped according to BMI with just 0.5% mined so far. Iran sits behind China, Kazakhstan and India as the world's number four producer of zinc ore.

After several years of production decline, Iran's zinc mine output is set to return to positive growth, boosted by stronger international prices and booming demand from domestic construction.

The two largest mines are Mehdiabad with 16.5 million tonnes of zinc ore reserves and the Angouran mine with 9 million tonnes of remaining zinc ore reserves. Lead and zinc production are in the hands of Iran Zinc Mines Development Group, Bama Mining & Industrial, Bafgh Mines and Calcimin.