Resurgent US Oil Industry Priming the Economic Pump / Commodities / Oil Companies

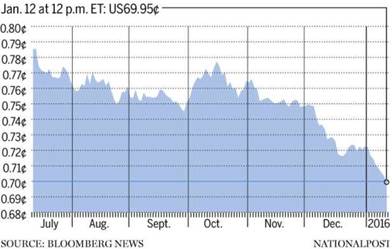

Crude oil prices dropped from $110 a barrel in the summer of 2014to about $30 in January 2016. The effect on oil producers and oil-producingcountries was dramatic. The Russian ruble plunged, and the Canadian dollar slipped to below 70 cents US for thefirst time since 2003, kicking the country intorecession and snuffing out the oil boom in Alberta. Many foreign companiesoperating in the high-cost Canadian oil sands pulled up stakes.

Crude oil prices dropped from $110 a barrel in the summer of 2014to about $30 in January 2016. The effect on oil producers and oil-producingcountries was dramatic. The Russian ruble plunged, and the Canadian dollar slipped to below 70 cents US for thefirst time since 2003, kicking the country intorecession and snuffing out the oil boom in Alberta. Many foreign companiesoperating in the high-cost Canadian oil sands pulled up stakes.

One of the hardest hit countries wasVenezuela, whose petro-currency crashed, leading to hyperinflation, shortages,protests and violence - a dire situation that continues to this day. Even SaudiArabia, the world’s number 2 oil producer, had to tap its $602 billion inforeign reserves to help finance its 2016 deficit of $88 billion - almost aquarter of GDP.

One of the hardest hit countries wasVenezuela, whose petro-currency crashed, leading to hyperinflation, shortages,protests and violence - a dire situation that continues to this day. Even SaudiArabia, the world’s number 2 oil producer, had to tap its $602 billion inforeign reserves to help finance its 2016 deficit of $88 billion - almost aquarter of GDP.

In the UK the number of oil and gas companies experiencingfinancial distress nearly doubled between the end of 2014 and the final quarterof 2015. In the US, 35 oil exploration companies went bankrupt between July2014 and December 2015, accordingto Oil & Gas Financial Journal.

While the oil industry has certainly lookedbleak the last few years, with environmentalists gleefully predicting the endof it, recently the industry has turned a corner, putting the doubters on thewrong side of the trade. Earlier this month, oil pushed past $70 a barrel forthe first time in three years. The US is exporting record amounts of oilfollowing the lifting of the export ban in 2015, and exploration is back,thanks to Donald Trump’s pro-oil agenda. The shale oil revolution that changedthe US’s ability to challenge the world’s top energy producers continuesunabated, putting the US for the first time in a position to challenge Russia,the top oil producer, for global energy dominance.

How did we get here?

The United States has been pumping oil since the 1800s, whenpetroleum was discovered in salt wells drilled in Ohio and Kentucky. The searchfor “black gold” was fuelled by the rising popularity of the automobile whichdemanded gasoline for its internal combustion engine.

The first commercial oil well was drilled in Titusville,Pennsylvania, where Colonel Edwin Drake struck “rock oil”. An oil rushfollowed, with oil wells and refineries springing up, along with railroads toship the refined products to markets across the country. Pennsylvania oilproduction peaked in 1891, and was later surpassed by Texas and California.

The US led the world in oil production up to the 1930s when largeoil fields were discovered in the Middle East. It was then that OPEC formed,and the oil producing cartel soon overtook the States as the dominant player -by 1970 producing 51% or 23.3 million barrels a day.

US involvement in the Vietnam War exploded military spendingduring the 1960s and that, along with social welfare reforms undertaken byPresident Lyndon Johnson without raising taxes, meant the US was runningmassive balance of payments deficits with the rest of the world.

As a result, in the 1970s the US dollar then went through amassive devaluation, and oil played a crucial role in propping it back up.President Nixon negotiated a deal with Saudi Arabia whereby in exchange forarms and protection, the Saudis would denominate all future sales of oil in USdollars. Other OPEC members agreed to similar deals, ensuring perpetual globaldemand for greenbacks. The dominance of the US “petrodollar” continues to thisday, although as I have recently written, USDhegemony is under threat from China and Russia.

Run-up to $70

On January 11 oil futures for Brent crude, the contract used forover half the world’s oil, rose to over $70 a barrel for the first time sinceDecember 2014. Analystsquoted by Bloomberg explained the current oilrally (Brent is still at $70 while WTI, the US benchmark, is hovering around$66) is due to OPEC clearing the glut caused by oversupply of US shale oil.Recall that in November, OPEC members agreed to extendoil output cuts until the end of 2018, something they were loathe to do beforethen. On January 13 OPECmembers Iraq, UAE, Qatar and Oman all joined the chorus, surprisingly, for the cartel to maintain the cuts,despite the temptation to pump more oil to earn $70+ a barrel.

Priceshave climbed over 50% since June, helped by cold weather in the US and Chinaraising demand for heating fuel, plus the threat of the Trump Administrationreinstating sanctions on Iran, which produces around 3.6 million barrels a day.In the first week of January crude inventories fell to their lowest levelssince 2015. The slumping US dollar is also supporting oil prices, along withother commodities.

On Sunday Oilprice.com reported that net long bets on WTI and Brent hit over a billion barrels the week of Jan. 8-12, which is good news for US shaledrillers who are hedging their production at higher prices.

Higher oil prices good or bad?

Intuitively a rise in oil price is good news for the Americaneconomy especially in light of four years of layoffs, bankruptcies and fallingrevenues for US oil companies. But in fact higher oil prices are a double-edgedsword. On the one hand rising prices are inciting US producers to keep pumping.The Energy Information Administration (EIA) forecasts that at this rate, USproduction is on track to rival both Saudi Arabia and Russia, topping 11million barrels a day by the end of 2019. But higher output risks puttingdownward pressure on oil prices.

Hydraulic fracturing technology coupled with horizontaldirectional drilling that emerged in the 1990s allowed for a huge burst in theextraction of shale oil deposits which up to that point were too expensive todrill. Fracked wells have a shorter life than conventional ones, meaningcompanies need to keep drilling so they don’t run out of supply. This activityrequires labor for drilling crews, truck drivers, mechanics, etc., not tomention ancillary businesses such as hotels, restaurants and car dealerships.When oil prices drop, all of these businesses suffer, as they did in shale oilstates like Texas and North Dakota post-2014. Banking and investment sectorswhich loan money to oil companies and suppliers also get hit when oil pricesfall.

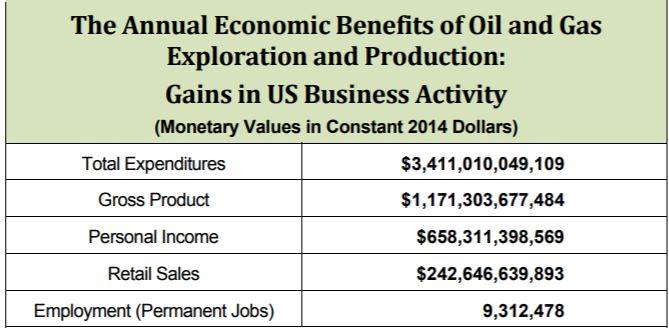

The PerrymanGroup did a study in 2014 that examined theimpacts of oil and gas drilling on the US economy. The study found “the totaleconomic benefits of oil and gas exploration and development activity(including multiplier effects) are estimated to include almost $1.2 trillion ingross product each year, as well as more than 9.3 million permanent jobs in theUnited States. By both measures, this activity represents nearly 7% of the USeconomy.”

The negatives of high oil prices are equally well known, though,and manifest in increased costs to the manufacturing and transportationindustries which rely on oil and gas inputs. As crude prices rise, so do theprices of jet fuel and gasoline, though controversially, gas prices rarely fallin step with slumping crude prices. Conversely, lower oil prices are generallyseen to be good for transportation and manufacturing, where decreased costs arepassed on to consumers, notesInvestopedia.

In another report, FXCMMarket Insights observed that 30% of agricultural expenses are energy-related, which impacts the price of food. Oil prices also affectshipping costs and will influence the prices of most raw materials andcommodities including metals. In 2014, the study said, oil consumptionaccounted for nearly 4% of GDP. A 10% increase in the price of oil shrinks US realGDP by 1.4%. Increases in crude oil prices also push up core inflation andinflation-adjusted bond yields.

The shale revolution

Booming shale production has put the United States oil industry ina position to overtake Russia as the world’s global oil superpower. The growthin shale oil has truly been astounding. As fracking technologies evolved tosuccessfully inject sand, water and chemicals at high pressure to crack tightlyformed shale rock formations, thus allowing oil and gas to flow to surface viahorizontal and vertical wells, drilling companies flocked to formations likethe Bakken, Eagle Ford and Permian Basin. The number of rigs in North Dakotadoubled from May to December 2009, and doubled again by the end of 2010. Thesleepy town of Williston, North Dakota more than doubled in population fromjust under 15,000 in 2010 to 32,000. Thousands of workers were housed inmakeshift camps while others showed up on spec without any place to live, the FTrecounted in a good summary of the shale revolution.

Between 2008 and mid-2017, US oil production nearly doubled to9.35 million barrels a day, driven largely by production from shale-producingregions. North American shale oil fields caused an estimated 5% increase in UScrude production in 2017. Blame for the oil crash of 2014 at least partly restson the United States for flooding the global market with shale oil.

While OPEC has cut back to compensate, there are no signs that theUS is going to do the same. While the first week of 2018 saw production slipfrom 9.78 million bpd to 9.49 million bpd, byJanuary 19 it was up again to 9.75 million bpd.

According to the EIA, US oil output will average 10.3 million bpdthis year and 10.9 million in 2019, driven by growth in Texas and North Dakotashale production. The last time US oil production was this high was in 1970(9.6 mbpd). Russia, the largest oil producer, by contrast pumped 11 millionbarrels a day in 2017 while Saudi Arabia, OPEC’s biggest producer, pumped justunder 10 million bopd in December, according to numbersreported recently by Bloomberg.

The EIA forecasts USshale production will grow by 111,000 barrels a day to 6.55 million in February; output from the Permian Basinin Texas and New Mexico is seen rising by 76,000 barrels a day.

Theeconomic and political impacts of soaring U.S. output are breathtaking, cuttingthe nation’s oil imports by a fifth over a decade, providing high-paying jobsin rural communities and lowering consumer prices for domestic gasoline by 37percent from a 2008 peak.

The news outlet adds that efficiencies brought on by the battlewith OPEC including multi-pad drilling and “walking oil rigs” helped US firmsto produce enough oil to lobby the government to removethe ban on oil exports that had been in placesince 1975 - following the 1973 OPEC oil embargo that led to shortages and longlineups at gas pumps.

Now the US exports some 1.7 million barrels a day of crude and 3.8billion cubic feet per day of natural gas - spurring a conversion of import toexport terminals and a boom in US pipeline construction such as the Keystone XLexpansion.

Accordingto Business Insider, with US oil productionhitting record levels, refiners from around the world, particularly China, arescrambling to book shipments.

“U.S.crude exports have spiked, jumping from around half a million barrels per dayin 2016 and about 1 mb/d for much of 2017, to over 2 mb/d at the end ofOctober, an all-time high,” BI reported.

Offshore oil exploration re-opened

With so much oil being pumped from US fields, is there a risk ofrunning short of reserves? Not as long as Donald Trump stays in power. Thepro-coal, pro-oil President has just proposed a sweeping offshore drilling plan- one that is starkly at odds with his predecessor, Barack Obama, who used hisfinal weeks in office to ban oil and gas drilling in portions of the Arctic andAtlantic oceans.

The plan would reverse that ban and open up drilling in those sameoceans, as well as parts of the Gulf of Mexico that have been off limits. Itwould run from 2019 to 2024 and make over 90% of the US coast available forlease sales to oil and gas companies.

TheAdministration believes the proposed territory holds some 90 billion barrels ofoil and 319 trillion cubic feet of natural gas, or reserves that are about 80percent larger than are currently available, reportedOilprice.com.

“We want togrow our nation’s offshore energy industry, instead of slowly surrendering itto foreign shores,” Ryan Zinke, the Secretary of the Interior, toldreporters. “This is a clear difference betweenenergy weakness and energy dominance. Under President Trump we’re going to havethe strongest energy policies and be the strongest energy superpower.”

New USconventional oil could also come into play under Trump’s aggressive newexploration policy. Just over a year ago Spanish company Repsol said it hasdiscovered an oil reserve of 1.2 billion barrels in the North Slope of Alaska. CNBCreported the company saying it’s the largestonshore discovery in the US in three decades - allowing production of 120,000barrels a day starting in 2021.

Conclusion

While the United States remains dependent on foreign countries fora large number of strategic minerals including manganese, cobalt and rareearths, when it comes to oil the States has achieved a remarkable position ofenergy independence that would have been unthinkable a decade ago. According to theEIA, in 2016 US net imports (imports minusexports) of petroleum from foreign countries was only about a quarter of thatconsumed in the US - the lowest level since 1970.

The flood of US shale oil has had a major effect on the globalsupply, so much so that OPEC, which used to hold the balance of oil power, nowfears the US oil machine will continue to grind on, knocking the price down andputting pressure on their petroleum-dependent economies.

But we also know that lower oil prices benefit the US economythrough lower transportation and manufacturing costs, which through themultiplier effect means lower prices for consumer goods and more spending. Farfrom collapsing the US oil industry, the oil crash of 2014 only appears to havemade it stronger. I’ve got the resurgence of US oil and the investmentopportunities it could present on my radar screen. Do you?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.