Retailer's Call Options Hot Before Earnings

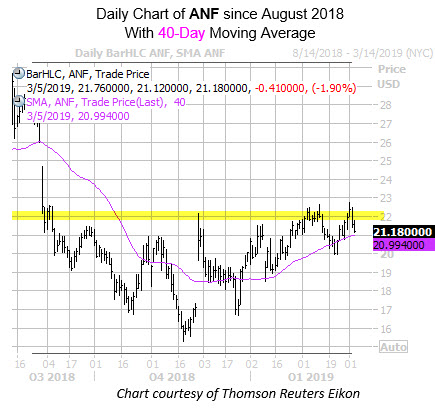

The 40-day trendline has failed to push the shares back above $22

The 40-day trendline has failed to push the shares back above $22

Another retailer ready to take the earnings stage this week is Abercrombie & Fitch Co. (NYSE:ANF), scheduled to report fourth-quarter results before the market opens tomorrow, March 6. Below we will dive into the stock's performance, and take a glance at what the options market is pricing in for ANF's post-earnings trading.

Abercrombie & Fitch shares have struggled to gain momentum since their late-August bear gap, specifically running into a ceiling of resistance at the $22 mark -- in spite of the supportive 40-day moving average. Despite currently trading down 1.9% at $21.21, ANF is clinging to year-over-year gains of 5%.

Moving onto ANF's earnings history, the stock tends to make extremely volatile post-earning swings, of which six have been positive over the past eight quarters. This includes an 21% surge in November. On average, the shares have swung 15.3% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 21% move for Wednesday's trading.

Call options traders have been circling ANF ahead of the impending earnings report. For example, during the past 10 trading days, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows the security with a ratio of 7.93, ranking in the highest annual percentile.

Echoing this, Abercrombie stock's Schaeffer's put/call open interest ratio (SOIR) of 0.58 lands in the 28th annual percentile. In other words, near-term options traders are more call-biased than usual right now.