Rick Mills: How to profit from the demands of a growing world population

As the world prepares to house, feed and care for 9.7 billion people, Ahead of the Herd founder Rick Mills is looking for the companies that will profit from the silent tsunami of demand creeping up on resource and healthcare providers. In this interview with The Gold Report, Mills reveals the six companies he thinks are well positioned in their respective sectors to ride this population wave to profits.

As the world prepares to house, feed and care for 9.7 billion people, Ahead of the Herd founder Rick Mills is looking for the companies that will profit from the silent tsunami of demand creeping up on resource and healthcare providers. In this interview with The Gold Report, Mills reveals the six companies he thinks are well positioned in their respective sectors to ride this population wave to profits.

Source: Ahead of the Herd

The Gold Report: What does the United Nations (U.N.) projection of a population tsunami of 9.7 billion (9.7B) people living on earth by 2050 mean for commodities?

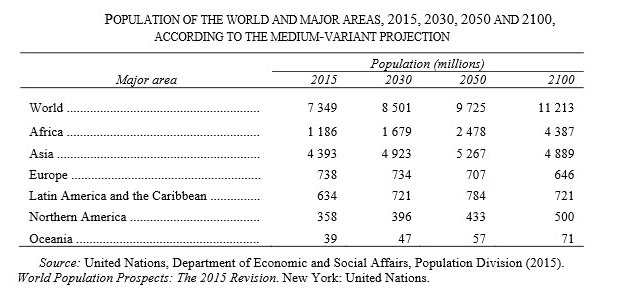

Rick Mills: The statistics are mind-boggling and extremely scary. According to the U.N., the world's population reached 7.3B in the middle of 2015. That's 1B more people sitting at the dinner table in the span of the last 12 years. Some 60% live in Asia (4.4B people); 16% live in Africa (1.2B people); 10% in Europe (just over 700 million [700M]); 9% in Latin America and the Caribbean (634M). The remaining 5% live in Northern America: Mexico, Canada and the U.S. (358M). Compare those numbers to China, which has 1.4B people, and India, which has 1.3B. That's 19% and 18% of the world's population, respectively.

Growth has slowed from 1.24% 10 years ago to 1.18% this year, but it still means we are adding 83M people to the world's population annually. Half of the global population growth between now and 2050 is going to occur in Africa. Most of the people born between now and 2050 will be in developing countries. When we look at the global demand for resources, the Western world doesn't count. We here in the West are almost a rounding error in the world population.

TGR: Can we innovate our way out of a commodity crisis?

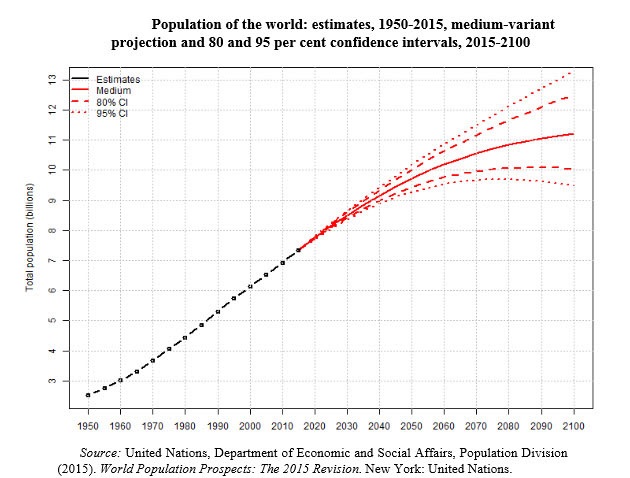

RM: Norman Borlaug, father of the Green Revolution, said if we did everything right, we'd be able to feed and water 10B people. We are close to the edge The world population is projected to reach 8.5 billion in 2030, and to increase further to 9.7 billion in 2050. The U.N. warned us when we reached 7B people, "The world population has now reached a stage where the amount of resources needed to sustain it exceeds what is available."

How are we going to feed, clothe and house 83M more people a year? Think of it as building a complete self-contained city for 1.5M people every week.

It's not going to stop. In 2015, the earth's overshoot day-the day every year when we've exhausted all the natural resources that can be renewed each year on our planet-occurred six days earlier than it did in 2014. Humans have exhausted a year's supply of natural resources in less than eight months, according to an analysis of the demands the world's population are placing on the planet.

This is when humanity goes into ecological debt. Right now, we are consuming the equivalent of 1.4 planets a year. By 2030, 8.5B of us could be consuming the equivalent of two planets. The median age of the global population, that is, the age at which half the population is older and half is younger, is 29.6 years. Half of the world's population is under 30 years old.

About one-quarter (26%) of the world's people are under 15 years of age. This is a lot of future consumption from people starting with much less than we have in the West.

The ecologist Garrett Hardin introduced the idea of the "tragedy of the commons." Think about a pasture. As farmers keep putting more animals on the land, the cows get skinnier, but people continue to do it because it's advantageous right up to the point that the grazing limit is exceeded. Then all the cows die, and all of the families suffer. Fishermen behave similarly. Hardin says the private gain of the individual is thus at the shared cost of the whole group and ultimately catastrophic in nature. We are doing that on a global scale and it's going to have drastic consequences.

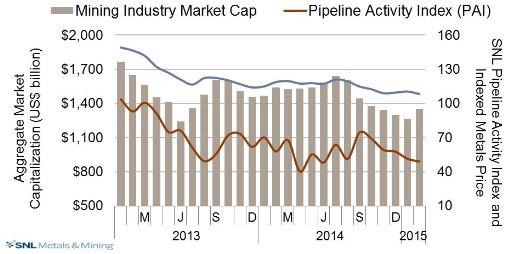

TGR: If we're running out of resources, why are the prices of the commodities going down instead of up?

RM: A lot of it has to do with cheap oil and gas. Saudi Arabia and Iraq are pumping oil and gas out like crazy to punish the frackers. Zero interest rates by the Federal Reserve cause investors to chase yield, mainly stocks and junk bonds. People are worried about whether China's economic growth can remain strong in the long run. Of particular importance to us is commodities are priced in the U.S. dollar. The U.S. dollar is pretty much off the charts, it's so strong, and it's causing a commodities pricing rout.

TGR: The other thing about the supply and demand picture for commodities that Brent Cook has talked about is the danger of a lack of supply in the coming decade because of a dearth of exploration that's going on now as companies try to conserve cash. When will we start to see that price pressure?

RM: It's hard to say. If you had asked me a few years ago, I would have thought that we'd have seen it by now, but we seem to be careening from one economic crisis to another and attention is elsewhere. Brent is right in focusing on the supply side rather than demand. But there's more to it than just the dearth of exploration. We're actually shutting down mines and high grading the rest. The world's largest mines-the ones that supply most of our production-are running out of reserves. New mines are harder to find. They're more remote and infrastructure-challenged. They come with more complicated mineralogy, meaning more expensive metallurgy. Also, we have a bit of a glut of experienced people. But when things turn around, we're going to have a shortage of trained people, especially the midlevel managers and professional geoscientists.

TGR: You have written that the coming scarcity of resources could be a security issue for countries that are not being proactive. You say that China is going out securing future supply. What are some examples of that?

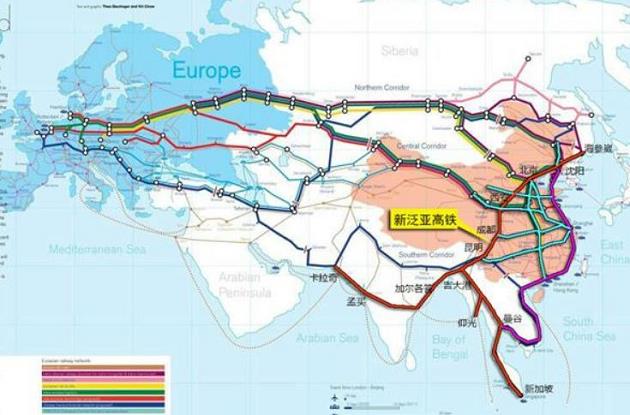

RM: China is trying to revive the old land and maritime Silk Roads. The new initiative is called One Belt, One Road (OBOR). This is a massive build-out of infrastructure, including tens of thousands of kilometers of roads, rail and ports. We're talking almost 100,000 kilometers (100,000km) of rail networks just in Eurasia. We're talking about close to 70% or more of the world's population, 30% of the world's economy, 25% of the world's good and services.

China has invested $30B in a $100B Asian Infrastructure Investment Bank to lend money to the countries along the planned route. China also has $4 trillion in foreign reserve that it is going to lend to countries along the routes. It will build ports, railroads, highways, airports, schools and dig wells. All these countries have to do is sign an offtake agreement for natural resources. That is happening right now.

All of that overcapacity that people think China screwed up on, all the megafactories, all the ghost cities, wasn't a mistake. This was planned. China wants to become the manufacturing center for 70% of the world. That's how it's going to do it, by the largest resource grab in history and the continuing urbanization (30M per annum) of its population.

TGR: Once the rest of the world understands they need to secure their piece of the shrinking pie, what are the specific commodities and companies that could benefit from this?

RM: Commodities have the benefit of being real things you can hold in your hands, whether it's nickel or precious metals or copper or ownership of uranium companies. These aren't paper promises like fiat currencies. These are things that have value and are going to become increasingly scarce and valuable going forward.

TGR: Let's start with gold. What are the companies that could benefit from a return to higher gold prices?

RM: New Carolin Gold Corp. (LAD:TSX.V) has an old gold mine, the Ladner gold project outside of Hope in British Columbia. I've said for years that sometimes your best investment is taking a good project screwed up by management and then having new management come in and right the ship. New Carolin's project fits the bill.

The other thing that's a positive is that with the Canadian dollar so weak against the U.S. dollar, gold isn't $1,100 an ounce ($1,100/oz). In Canadian money, it's CA$1,600/oz. Being two hours outside of Vancouver and a half an hour outside Hope for supplies, its costs should be in the lowest quartile of producers. New Carolin could surprise people to the upside with just how much gold it has, the grade of it, the fact that it's close to surface and everything is so close in the lower mainland-supplies, infrastructure and workers who can sleep in their own beds at night.

TGR: When can we expect to see a resource estimate or some other catalyst on that project?

RM: New Carolin is raising the money to acquire the remaining 60% of the project. We should hear some news on that soon. Then the drill program will start this spring. We should see 3,000-4,000 meters (3,000-4,000m) of drill results this year. I think it's going to surprise a lot of people with just how much gold is up there.

TGR: Do you see similar upside for any companies in the silver space?

RM: Kootenay Silver Inc. (KTN:TSX.V) has the Promontorio project, which has 110 million ounces (110 Moz) of silver equivalent. Just a few kilometers away Kootenay found a fabulously rich, near-surface, pure silver discovery called La Negra. Kootenay is going to come out with an NI 43-101 resource on La Negra this year. I think that the two projects can be combined and mined as one. Kootenay is also going to be drilling, looking for some of the higher-grade zones on Promontorio.

Kootenay also took advantage of the discount prices at the bottom of the market and bought Northair Silver Corp. (INM:TSX.V), with its La Cigarra project that has 62Moz in the Measured and Indicated (M&I) and Inferred categories, for $11M. There's unbelievable blue sky potential on that project as there is on La Negra. At La Cigarra, Kootenay is going to be drilling the RAM zone, and update the NI 43-101. Among Kootenay's three projects, we're going to see well over 200 Moz silver and silver equivalent, half of it pure silver. Again, lots of drilling, lots of high grade, huge discovery upside and an NI-43-101-compliant resource coming.

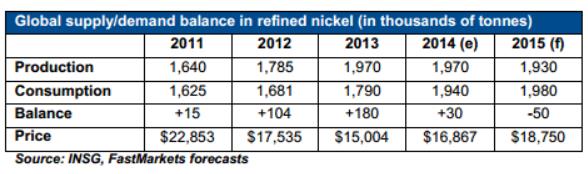

TGR: What is the supply-demand picture for nickel?

RM: I have long thought that nickel and copper have some of the better supply-demand fundamentals going forward. Asia is now by far the largest regional market for nickel representing 65% of total world demand. China alone now accounts for close to 44% of world nickel demand. Investors need to be looking down the road.

TGR: What company do you like in the nickel space?

RM: North American Nickel Inc. (NAN:TSX.V) has a huge land package, pretty much the entire Greenland Norite Belt. The company spent the last few years exploring and drilling, and found many mineralized zones. This is the year it is going back in a search for tonnage. It has commitments for financing from the Sentient Group and its other large investors. We could see a starter 10-15 million tons of high-grade nickel sulfide, 2% equivalent, close to tidewater. North American Nickel has its own port and will be able to ship concentrate anywhere in the world. Again, that very well could be the start of a world-class deposit.

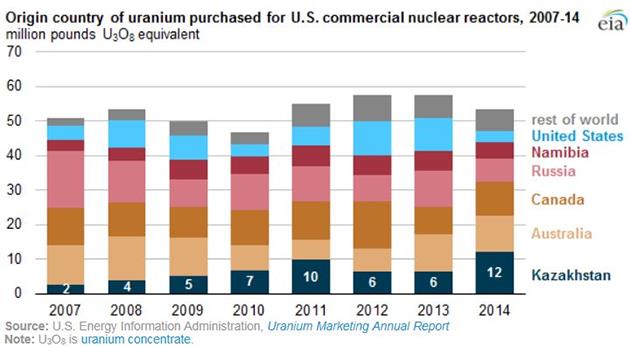

TGR: Marin Katusa has talked about the security of supply concern, particularly when it comes to the fact that when we moved away from Russian uranium, we switched to more Kazakhstan uranium. Do you see that as a catalyst for uranium prices and domestic producers?

RM: The U.S. consumes 55 million pounds (55 Mlb) of uranium each year and imports over 90% of the uranium it uses. What could be more important to a country than security of energy supply in the form of nuclear fuel in the United States?

Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.MKT; EFRFF:OTCQX) is set up to be the premier U.S./North American uranium producer. It's undervalued, and that's why it's well worth putting on your radar screen. You buy at the bottom because of what you think is going to happen in the future.

TGR: Energy Fuels just completed a merger. How big a role could that company play in fulfilling domestic demand?

RM: Energy Fuels has two of North America's key production centers: the White Mesa mill in Utah and the Nichols Ranch processing facility in Wyoming, which it acquired when it took over Uranerz Energy Corp. The White Mesa mill is the only conventional uranium mill operating in the U.S., and it has a licensed capacity of over 8 Mlb/year U3O8. The Nichols Ranch processing facility is an in situ recovery center with a licensed capacity of 2 Mlb. Energy Fuels has the largest NI 43-101 uranium resource portfolio in the U.S. and two producing mines.

TGR: A growing aging population also needs healthcare. You've written about a mining company that's turning itself into a life science company. How does that work? Are there crossover skills? What does that mean for the investor?

RM: Expedition Mining Inc. (EXU:TSX.V) acquired all the shares of BSS Life Sciences Inc. Imagin Medical CSE (IME.TSX.V) is the new company being formed by the reverse takeover.

White light is the standard convention and it's what is commercially available in all endoscope devices manufactured today. White light has visualization limitations for all cancer types because white light cannot pass through tissue or blood and cannot illuminate tumors beneath the skin surface. White light is also not effective in visualizing the borders or margins of the tumor to determine where it starts and ends, especially after the initial removal of the main mass. Imagin Medical will commercialize an ultrasensitive, next-generation imaging technology for extremely accurate visualization of cancers.

TGR: Will it be the same management team and investors?

RM: A couple of Expedition's directors will stay but the management of BSS is going to be the management of the new company.

TGR: Staying on the healthcare theme, you recently wrote that the World Economic Forum estimated global diseases will kill 36M people every year and cost upward of $47 trillion by 2030, and you point to diabetes as one of the four biggest killers. What companies are you watching that are focused on solving that problem?

RM: Sernova Corp. (SVA:TSX.V) developed an under-the-skin implanted medical device the size of a credit card called the Cell Pouch. It generates and maintains a blood vessel-rich, ideal environment for stem cells or therapeutic cells. The idea is the cells will monitor blood sugar levels and secrete insulin, effectively becoming a mini-pancreas, controlling diabetes. It has been tested on small and large animals and has been proven safe and compatible with humans. The company is expecting to be in clinical trials in people shortly.

We're also doing the same thing for hemophilia.

TGR: Are there any catalysts coming up for that company in 2016 we should be watching?

RM: I think there will be a validation event when some large pharma wants to partner on trials.

TGR: What is the one piece of advice you have for investors bracing themselves for 2016?

RM: We live on a small planet with finite resources. Much of the world's undeveloped resources lie within China's One Road One Belt initiative-what this author believes is a massive resource grab. Resources-real things-are going to become a dominate investment theme and should be on everyone's radar screens. It is an exciting time for the healthcare sector, patients, and, yes, investors, with many disruptive innovations on the near horizon.

Picking the companies offering the most for the least with good management teams is the way to prosperity.

TGR: Thanks for your time. It's always a pleasure.

Richard Mills is host of www.Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Source: JT Long of The Gold Report

DISCLOSURE:1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Energy Fuels Inc. and North American Nickel Inc. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.3) Rick Mills: I own, or my family owns, shares of the following companies mentioned in this interview: New Carolin Gold Corp., Expedition Mining Inc. and Sernova Corp. I personally am, or my company is, paid by the following companies mentioned in this interview: Energy Fuels Inc., North American Nickel Inc., Kootenay Silver Inc., New Carolin Gold Corp., Expedition Mining Inc. and Sernova Corp. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise - The Gold Report is Copyright (C) 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.