Rio Tinto investors partying like it's 2014

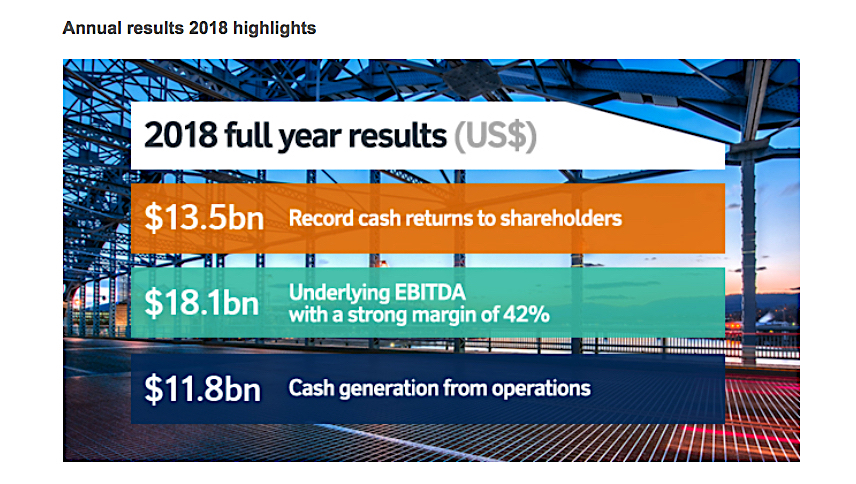

Rio Tinto's (ASX, LON:RIO) investors will be celebrating Christmas in February, as the miner is giving them a $4 billion special dividend, or $2.43 cent a share, after posting its highest annual underlying earnings since 2014.

The world's second largest miner reported Wednesday a 2% increase in underlying profit, up to $8.8 billion, beating market forecasts of $8.5 billion on the back of rising revenue of $40.5 billion. The special dividend also came after a string of asset divestments, including Rio's entire interest in Indonesia's Grasberg mine for $3.9 billion.

Shareholders will receive a special dividend worth $4 billion, or $2.43 cent a share, as Rio Tinto recorded its highest annual underlying earnings in the last five years.Since Jean-S?(C)bastien Jacques took the helm in July 2016, Rio has focused on cutting costs, generating cash and returning as much of it as possible to investors through dividends and share buybacks.

Last year, the company waved all its coal assets goodbye and is now the only major miner with a fossil-fuel-free portfolio. In total, Rio has sold $12 billion worth of unwanted assets since 2015.

But not all was rosy in the company's 2018 results. The firm flagged a further delay from the $5.3 billion underground expansion of its Oyu Tolgoi copper-gold-silver mine in Mongolia. The expansion has now been scheduled for the third quarter of 2021.

Jacques also acknowledged the clouds currently casting shadows over the global economy, including the threat of a trade war between the U.S. and China, the main market for Rio's iron ore.

"I believe common sense will prevail at some stage," Jacques said. "There is uncertainty around, but we are very well positioned. The only thing I can do is to make sure I have a business that is even stronger."

From Rio Tinto

Separately, Rio Tinto released a major report into its plans to transition into a low carbon future, and Jacques made a point of underlining its Environmental, Social and Governance (ESG) credentials.

The company also finally confirmed a promising copper find at its Winu project in Western Australia.