Rio Tinto is no longer worried about China's growth

World's second largest miner Rio Tinto (ASX, LON:RIO) injected some much-needed optimism in the markets Monday by saying that while China's short-term demand remains difficult to read, the long-term outlook is looking much brighter than a few months ago.

Figures out of China, Rio Tinto's and most mining companies' biggest consumer, show that factory output, investment and retail sales all exceeded analyst estimates in August as the property sector picked up pace.

We can see an inflection point and we are going to make the most of it - Rio's chief executive officer Jean-Sebastien Jacques.Home prices climbed the most in more than six years last month, South China Morning Post reported, quoting data from the National Bureau of Statistics.

Those and other indicators, said Rio's chief executive officer Jean-Sebastien Jacques in an interview with Bloomberg TV, is pushing his company closer to what he described as "cautiously optimistic" in relation to China.

"We can see an inflection point and we are going to make the most of it," Jacques said, adding that Rio believed that from all the commodities it mines, copper would be the first one to come out of the current "twilight zone."

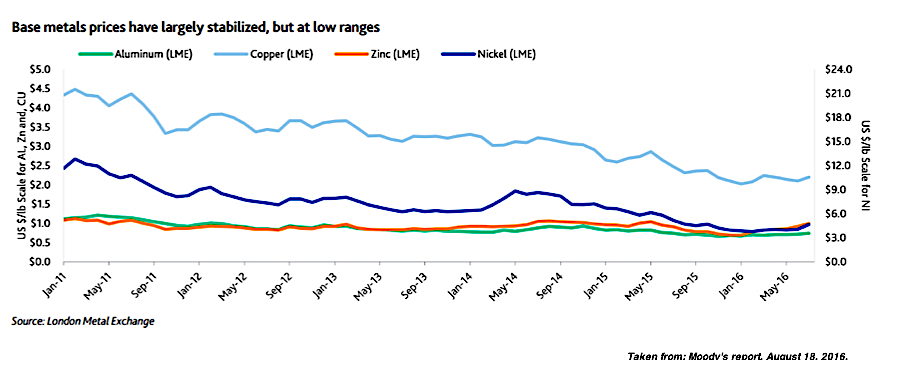

Several analysts back his views. Moody's Investors Service, for instance, changed its outlook for base metals in August from negative to stable, which basically means it believes prices for aluminum, copper, nickel and zinc have already bottomed out.

"The data in China has been much stronger than people expected and that should be a precursor as a demand for commodities," Julian Babarczy, head of Australian equities at Regal Funds Management, told Sydney Morning Herald. "The only caveat is that demand is stimulus lead, and we don't know whether that's sustainable or not. But there is a greater tendency for people to buy these stocks at the moment."

Former Morgan Stanley chief economist Stephen Roach, who is among those arguing the China downturn story has been oversold, partly agrees. He has said that if Beijing meets its 6.7% growth -target, it will account for 1.2% of global GDP growth, or roughly 40% of the total, which means that commodity prices may show further gains.