Rough Bubble Brewing

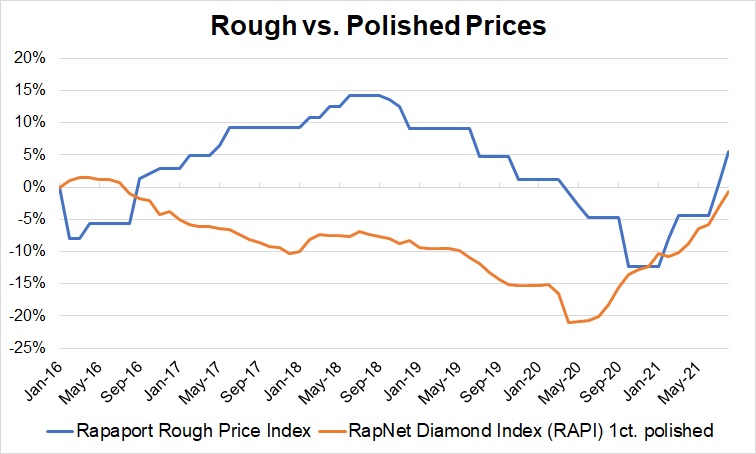

RAPAPORT... The rough market is buoyant after yet another price increase by De Beers, leaving many in the trade scratching their heads. Goods are selling at strong premiums on the secondary market - double-digit percentages in some categories - as manufacturers continue to boost production after the past year's coronavirus-induced stoppages.De Beers raised prices an estimated average of 5% during this week's July sight, as first reported by Rapaport News. The increase was the fifth the company has implemented in eight months. Alrosa has made similar moves through June, and there is some expectation it will up prices again at its July sale. The miners do not comment on pricing. They might justify the increases by pointing to several factors. They would note that demand is robust in the polished sector, driven by strong sales at retail. They would also look at the hot auction and tender circuit along with activity on the secondary rough market.Indeed, polished prices are up 11% since the beginning of the year as measured by the RapNet Diamond Index (RAPI?,,?) for 1-carat diamonds. And the rough tender houses saw increases of up to 20% in June versus April. That may justify the hikes in the short term. However, the price increases will hurt the market in the long run. The move is already putting pressure on manufacturing margins, as one Indian banker stressed in a conversation on Thursday. Rough prices in the primary market for De Beers and Alrosa supply have increased by 20% since the beginning of the year, versus the 11% rise in polished, Rapaport estimates (see graph).

RAPAPORT... The rough market is buoyant after yet another price increase by De Beers, leaving many in the trade scratching their heads. Goods are selling at strong premiums on the secondary market - double-digit percentages in some categories - as manufacturers continue to boost production after the past year's coronavirus-induced stoppages.De Beers raised prices an estimated average of 5% during this week's July sight, as first reported by Rapaport News. The increase was the fifth the company has implemented in eight months. Alrosa has made similar moves through June, and there is some expectation it will up prices again at its July sale. The miners do not comment on pricing. They might justify the increases by pointing to several factors. They would note that demand is robust in the polished sector, driven by strong sales at retail. They would also look at the hot auction and tender circuit along with activity on the secondary rough market.Indeed, polished prices are up 11% since the beginning of the year as measured by the RapNet Diamond Index (RAPI?,,?) for 1-carat diamonds. And the rough tender houses saw increases of up to 20% in June versus April. That may justify the hikes in the short term. However, the price increases will hurt the market in the long run. The move is already putting pressure on manufacturing margins, as one Indian banker stressed in a conversation on Thursday. Rough prices in the primary market for De Beers and Alrosa supply have increased by 20% since the beginning of the year, versus the 11% rise in polished, Rapaport estimates (see graph).

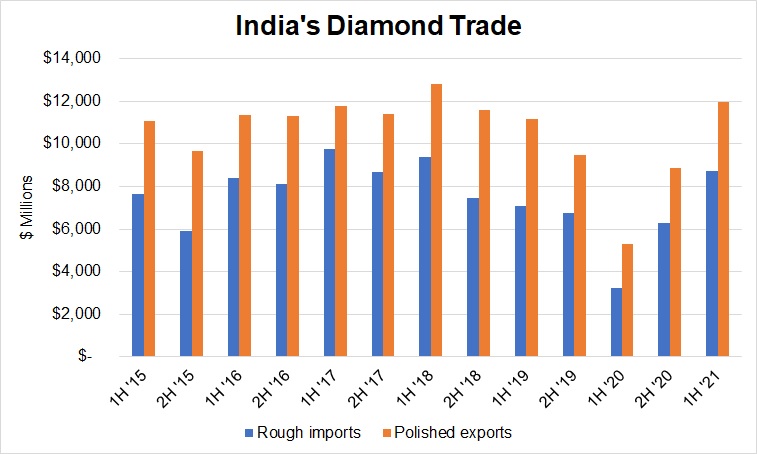

The miners would also view the dynamic through a broader lens, as we all do. Ultimately, the market is driven by four major forces: liquidity, supply, demand and expectation.There is a sense that lenders have increased their exposure to the industry since the beginning of the year, injecting more cash for rough buying - although the banker we spoke with stressed his credit remains within reason. Notwithstanding the banks, the diamond midstream has emerged from the coronavirus crisis profitable and with good liquidity as manufacturers and dealers sold excess polished inventory, while rough purchases froze for a period in 2020.In a surprising consequence of the pandemic, there was more available credit than demand at the start of 2021 (see "Banking on Diamonds" in the April issue of Rapaport Magazine). The concern then was that excess liquidity would lead to overexuberant rough buying.That is playing out now. Manufacturers are paying high prices demanded by De Beers, Alrosa, and on the tender and secondary markets because they have the money to do so.There is also an argument that they simply need the goods. Covid-19 restrictions have forced Indian manufacturers to limit their operations, and there is a glut in the supply chain due to ongoing delays at the Gemological Institute of America (GIA). That said, India's polished exports reached $11.98 billion in the first half, exceeding pre-pandemic levels - 7% above the first six months of 2019. The country's rough imports increased 24% for the same period over the two years to $8.74 billion (see graph).

The miners would also view the dynamic through a broader lens, as we all do. Ultimately, the market is driven by four major forces: liquidity, supply, demand and expectation.There is a sense that lenders have increased their exposure to the industry since the beginning of the year, injecting more cash for rough buying - although the banker we spoke with stressed his credit remains within reason. Notwithstanding the banks, the diamond midstream has emerged from the coronavirus crisis profitable and with good liquidity as manufacturers and dealers sold excess polished inventory, while rough purchases froze for a period in 2020.In a surprising consequence of the pandemic, there was more available credit than demand at the start of 2021 (see "Banking on Diamonds" in the April issue of Rapaport Magazine). The concern then was that excess liquidity would lead to overexuberant rough buying.That is playing out now. Manufacturers are paying high prices demanded by De Beers, Alrosa, and on the tender and secondary markets because they have the money to do so.There is also an argument that they simply need the goods. Covid-19 restrictions have forced Indian manufacturers to limit their operations, and there is a glut in the supply chain due to ongoing delays at the Gemological Institute of America (GIA). That said, India's polished exports reached $11.98 billion in the first half, exceeding pre-pandemic levels - 7% above the first six months of 2019. The country's rough imports increased 24% for the same period over the two years to $8.74 billion (see graph).

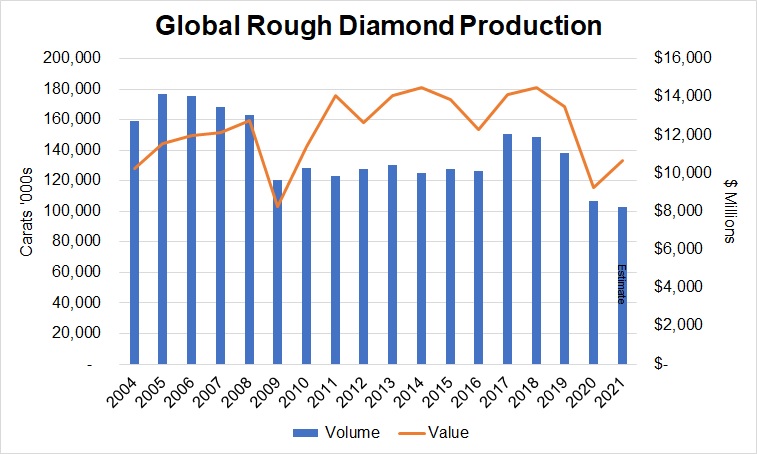

Based on monthly data published by the Gem & Jewellery Export Promotion Council (GJEPC). Meanwhile, polished demand is being driven by a strong retail rebound in the US and China. Most expect that momentum to continue in the second half of the year as jewelers prepare for the holiday season. US consumer confidence is on the rise, boosted by government stimulus checks and the resumption of gift-giving events and celebrations that were canceled during the pandemic.Diamantaires are still reporting shortages in the polished market, particularly for 1- to 2-carat goods. Inventory on RapNet has increased since the beginning of the year for 0.30- to 0.89-carat diamonds but has been stable at relatively low levels for larger goods.Perhaps inventory will rise at a faster pace as the GIA releases more polished in the coming months. However, it seems the mining companies are also being careful not to flood the market with goods. Production plans appear conservative considering the level of demand and that the Argyle mine closed last year, taking high volumes of rough off the market. We expect global production volume to decline about 4% in 2021 from last year's lows, based on forecasts by six major miners (see graph).

Based on monthly data published by the Gem & Jewellery Export Promotion Council (GJEPC). Meanwhile, polished demand is being driven by a strong retail rebound in the US and China. Most expect that momentum to continue in the second half of the year as jewelers prepare for the holiday season. US consumer confidence is on the rise, boosted by government stimulus checks and the resumption of gift-giving events and celebrations that were canceled during the pandemic.Diamantaires are still reporting shortages in the polished market, particularly for 1- to 2-carat goods. Inventory on RapNet has increased since the beginning of the year for 0.30- to 0.89-carat diamonds but has been stable at relatively low levels for larger goods.Perhaps inventory will rise at a faster pace as the GIA releases more polished in the coming months. However, it seems the mining companies are also being careful not to flood the market with goods. Production plans appear conservative considering the level of demand and that the Argyle mine closed last year, taking high volumes of rough off the market. We expect global production volume to decline about 4% in 2021 from last year's lows, based on forecasts by six major miners (see graph).

Based on Kimberley Process data; Rapaport estimates for 2021. Last year, De Beers and Alrosa, which together account for about half of global supply volume, adopted a strategy to sell less for more. They made downward price adjustments only around August when demand returned, although the downturn began in March. That helped the market recover from the crisis, but it also enabled those miners to make steady increases since then - five in eight months.They are now continuing the strategy of withholding supply to uphold value. That brings us to the final factor that is motivating the upswing - expectation. Polished suppliers are already trying to raise prices to cover their rough costs. Manufacturers are paying more for rough because they expect polished prices to go up.That should ring a warning bell for the industry, signaling that the market is shifting again to being supply-driven.Unsure they will be able to resell the goods at a profit, more seasoned dealers have been hesitant to buy. The smartest in the trade are managing their expectations about increases in the polished market, but many are riding the wave.The conundrum is whether upbeat sentiment and expectations are driving prices to unsustainable levels. Following previous sharp recoveries suggests that the market is heading in that direction. No party lasts forever, and the miners are taking full advantage of the current optimism by trying to maximize profit while they can. In doing so, they are raising expectations - and prices - beyond the industry's reach.

Based on Kimberley Process data; Rapaport estimates for 2021. Last year, De Beers and Alrosa, which together account for about half of global supply volume, adopted a strategy to sell less for more. They made downward price adjustments only around August when demand returned, although the downturn began in March. That helped the market recover from the crisis, but it also enabled those miners to make steady increases since then - five in eight months.They are now continuing the strategy of withholding supply to uphold value. That brings us to the final factor that is motivating the upswing - expectation. Polished suppliers are already trying to raise prices to cover their rough costs. Manufacturers are paying more for rough because they expect polished prices to go up.That should ring a warning bell for the industry, signaling that the market is shifting again to being supply-driven.Unsure they will be able to resell the goods at a profit, more seasoned dealers have been hesitant to buy. The smartest in the trade are managing their expectations about increases in the polished market, but many are riding the wave.The conundrum is whether upbeat sentiment and expectations are driving prices to unsustainable levels. Following previous sharp recoveries suggests that the market is heading in that direction. No party lasts forever, and the miners are taking full advantage of the current optimism by trying to maximize profit while they can. In doing so, they are raising expectations - and prices - beyond the industry's reach.