Russia Ukraine Tension Blinded Gold Ignores the Real Threats: USDX and Fed / Commodities / Gold and Silver 2022

Gold continues to benefit from themarket turmoil and has apparently forgotten about medium-term problems.Meanwhile, the rising USD and a hawkish Fed await confrontation.

With financial markets whipsawing afterevery Russia-Ukraine headline, volatility has risen materially in recent days.With whispers of a Russian invasion on Feb. 16 (which I doubt will berealized), the game of hot potato has uplifted the precious metals market.

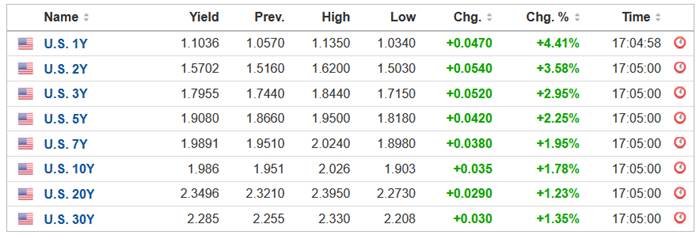

However, as I noted on Feb. 14, while thedevelopments are short-term bullish, thePMs’ medium-term fundamentals continue to decelerate. For example,while the general stock market remains concerned about a Russian invasion, U.S.Treasury yields rallied on Feb. 14. With risk-off sentiment often born in thebond market, the safety trade benefiting the PMs didn’t materialize in U.S.Treasuries. As a result, bond traders aren’t demonstrating the same level of fear.

Please see below:

Source: Investing.com

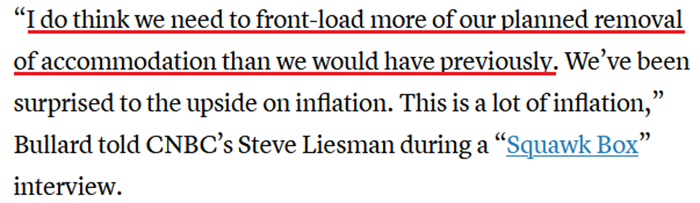

Furthermore, while the potential conflictgarners all of the attention, the fundamental issues that upended the PMs in2021 remain unresolved. For example, with inflation surging, St. Louis FedPresident James Bullard said on Feb. 14 that “thelast four [Consumer Price Index] reports taken in tandem haveindicated that inflation is broadening and possibly accelerating in the U.S.economy.”

“The inflation that we’re seeing is verybad for low- and moderate-income households,” he said. “People are unhappy, consumer confidence is declining. This is not agood situation. We have to reassure people that we’re going to defend ourinflation target and we’re going to get back to 2%.”

As a result, Bullard wants a 50 basis pointrate hike in March, and four rate hikes by July.

Please see below:

Source: CNBC

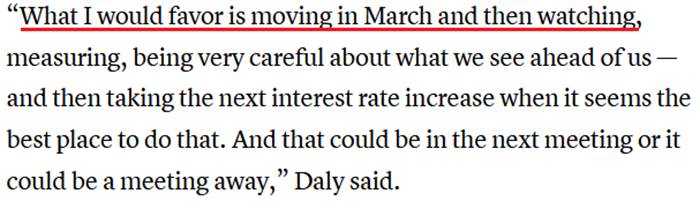

Likewise, while San Francisco FedPresident Mary Daly is much less hawkish than Bullard, she also supports a ratehike in March.

Source: CNBC

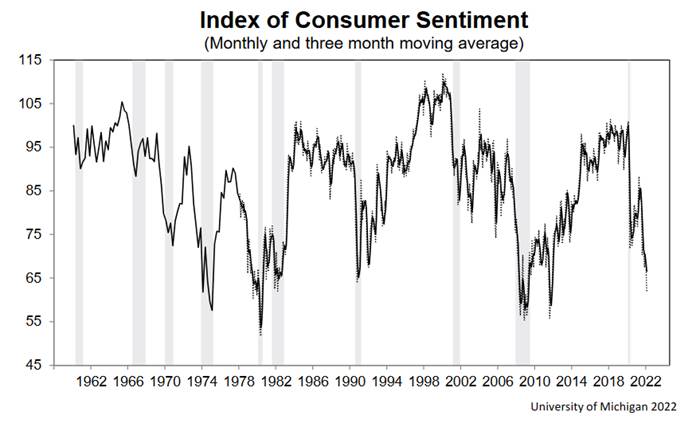

As a result, while the PMs can hide behindthe Russia-Ukraine conflict in the short term, their medium-term fundamentaloutlooks are profoundly bearish. As mentioned, Bullard highlighted inflation’simpact on consumer confidence, and for a good reason. With theUniversity of Michigan releasing its Consumer Sentiment Index on Feb. 11, thereport revealed that Americans’ optimism sank to “its worst level in a decade, falling a stunning 8.2% from last monthand 19.7% from last February.”

Chief Economist, Richard Curtin said:

“The recent declines have been driven byweakening personal financial prospects, largely due to rising inflation, lessconfidence in the government's economic policies, and the least favorable longterm economic outlook in a decade.”

“Theimpact of higher inflation on personal finances was spontaneously cited byone-third of all consumers, with nearly half of all consumers expectingdeclines in their inflation adjusted incomes during the year ahead.”

Please see below:

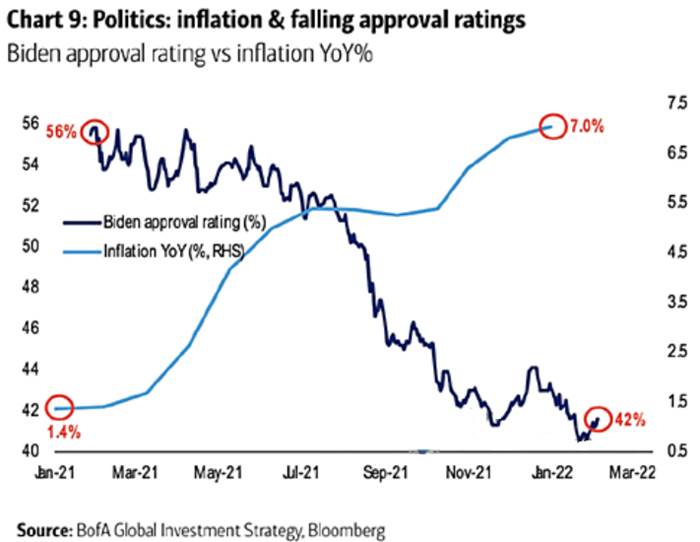

To that point, I’ve highlighted onnumerous occasions that U.S. President Joe Biden’s re-election prospects oftenmove inversely to inflation. With the dynamic still on full display, immediateaction is needed to maintain his political survival.

Please see below:

To explain, the light blue line abovetracks the year-over-year (YoY) percentage change in inflation, while the darkblue line above tracks Biden’s approval rating. If you analyze the right sideof the chart, you can see that the U.S. President remains in a highly perilousposition. Moreover, with U.S.midterm elections scheduled for Nov. 8, the Democrats can’t wait nine to 12months for inflation to calm down. As a result, there is a lot atstake politically in the coming months.

As further evidence, as inflation reducesreal incomes and depresses consumer confidence, the Misery Index also hoversnear crisis levels.

Please see below:

To explain, the blue line above tracksthe Misery Index. For context, the index is calculated by subtracting theunemployment rate from the YoY percentage change in the headline CPI. In anutshell, when inflation outperforms the unemployment rate (the blue linerises), it creates a stagflationary environment in America.

To that point, if you analyze the rightside of the chart, you can see that the Misery Index is approaching a levelthat coincided with the global financial crisis (GFC). As a result, reversingthe trend is essential to avoid a U.S. recession.

As such, with inflation still problematicand the writing largely on the wall, themarket-implied probability of seven rate hikes by the Fed in 2022 is nearly 93% (as of Feb. 10).

Please see below:

Ironically, while consumers and the bondmarket fret over inflation, U.S. economic growth remains resilient. While I’vebeen warning for months that a bullish U.S. economy is bearish for the PMs,continued strength should turn hawkish expectations into hawkish realities.

To that point, the chart above shows thatfutures traders expect the U.S. Federal Funds Rate to hit 1.75% in 2022 (versus0.08% now). However, Michael Darda, Chief Economist at MKM Partners, expectsthe Fed’s overnight lending rate to hit 3.5% before it’s all said and done.

“Wehave this booming economy with high inflation and a rapid recovery in the labormarket – much different relative to the last cycle,” he said. “The Fed isbehind the curve this time. They are going to have to do more.”

Singing a similar tune, John Thorndike,co-head of asset allocation at GMO, told clients that “inflation is now here,[but] the narrative is that inflation goes away and markets tend to strugglewith change. It is more likely than notthat real yields and policy rates need to move above inflation during thiscycle.”

The bottom line? While the Russia-Ukrainedrama distracts the PMs from the fundamental realities that confront them overthe medium term, theiroutlooks remain profoundly bearish. Moreover, while I’ve noted onnumerous occasions that the algorithms will enhance momentum in eitherdirection, their influence wanes materially as time passes.

As such, while headline risk is materialin the short-term, history shows that technicals and fundamentals reign supremeover longer time horizons. Thus, while the recent flare-up is an unfortunateevent that hurts our short position, the medium-term developments that led to ourbearish outlook continue to strengthen.

In conclusion, the PMs rallied on Feb.14, as the Russia-Ukraine conflict is the primary driver moving the financialmarkets. However, while the PMs will ride the wave as far as it takes them,they ignored that the USD Index and U.S. Treasury yields also rallied.Moreover, with Fed officials ramping up the hawkish rhetoric, the PMs'fundamental outlook is more bearish now than it was in 2021 (if we exclude theRussia-Ukraine implications). As a result, while the timeline may have beendelayed, lower lows should confront gold, silver, and mining stocks in thecoming months.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.