Russian Demand Is Helping Gold

Russia's divestiture out of dollars and into gold is bullish for the metal.

50-year high in central bank demand is also boosting the yellow metal.

Gold's intermediate-term trend remains up despite strong dollar.

Despite the continued strength of the U.S. currency, and partly because of Russia's increased appetite for the metal, gold's bullish prospects in 2019 are as strong as they've been in years. That's because gold now enjoys a unique combination of positive growth factors, including rising central bank demand and hedging demand among global investors in the face of global economic fears. In today's report, we'll review these factors. We'll also take a look at how gold's price pattern over the last five moths reveals some penetrating insights into the collective psyche of gold market participants.

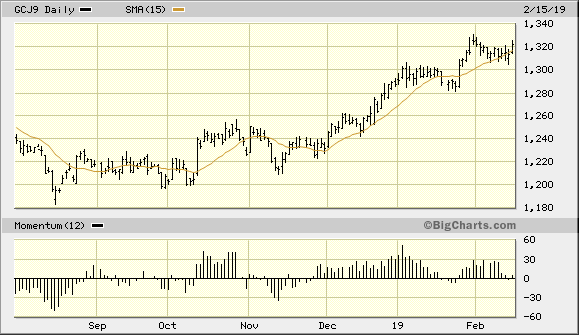

Let's begin this review by taking a look at the basic behavior of gold prices since the August 2018 bottom. Investors who favor fundamental analysis over technical analysis may frown on the emphasis on price patterns among technicians, and admittedly, it's quite difficult to consistently divine the market's intermediate-term (3-9 month) direction by extrapolating price trends and patterns. There are times, however, when price patterns can prove remarkably valuable in evaluating the market's psychological profile. Where gold is concerned, now is one of those times.

Gold has established a classic stair-stepping pattern where rallies are followed by brief lateral consolidations, then repeated. This orderly series of ascending plateaus is typical of a nascent bull market where informed investors are doing most of the buying. This explains the gradual pace and orderliness of gold's upward trend since last fall. The symmetry of gold's turnaround can be clearly seen in the April gold futures graph shown below.

Source: BigCharts

The lack of choppy price action or excess enthusiasm on the part of participants is another reason why the pullbacks in gold's price in the last three months. Because there has been a paucity of uninformed retail traders (who tend to be fickle by disposition), there has been no need for gold's big players to engineer any downside moves to shake out the weak hands. Thus, the low-volatility 6-month rise reflected in gold's chart can be interpreted at face value as a bullish indication for the intermediate-term trend.

If there were no additional corroboration for gold's interim rising trend, the behavior of gold prices since last fall could be viewed with at least some healthy skepticism. Fortunately, though, there exists an abundance of evidence which supports the integrity of gold's upward trend. One of the biggest fundamental supports for gold's intermediate-term trend is the recent increase in central bank demand. Central bank gold buying recently hit its highest level since 1967, according to the World Gold Council, with banks buying approximately $5.82 billion worth of bullion to increase reserves. Commenting on this development, analyst Alex Kimani wrote:

"National banks bought more than 148 metric tons of gold from July 1 to September 30, 2018, a 22 percent rise compared to the previous year's corresponding period. Russia was the biggest buyer, purchasing more than 92 tons of the metal mainly as a hedge against legal and political risks while the likes of Poland and Hungary stockpiled it as a hedge against potential currency crises."

Interestingly, Russia's increasing reliance on gold is designed to reduce its reliance on the dollar. According to reports, Russia's central bank sold most of its U.S. Treasury stock to purchase 274.3 tons of gold in 2018.

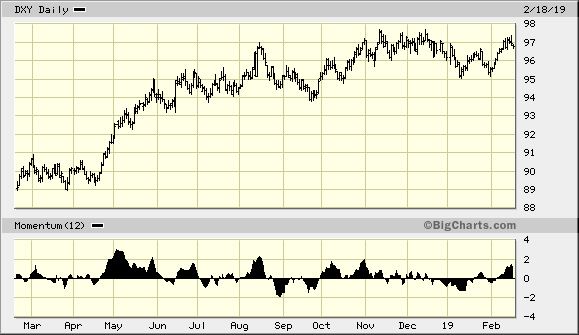

This brings us to the next factor influencing gold's price, namely the U.S. dollar. Despite Russia's divestiture of the dollar, the U.S. currency has remained strong in recent months. While the Russian government's motives for divesting from the dollar are largely political, individual investors from other countries are driven by more practical considerations. Continued uncertainty over the international trade outlook, along with a slowing eurozone economy, has catalyzed a move out of other currencies and into the dollar among safety-conscious investors.

Normally, this progressive strengthening of the U.S. dollar index (DXY) since last April would undermine the gold price due to gold's currency component. However, since gold is also a safe-haven asset, it has also benefited from the hedging demand stimulated by the trade war and is accordingly in the rare position of rising despite the strong dollar.

Source: BigCharts

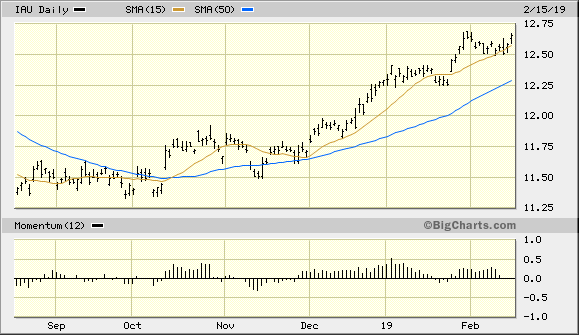

On the ETF front, the iShares Gold Trust ETF (IAU) remains in good shape technically based on the rules of my trading discipline. IAU remains above both its 15-day and 50-day moving averages - the latter trendline being the one most commonly watched by retail traders and institutional investors alike. This confirms that IAU's intermediate-term (3-9 month) rising trend is still technically intact.

Strategically, my buy signal for IAU since October will remain intact as long as the ETF's price remains above the $12.35 level on an intraday basis. In the event that this level is violated in the coming days, I'll advocate a return to cash for short-term ETF traders based on the conservative rules of my trading discipline. For now, though, a bullish stance on gold is still warranted.

Source: BigCharts

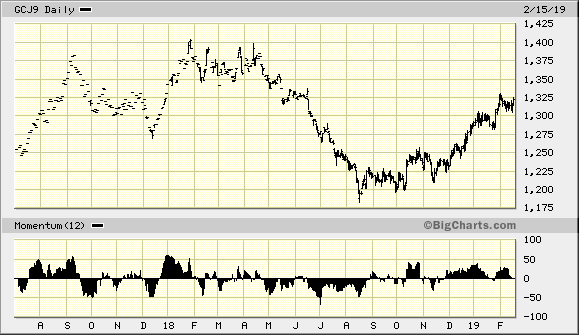

Sooner or later, higher gold prices will do what they've always done historically, namely increase the greed factor of hedge fund managers and retail traders. We've not yet arrived at that point, but a reasonable guess would be that once the gold price overshoots its 2018 high at about the $1,400 level (below), we'll see a substantial increase in bullish news and commentaries which tout gold investment and trading for the sake of short-term capital gains. In other words, the momentum-chasing crowd will join the fray once gold has achieved a new multi-year high. Until then, however, I expect the market's psychological profile will remain subdued as mostly informed professional-type investors dominate the field. At any rate, I don't expect to see the end of gold's intermediate-term rising trend until we first see a conspicuous increase in price volatility. Gold's current volatility is still quite low by historical standards, which favors a continuation of rising prices.

Source: BigCharts

The gradual strengthening of gold's technical and fundamental position is a testimony to the unique combination of factors facing the world's investors in 2019. I expect that rising levels of fear over global trade and the eurozone economy will continue to support gold's recovery despite a stronger dollar. The lack of effervescence in the market is also an encouraging sign, for it shows that there is no "bubble" mentality among gold investors as yet. Indeed, gold's psychological profile suggests that only the strongest of hands - including central banks - control the trend right now. As such, individual investors are justified in maintaining a bullish bias on the yellow metal.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts