S&P 500 Stirs the Gold Pot / Commodities / Gold and Silver 2021

With the S&P 500 back at itsall-time highs, gold stopped lagging behind. However, how long can thisunsustainable growth last?

TheFOMO Rally

While the S&P500 has demonstrated a resounding ability to shake off bad news, anepic divergence has developed between positioning and economic expectations.And while ‘fear of missing out’ (FOMO) keeps sentiment near the high-end of itsrange, Q3 DP growth is projected near the low-end of its range.

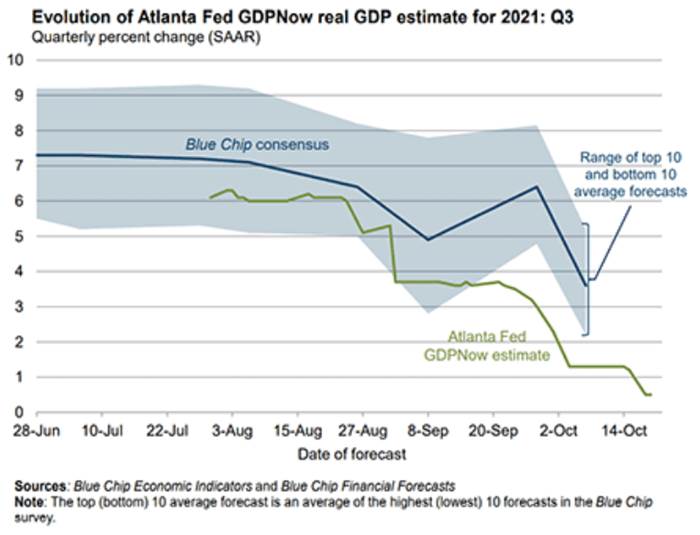

For example, while the Atlanta Fed’sthird-quarter GDP growth estimate was north of 5% in early September, the bankreduced the estimate to 1.3% on Oct. 5. Moreover, with the outlook even worsenow, the Atlanta Fed cut its Q3 GDPgrowth estimate to 0.5% on Oct. 19.

Please see below:

To explain, the blue line above tracksthe Blue Chip consensus GDP growth estimate for the third quarter, and theshaded blue area represents the range of economists’ estimates. If you analyzethe depth, you can see that economists expect a print in the ~2% to ~5.5%range. In stark contrast, the green line above tracks the Atlanta Fed’s GDPNowestimate – which has sunk like a stone and now implies 0.5% GDP growth in thethird quarter.

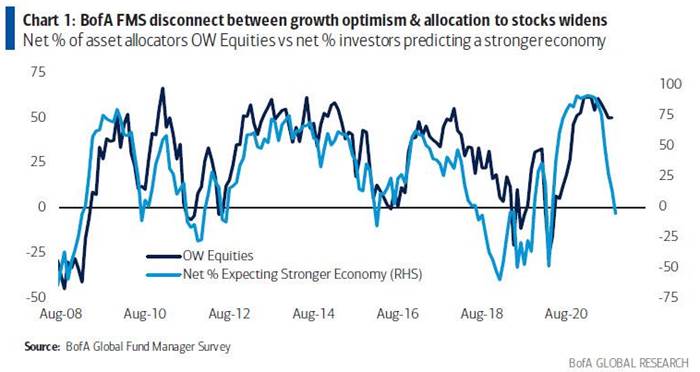

What’s more, Bank of America alsoreleased its latest Global Fund Manager Survey on Oct. 19. And with institutional investors increasingtheir equity exposure when their economic expectations have turned negative forthe first time in 18 months, FOMO is now on full display.

Please see below:

To explain, the dark blue line abovetracks the net percentage of respondents that are overweight equities, whilethe light blue line above tracks the net percentage of respondents that expectstronger economic growth. If you analyze the right side of the chart, you cansee that intuitional investors’ equity positioning still far exceeds what’simplied from economic growth prospects. As a result, if the dark blue linemoves lower and reconnects with the light blue line, plenty of sell orders willhit the market.

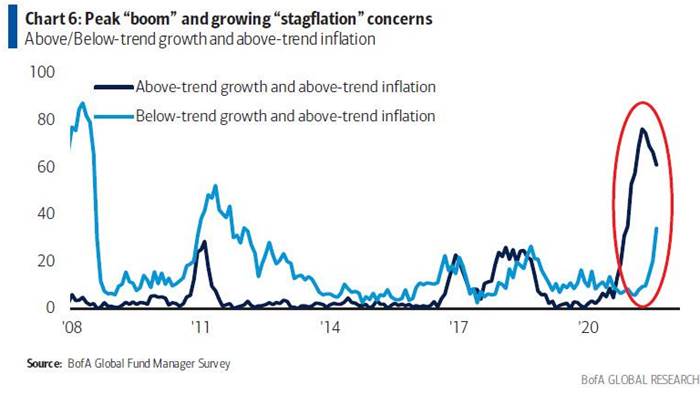

On top of that, with stagflation fears now front and center, institutionalinvestors are hitting the bid even when their better judgment tells themotherwise.

Please see below:

To explain, the dark blue line abovetracks the net percentage of respondents that expect above-trend growth andabove-trend inflation, while the light blue line above tracks the net percentageof respondents that expect below-trend growth and above-trend inflation. If youanalyze the red circle on the right side of the chart, you can see thatgrowth-with-inflation prophecies are losing momentum (the dark blue line),while fears of low growth and persistent inflation are increasing (the lightblue line).

WillWe See an Inflation Miracle?

Moreover, with the Fed stuck between a rock (high inflation) and a hard place(weak growth), the margin for error has dwindled and one policy mistake could bringdown equities’ entire house of cards.

To that point, while I’ve been warningfor months that the Fed was (and still is) materially behind the inflationcurve, FOMC officials aren’t the only ones displaying inflationary anxiety.

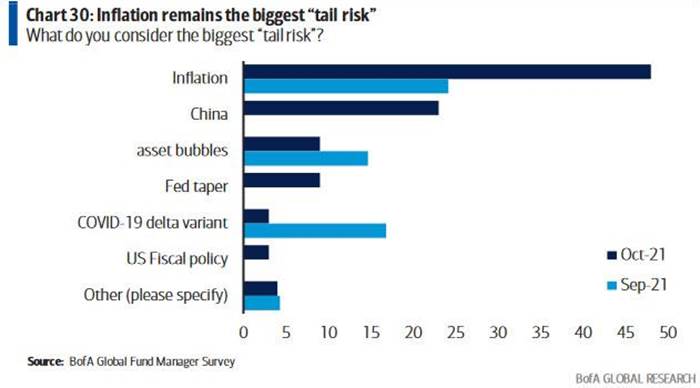

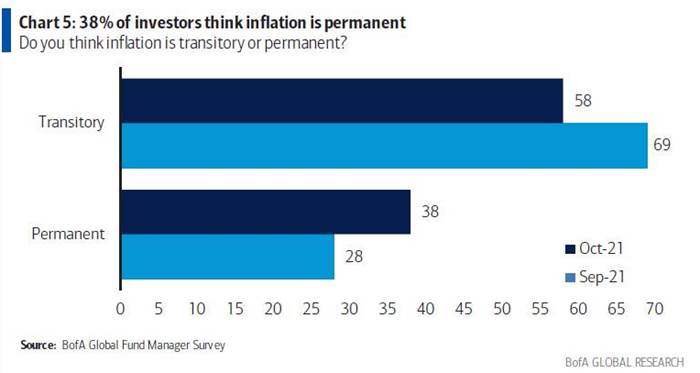

Please see below:

To explain, inflationary concerns havesurged in October. And while the spreadbetween institutional investors’ concerns over “Inflation” and the “Fed taper”is quite the oxymoron, persistent inflation makes another hawkish surprise evenmore likely. Moreover, with the death of QE unlikely to solve the inflationaryconundrum on its own, the Fed will likely forecast further tightening in 2022.

To that point, slowly but surely,institutional investors are waking up to this reality. For context, Q3 earningscalls have been riddled with mentions of inflation and many CEOs that dabble inreal goods have projected a further acceleration in 2022. As a result, with the“transitory” camp now suffering a death by a thousand cuts, it will likely takea miracle for the Fed’s 2022 inflation forecast to come to fruition.

To explain, 69% (28%) of respondentsviewed inflation as “transitory” (“permanent”) in September. However, thescript has flipped to 58% and 38% in October. As a result, it’s likely only a matter of time before the majority of institutionalinvestors (and the Fed) realize what’s actually happening on the ground.

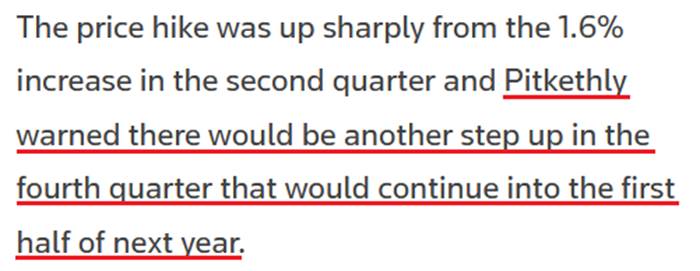

Case in point: Unilever – a consumergoods company with 149,000 employees and 400 brands that operates in more than190 countries – released its third-quarter earnings on Oct. 21. CFO GraemePitkethly said that Q4 price increases should at least rival Q3 and extend into2022:

Source: Reuters

Moreover, Unilever CEO Alan Jope toldBloomberg on Oct. 21:

“Peak inflation will be in the first halfof 2022, and it will moderate as we move towards the second half…. We continueto responsibly take pricing, and that’s in relation to the very high levels ofinflation we’re seeing.”

TheS&P 500 Ahead of a Deep Correction?

Furthermore, I highlighted on Oct. 21that rising commodity prices over the last month should filter into theCommodity Producer Price Index (PPI) and headline Consumer Price Index (CPI) inthe coming months.

I wrote:

Thecommodity PPI is a reliable leading indicator of thefollowing month’s headline Consumer CPI. And if the former stays flat for thenext three months (which is unlikely) – referencing releases in November 2021,December 2021 and January 2022 – the readings will still imply year-over-year(YoY) percentage increases in the headline CPI in the 4.75% to 5.50% range.

Furthermore, this is an extremely conservative forecast since the commodity PPI hasincreased month-over-month (MoM) for the last 17 months. Thus, it’s more likely that the headlineCPI rises above 6% YoY than it falls below 4% YoY.

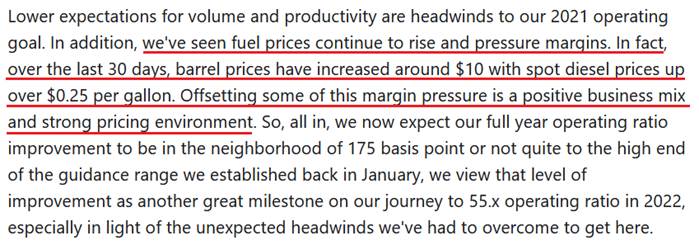

To that point, Union Pacific Railroad – ashipping company that operates 8,300 locomotives in 23 U.S. states – releasedits third-quarter earnings on Oct. 21. And with freight revenue up by 12% andaverage revenue per car up by 9%, EVP KennyRocker said that the results reflected “strong core pricing gains andhigher fuel surcharge revenue.”

More importantly, though, with the inputsurge intensifying “over the last 30 days,” the cost-push inflationary spiralremains alive and well, and it signals something important.

Source: Union PacificRailroad/ The Motley Fool

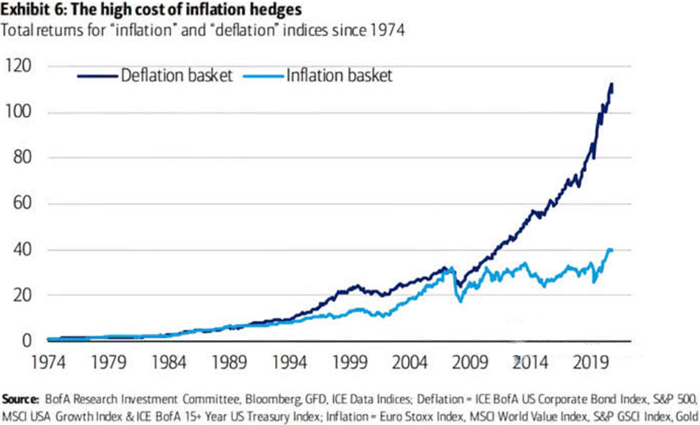

Finally, the reason why inflation is soimportant in terms of its direct effect on the general stock market and itsindirect effect on the PMs is due to the composition of the S&P 500. With information technology andcommunication services stocks accounting for roughly 39% of the S&P 500’smovement, deflationary assets have been the go-to source for returns since 2009.However, if the “transitory” narrative suffers a painful death, a materialunwind could ensure.

Please see below:

To explain, the “Deflation basket” (thedark blue line) has materially outperformed the “Inflation basket” (the lightblue line) since the global financial crisis (GFC). Thus, if surging inflationencourages a reversion to the mean, immense volatility could strike the S&P500.

The bottom line? With investorsprioritizing FOMO over fundamentals, the general stock market’s recent uprisinghas helped uplift the PMs. However, with the Fed losing its inflation battleand the USD Index poised to benefit from more hawkish momentum over the nextfew months, a profound correction of the S&P 500 will only enhance the U.S.dollar’s already robust fundamentals. Moreover, with the PMs often movinginversely to the U.S. dollar, their performance should suffer along the way.

In conclusion, the PMs declined on Oct. 21, asthe USD Index regained its mojo. Furthermore, the front-end of the U.S. yieldcurve surged (2-year yield up by 21% rounded), and the U.S. 10-Year Treasuryyield closed at its highest level (1.7% rounded) since Apr. 4. Thus, while thePMs borrow confidence from the S&P 500, their fundamentals are actuallydeteriorating rather quickly.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.