Sad Silver Price Lags Gold / Commodities / Gold & Silver 2023

With the economic backdrop continuingto deteriorate, silver’s bull case has become increasingly fragile.

Ominous Signs Ahead

While silver has bounced off its recentlows, the white metal continues to underperform gold. And whenvolatile areas of the precious metals market showcase weakness (silver andmining stocks) it’s often an ominous sign for the entire sector.

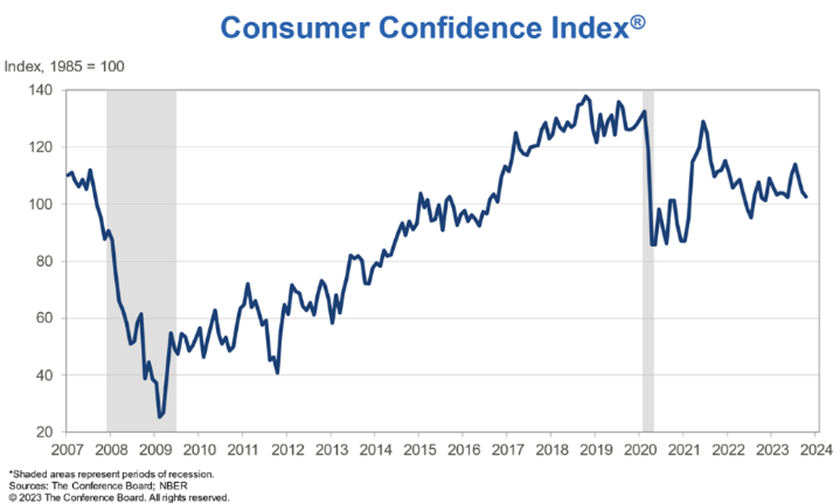

In addition, with recession winds likely to push silver off a cliff, lower interestrates are unlikely to help when the dust settles. For example, TheConference Board released its Consumer Confidence Index on Oct. 31. DanaPeterson, Chief Economist at The Conference Board, said:

“Consumer confidence fell again in October 2023, marking threeconsecutive months of decline. October’s retreat reflected pullbacks in boththe Present Situation and Expectations Index. Write-in responses showed thatconsumers continued to be preoccupied with rising prices in general, and forgrocery and gasoline prices in particular. Consumers also expressed concernsabout the political situation and higher interest rates.”

Please see below:

To explain, the blue line’s pullback onthe right side of the chart highlights how consumers are increasinglypessimistic about the economic outlook. And while we warned that higherlong-term interest rates were much different than a higher FFR, it’s nocoincidence the recent slide occurred alongside the rapid rise in Treasuryyields.

In reality, higher long-term rates makeconsumers’ financing vehicles more expensive, and big-ticket items becomeunaffordable the longer the gambit persists. As a result, while gold remainsthe belle of the ball for now, it should mirror silver andmining stocks’ poor performances in the months ahead.

U.S. Growth Concerns

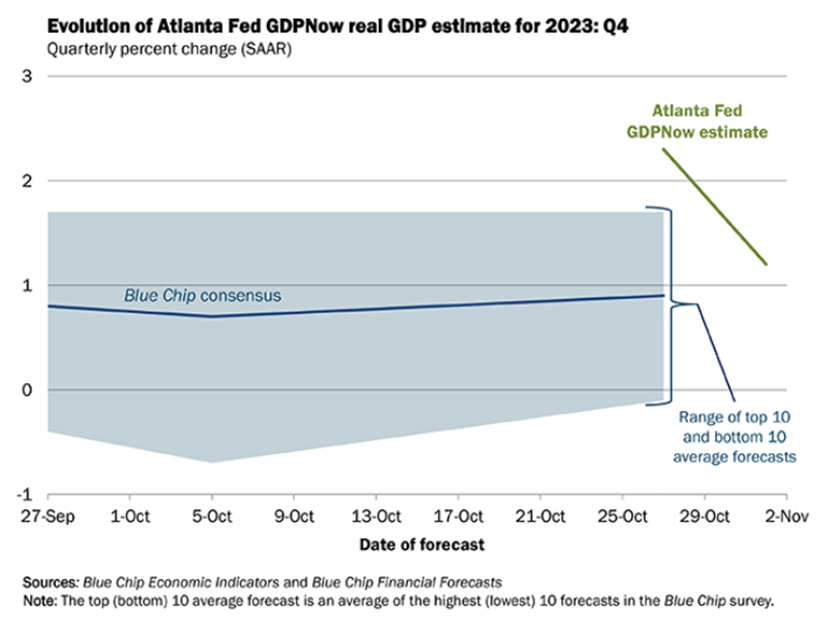

While we remain confident the Eurozoneand Canada’s economic woes will eventually spread to the U.S., some scarsemerged on Nov. 1. The Atlanta Fedcut its Q4 real GDP growth estimate from 2.3% to 1.2%, as recent datasignals a much weaker outlook going forward.

Please see below:

To explain, the green line above tracksthe Atlanta Fed’s Q4 real GDP growth estimate, while the blue line above tracksthe Blue Chip (investment banks) consensus estimate. If you analyze thetrajectory of the former, you can see a meaningful drop. And again, we’re notsurprised the weakness occurred alongside higher long-term interest rates.Consequently, more pain should emerge as the Fed attempts to normalize the U.S.economy.

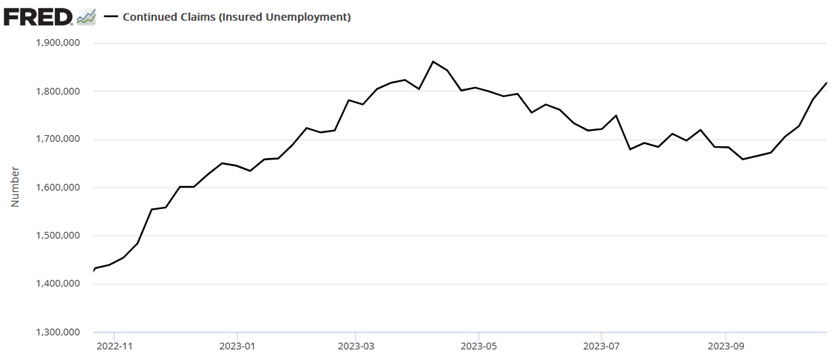

On top of that, continued jobless claims have risen for the last six weeks. Forcontext, the metric tallies the number of Americans who file for unemploymentmore than once. The more this persists, the more trouble it spells for oil andthe PMs.

Please see below:

To explain, while the metric had been ina downtrend since peaking in April 2023, the sharp spike on the right side ofthe chart has also occurred alongside higher long-term interest rates.Therefore, several metrics highlight the forming economic wounds, and thebearish trend should hurt consumer spending and theS&P 500.

Finally, the Dallas Fed released itsTexas Manufacturing Outlook Survey on Oct. 30. The report stated:

“Labor market measures suggest sloweremployment growth and shorter workweeks in October. The employment indexdeclined seven points to 6.7, a reading just below the series average of 7.9.Nineteen percent of firms noted net hiring, while 13 percent noted net layoffs.The hours worked index slipped back into negative territory, coming in at-2.3.”

So, while the crowd will celebrate the news as a soft landing in process,we see it more as a boom-and-bust cycle. During the pandemic, lawmakersoverstimulated, and the U.S. economy roared much louder than expected.

But now, with higher long-term interestrates and quantitative tightening (QT) taking effect, the U.S. economy shouldcool much more than the consensus expects. As a result, several assets,including the PMs, should experience profound drawdowns before the next bullmarket arrives.

Overall, our fundamental thesis continuesto unfold as expected. Inflation, a hawkish Fed, and higher interestrates helped boost the USD Index in2021/2022. Next, a recession and heightened volatility should be thefundamental catalyst that pushes the dollar basket substantially higher in2024. And if that occurs, the PMs are unlikely to sidestep thecarnage.

To prepare for these likely events andmuch more, subscribeto our premium Gold Trading Alert. We’re on pace for our12th-straight profitable trade, and our technical analysis has been extremelysharp. When analyzing the long-term health of various assets, the fundamentalsare essential. However, the technicals are better for tactical trading, as theyallow you to enter and exit with defined risk parameters. Consequently, joiningour team can help you navigate the markets with much more clarity.

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.