Sanctions Threat Already Wipes Out Almost all Russian Oil / Commodities / Crude Oil

Crude Oil Climbs High. Is It Enough to Enjoy a BetterView?

The threat of sanctions caused a stirin the markets: WTI spiked above $130 and Brent is nearing the $140 mark. Whereis crude oil going next?

A possible Western embargo on Russian oilcaused oil prices to soar again on Monday, as stock markets feared persistentinflation and a consequent economic slowdown.

On the US dollar side, the continuedrally of the greenback has propelled the dollar index (DXY) towards higherlevels, as it is now approaching the three-figure mark ($100), even though ithas not had a huge impact on crude oil, other petroleum products, or any othercommodities in general. What we rather witness here is the greenback’s safe haveneffect attracting investors, much like gold would tend to act in a “store ofvalue” role.

US Dollar Index (DXY) CFD (daily chart)

On the geopolitical scene, Russia-Ukrainepeace talks will be resumed today in Brest (Belarus) at 14:00 GMT, whileanother meeting is already scheduled at the Antalya Diplomacy Forum on Thursdayin Turkey. Russian Foreign Minister Sergei Lavrov and his Ukrainian counterpartDmytro Kuleba will talk there in the presence of the Turkish foreign minister.We might therefore expect some de-escalation in the Black Sea basin this weekif the two parties involved were able to reach an agreement after further negotiations.

WTI Crude Oil (CLJ22) Futures (Aprilcontract, daily chart)

Brent Crude Oil (BRNK22) Futures (Maycontract, daily chart)

RBOB Gasoline (RBJ22) Futures (Aprilcontract, daily chart)

Henry Hub Natural Gas (NGJ22) Futures(April contract, daily chart)

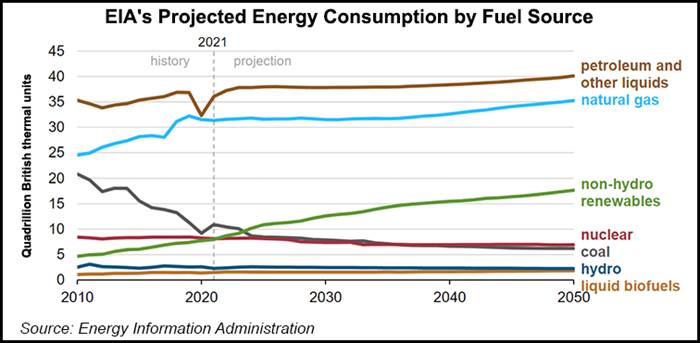

Regarding natural gas, the U.S. EnergyInformation Administration (EIA) published its Annual Energy Outlook (AEO) 2022report, suggesting that even with non-hydro renewable sources set to rapidlygrow through 2050, oil and gas-derived sources should still remain the topenergy sources to fuel most of the United States. The agency is forecasting arise in the production of Liquefied Natural Gas (LNG) – which mainly comes fromshale gas – by at least 35%!

Insummary, the threat of sanctions has already wiped out almost all Russian oil –at least 7% of global supply – from the world oil market. In the weeks ormonths to come, we can see sanctions on Russian oil exports create a boomerangeffect on European economies, decreasing world market supply, increasing pricesfor industry, as well as even more rising expenses, and thus cost of livingthrough a ripple effect.

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.