Sandstorm Gold: Reviewing Asset And Corporate Updates

The company announced a asset and corporate update and gave a update of its flagship asset, Hod Maden.

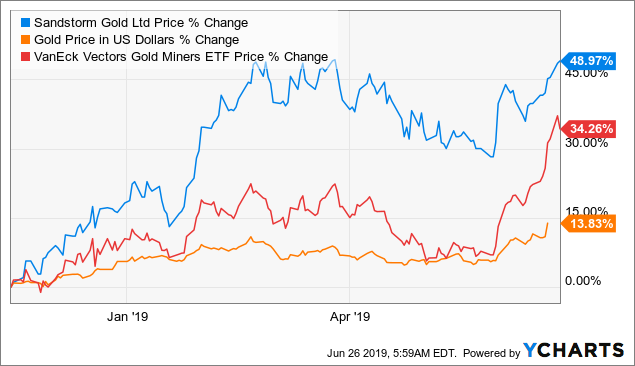

Sandstorm's shares appreciated a 48% Since the buyback was announced, outperforming both gold price and gold miners.

The updated guidance for Hod Maden has been somewhat disappointing, as I will explain below.

I will give my opinion about the relevant asset updates.

Sandstorm Gold (SAND) published a press release on June 25, 2019 explaining the latest asset and corporate updates.

There were several positive updates - and a negative one -. I think that the more significant were:

A slight delay in the scheduled start of the production on Hod Maden. New high-grade discoveries on the Moroy deposit, a key asset of the company, 'Slowdown' on the share buybacks, depending on the share price range. The company increased its stake in Entr?(C)e Resources (EGI).I will detail and extend the information provided by the company, giving my opinion on several updates.

Share Buybacks

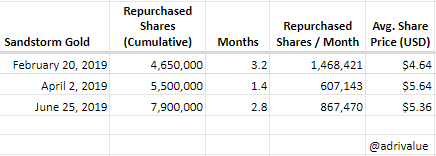

Sandstorm has repurchased approximately 7.9 million shares, or 43% of the original program of 18.3 million. The buyback program was announced on November 15, 2018.

I would like to highlight that the company slowed its repurchases in late February and March, when the average share price was ~$5.64.

After that, they slightly increased the buybacks during May and June, but still far from the 1.5 million shares/month at the beginning of the program, when the shares traded at $4.64 in average.

- Source: Author using company filings.

It would reasonable to think that the management team estimated that the company was deeply undervalued at the 2018 year end and early 2019, and "less undervalued" during the remaining part of 2019.

Now that the company is trading close to $6 I guess that the company will slow again its buybacks.

Data by YCharts

Data by YCharts

Since the buyback program was announced on November 15, 2018 the company's share price appreciated a 49% versus a 34% of the Gold Miners ETF (GDX) or a 14% of the gold spot price.

Data by YCharts

Data by YCharts

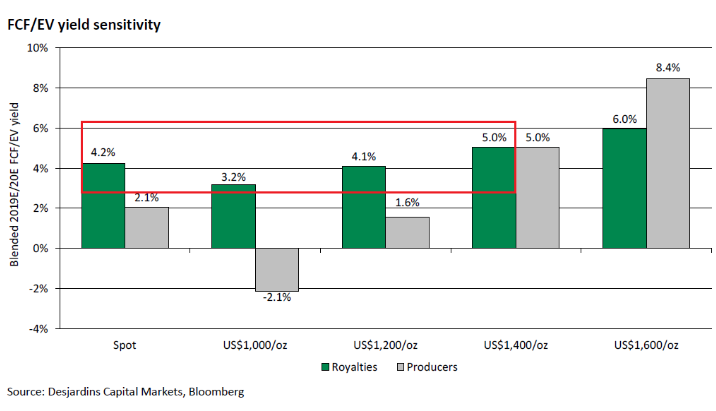

Once again, the company showed better leverage versus the gold price than the gold miners. Is the usual for the royalty companies, unless the gold price goes up to $1,500 or $1,600, that would be when the miners might outperform.

I think that this graph that I've previously used on my article 'Strategies To Benefit From The Upcoming Gold Bull Market' explains this leverage quite well:

Besides, the company sold $17 million in equity investments, which was mainly to pay down debt drawn on the existing credit facility.

Aurizona

As we already knew, Equinox (OTCPK:EQXFF) announced first gold pour in its Aurizona mine in May 14, 2019. Commercial production should be imminent, as Equinox was targeting it for the end of the second quarter.

Sandstorm currently holds a 3% NSR in this mine. This royalty would increase to 4% if gold price goes above $1,500. This seemed improbable a few months ago, but now gold is trading above $1,400, so it would only need a +7% to reach the $1,500 level.

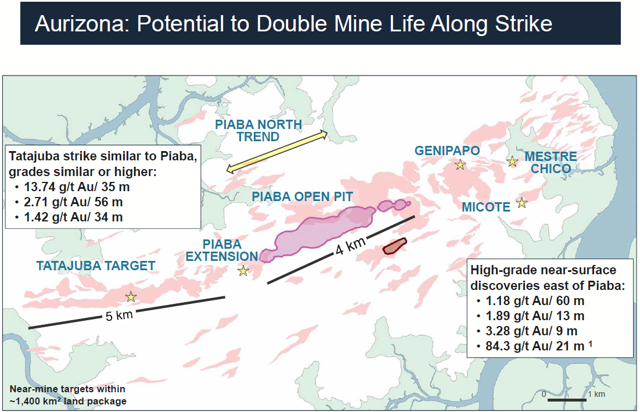

Aurizona has an initial 6.5 year mine life, but Equinox has the potential to double it due to the huge exploration potential in the area, where Sandstorm's royalty still applies.

- Source: Equinox

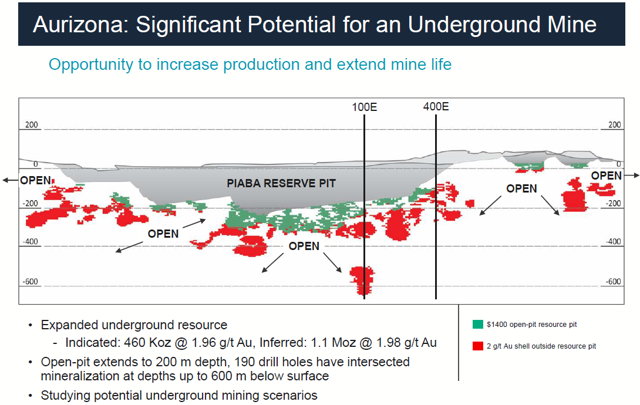

Besides, the deposit also offers the potential for an underground mine development.

- Source: Equinox

Hod Maden

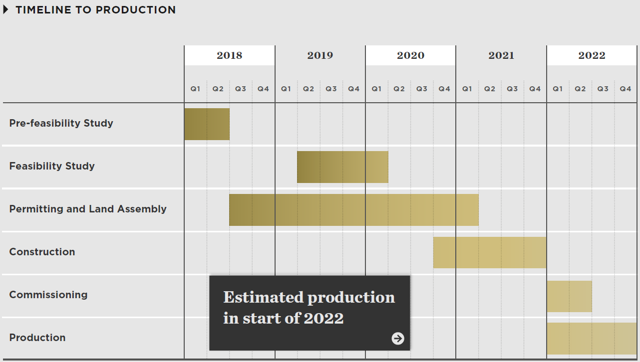

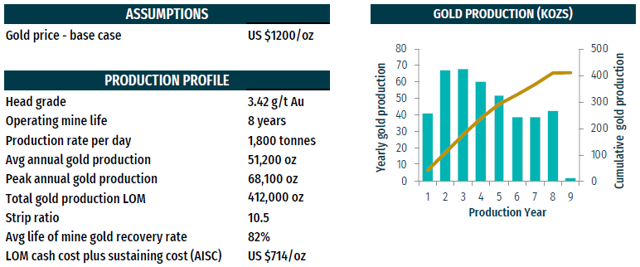

The updated guidance is somewhat disappointing, as the main operator (Lidya Madencilik) says that they are now expecting first production for the Q4 2022. The previous guidance was for "early 2022".

- Source: Company (April 2019 Corporate Presentation)

I do not really care about this 6 or 9 month change, as the delays in the mining projects are the norm, not the exception. But this could affect the share price in the short term and I considered it significant enough to mention.

A gap analysis and trade-off studies on Hod Maden were completed during the first quarter of 2019 which will contribute to the Feasibility Study work, which began during the second quarter of 2019. The Feasibility Study contract was awarded to GR Engineering Services and AMC Consultants.

An Environmental Impact Assessment (EIA) has been submitted and a public participation meeting was successfully conducted as part of the permitting process.

The Feasibility Study is expected to be completed in the second quarter of 2020, with first production projected for the fourth quarter of 2022.

- Source: Company

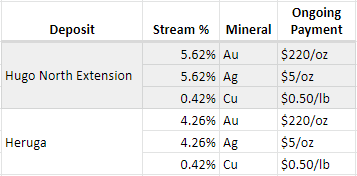

Hugo North Extension / Heruga

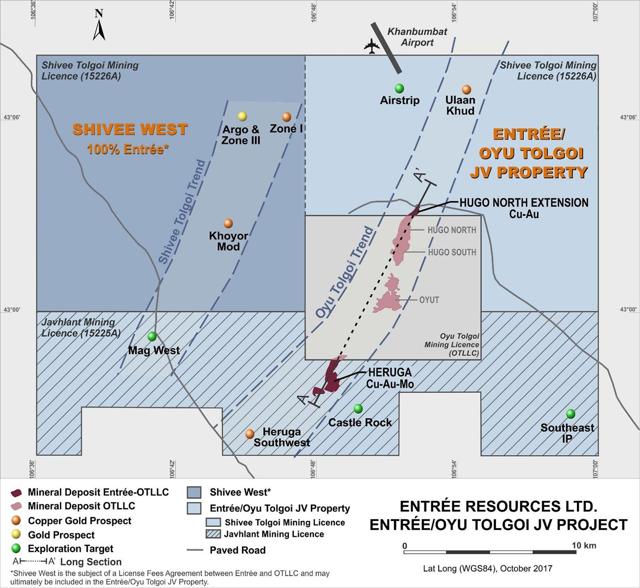

Sandstorm bought more common shares of Entr?(C)e Resources and now controls 32,599,197 Entr?(C)e Shares, or 18.6% of the outstanding diluted shares.

Entr?(C)e's main asset is its interest in the Entr?(C)e/Oyu Tolgoi LLC partnership. The Entr?(C)e/Oyu Tolgoi JV Property covers 39,807 hectares and includes portions of the following Oyu Tolgoi project deposits:

Hugo North Extension: Copper-Gold Deposit, Lifts 1 and 2. Lift 1 development production is currently expected in 2021. Heruga: Copper-Gold-Molybdenum Deposit (the southernmost deposit at Oyu Tolgoi, ~94% of which occurs on the Entr?(C)e/Oyu Tolgoi JV Property)- Source: Entr?(C)e Resources

This is a long-term bet for Sandstorm, as the company do not expect significant cash flows from their streams on Hugo North Extension until 2026. This deposit wouldn't reach peak production until 2031.

Sandstorm holds several streams in the Hugo North Extension (Lifts 1 & 2) and also in the Heruga deposit.

- Source: Author using company filings.

Nolan Watson (Sandstorm's CEO) said in a recent interview that Turquoise Hill would be its favorite investment, excluding Sandstorm.

Q: If there was one other mining company that you could invest in, and you couldn't invest your money in Sandstorm shares, what company, which company would that be?

Nolan: Yeah, that's an absolute no-brainer for me. It's a company called Turquoise Hill, which has the world's best undeveloped copper mine.

- Source: The Stock Podcast - Nolan Watson interview transcript

My guess is that Sandstorm management team might be expecting a buyout of Entr?(C)e Resources from one of the JV partners, like Rio Tinto (RIO) or the private operator and government-backed China Minmetals.

But the timing of this catalyst is uncertain, so I think that the management team also expect a P/NAV multiple boost on Entr?(C)e, once the project gets closer to commercial production.

Khundii Gold Project

Sandstorm highlighted some results from the April 2019 drilling program of Erdene Resources (OTCPK:ERDCF), like:

112.0 meters of 5.9 g/t gold from 13.0 meters. 14.0 meters of 14.1 g/t gold from 9.0 meters. 23.3 meters of 4.4 g/t gold from 97.6 meters. 2.0 meters of 39.0 g/t gold from 202.0 meters. 16.0 meters of 1.1 g/t gold from 28.0 meters 3.0 meters of 40.0 g/t gold from 142.0 meters.But I think that it also worth mention that Erdene Resources secured a small financing of $2 million, that will be used mainly to fund the Pre-Feasibility Study and drilling programs.

Proceeds of the Private Placement will be used to fund completion of the independent Pre-Feasibility Study of the Company's Khundii Gold Project, mining license applications for the Project's properties, acquisition and exploration, including step-out holes to test continuity of the Bayan Khundii extension identified in Q2-2019, and for general working capital purposes.

- Source: Erdene Resources

Based on Erdene's guidance, the current project schedule is as follows:

Q3 2019 PFS & Permitting. Q4 2019 Engineering, design, geotechnical. 2020 Earthworks & Construction. 2021 Production.Please note that this schedule could suffer delays and/or financing problems.

- Source: Erdene Resources

Lobo-Marte

Kinross (KGC) completed a Scoping study in Q1 2019. Some highlights are:

Total estimated production: 4.1M Au oz. at 1.2 g/t. Mine life: 10+ years. Processing: heap leach with SART. Initial capital: $750M (+/- 20%). Proceeding to a PFS, expected to be complete in mid 2020.Please note that Lobo-Marte is another long-term bet of Sandstorm. Production at Lobo-Marte will start at the end of the La Coipa mine life, which is approximately 5.5 years and it could be extended.

Kinross is currently working to restart production in the La Coipa mine.

I wouldn't expect commercial production in Lobo-Marte before 2024 or 2025.

Moroy

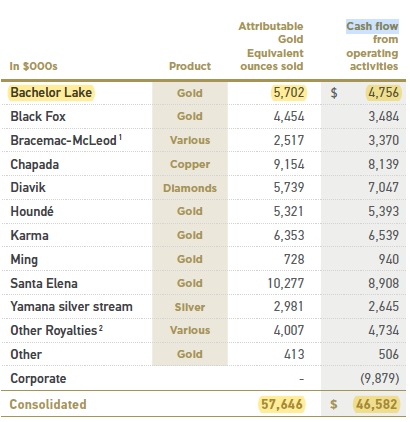

This deposit is part of a key asset of Sandstorm. This royalty alone represented ~10% of the annual cash flow and GEOs for the company in 2018.

- Source: Company

Sandstorm highlighted a few high-grade discoveries from the ongoing drill program of Bonterra (OTCQX:BONXF):

Barry Deposit

4.2 meters of 5.1 g/t gold from 206.7 meters. 1.5 meters of 6.3 g/t gold from 453.7 meters.Moroy Deposit

5.6 meters of 12.8 g/t gold from 256.3 meters. 5.4 meters of 12.2 g/t gold from 70.5 meters.A mineral resource estimate for Moroy is expected to be released during 2019.

The mined ore from the Moroy deposit is processed on the Urban-Barry mill. Bonterra plans to increase its processing capacity to 2,400 tpd.

Fruta del Norte

- Source: Lundin Gold

This asset was not updated in the press release of Sandstorm, but Lundin Gold (OTCPK:FTMNF) submitted an update in the same date.

This is the flagship asset of Lundin Gold and it is also a key asset for Sandstorm, so I would like to share this update with my readers and dear followers:

Lundin Gold is pleased to announce that it has begun mining of its first production stope at its Fruta del Norte gold project.

"Fruta del Norte reached another important milestone on schedule. At the end of May overall construction progress was 73% complete and 88% of the Project's capital expenditure was committed. The team continues to make great progress as we head towards our first gold pour later this year," said Ron Hochstein, Lundin Gold's President and CEO.

Underground mine development reached 7.3 kilometers as at May 31, 2019, versus a target of 7.1 km (...)

Critical path work on development to the South Vent Raise was 74 days ahead of plan at the end of May. (...)

- Source: Lundin Gold

Everything seems on track or even ahead of schedule. But as I've said before, delays are the norm in this business.

Lundin Gold is targeting commercial production for the second quarter of 2020.

Conclusion

The slight delay on the commercial production of Hod Maden could affect analysts' estimates for 2022 and/or 2023. If so, the share price of the company could suffer some short-term headwinds.

The remaining updates were positive and the company is well positioned for growth without any requirement for additional investments.

If you want to know more about the upcoming producing assets of Sandstorm, please check my article:

Sandstorm Gold: Upcoming Producing Assets Will Increase NAV In The Near TermDon't forget to draw your own conclusions.

Disclosure: I am/we are long SAND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article does not represent any kind of investment recommendation or advice. This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Follow Adri??n Hern??ndez and get email alerts