Sandstorm Gold: Updates After The Relief Canyon Royalty Acquisition

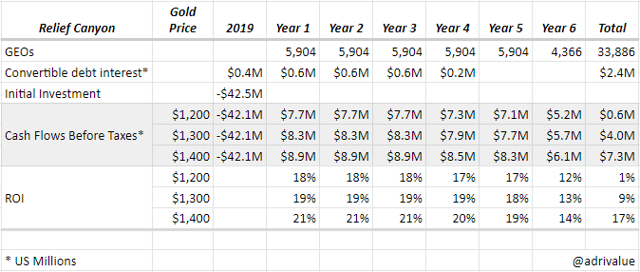

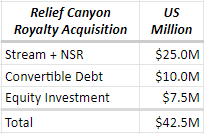

Sandstorm agreed to pay $25 million to Americas Silver, plus $10 million in convertible debt with an equity investment of ~$8 million.

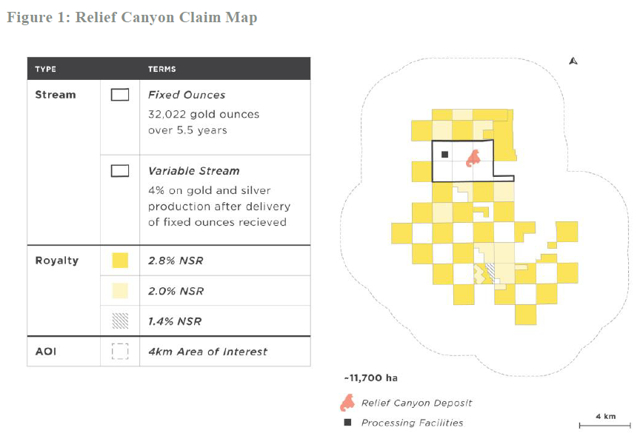

In exchange, the company will receive 32,022 ounces of gold over 5.5 years, a 4% stream and a 1.4-2.8% NSR royalty over the adjacent property.

Sandstorm will recover its initial investment of $42.5 million in 5 to 6 years with gold prices of $1,200 to $1,300, plus ~9 million common shares of Americas Silver.

Relief Canyon mine has a huge exploration upside. Americas Silver has just explored 20% of the total acreage.

- Relief Canyon Mine; Source: Pershing Gold

Sandstorm (SAND) announced the acquisition of a stream and a NSR royalty over the Relief Canyon deposit and its adjacent area.

The company is paying a total of $42.5 million for this deal to Americas Silver (USAS).

In exchange, Sandstorm will receive

32,022 ounces of gold over 5.5 years, starting as soon as April 3, 2020. 4.0% Stream over the gold and silver production in the Relief Canyon deposit after the mentioned 5.5-year period. 1.5-2.8% NSR royalty over the adjacent property.In this article, I will focus on the return on investment, the exploration upside and the mine characteristics.

If you want to know more about Sandstorm, I encourage you to read my previous articles:

Sandstorm Gold: My Top Pick For 2019 Sandstorm Gold: Updates After The Latest Royalty Acquisition Sandstorm Gold: Share Buyback Drives Strong MomentumROI Secured

With this deal, Sandstorm is securing its ROI in 5.5 years. The 32,022 ounces would be valued at $41.6 million with a gold price of $1,300.

Besides, ~41% of the total financing is in the form of convertible debt and common shares, so the company could recover most of the initial investment after a few years.

Source: Author

The convertible debt bears an annual interest rate of 6% and has a term of 4 years. In addition, Sandstorm has the right to convert its debt investment at any time prior to the maturity date with a conversion price of $2.14 per share.

The $7.5-million equity investment represents 4.8 million common shares of Americas Silver.

The company has not specified any lock-up period, so Sandstorm could recover part of its initial investment at any time from now on.

Regarding Americas Silver, the company used the funds received from Sandstorm to fund the acquisition of Pershing Gold (PGLC), as it announced recently. Pershing Gold's flagship asset is the Relief Canyon mine.

Acquisition Analysis

Relief Canyon mine is expected to start commercial production by the end of 2019. Sandstorm will receive its first gold delivery as soon as April 3, 2020.

These are my estimates for the Cash Flow Before Taxes that Sandstorm will receive during the expected Life Of Mine (LOM) of 5.6 years:

Source: Author using company filings and his own estimates.

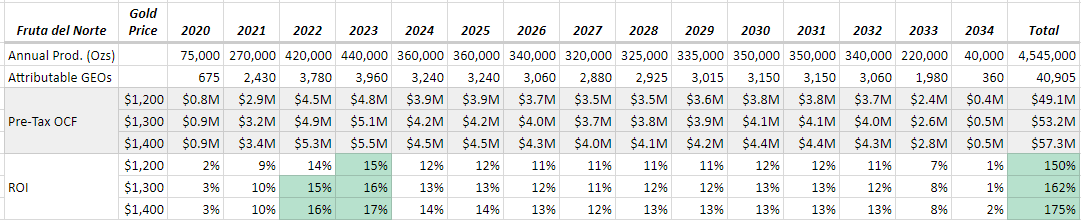

Let's compare this table with my previous estimates from the 'Fruta del Norte' royalty acquisition:

Source: Author using company filings and his own estimates.

Then, we would have a higher initial ROI from the Relief Canyon stream, but the LOM seems too short, right?

Let's take a look at the exploration upside.

Exploration Upside

The acquired stream applies to the area surrounding the Relief Canyon deposit.

The NSR royalty consists of

Several "small zones" with a 2.8% NSR. A few acreages with a 2.0% NSR. A tiny area with a 1.4% NSR.Source: Sandstorm Press Release

First of all, it is key to know that 80% of the mine acreage has not yet been explored.

Relief Canyon has a large prospective land package that is relatively underexplored. Sandstorm's royalty covers the full property area surrounding the mine site.

Significant exploration potential exists at Relief Canyon as approximately 20% of the 11,700-hectare land package has been explored to date.

- Sandstorm Press Release

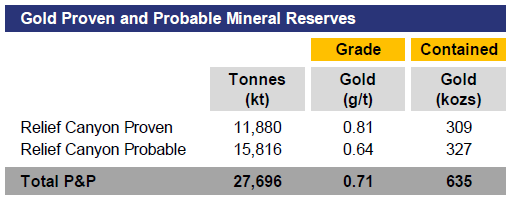

Regarding the Relief Canyon main deposit, it's worth knowing that Americas Silver could replace the mined Proven reserves with the Probable resources, extending the LOM.

Source: Pershing Gold

Summarizing, the LOM is short, but in my opinion, Americas Silver should be able to replace the mined gold resources with the probable reserves plus the discovered ounces in the adjacent area.

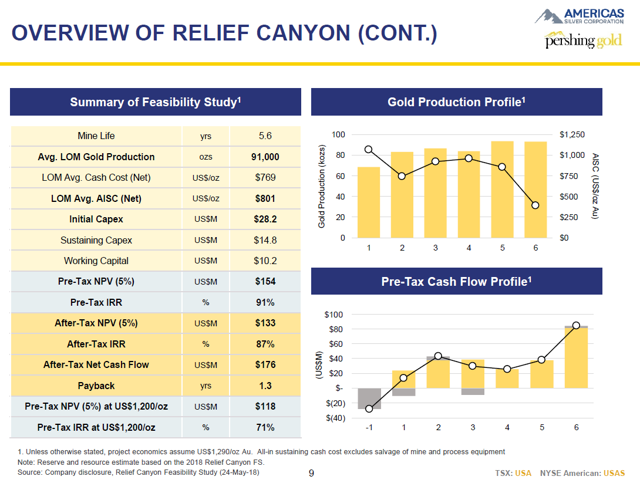

Relief Canyon Overview

Relief Canyon includes three open-pit mines, expanding adjacent open-pit-able gold deposits, and a fully permitted and constructed heap-leach processing facility.

Source: Pershing Gold

The mine is located approximately 95 miles northeast of Reno, Nevada, a safe jurisdiction.

According to the Feasibility Study, the annual average production would be 91,000 gold ounces, with higher production and lower AISC for years 5 and 6.

Source: Pershing Gold

In my opinion, the initial and sustaining CapEx seems reduced for a project with an annual average production of 91,000 gold ounces, and the AISC of ~$801 per ounce should allow to generate more than enough cash flows to fund future exploration programs.

Pierre Lassonde's Seal Of Approval

Source: Google Images

Reading the latest financial report for Americas Silver, I've found that Pierre Lassonde financed part of the Pershing Gold acquisition with a convertible loan:

In connection with the proposed Pershing Gold Acquisition, the Company entered into a short-term, secured, convertible loan agreement with Pierre Lassonde and two other lenders for C$5.5 million with interest payable at 15% per annum.

Source: Americas Silver

In a recent press release, we can see that the 'other lender' was Trinity Capital Partners.

For those who don't know him, Pierre Lassonde is a legend. He previously was in the management team of Newmont Mining (NEM) and in Franco-Nevada (FNV), among other great achievements. More information in Wikipedia.

Source: Google Images

Conclusion

The stream and royalties from the Relief Canyon mine will generate significant cash flows for the company, starting in 2020.

Sandstorm's management team said the company would acquire near-term producing assets with no dilution to the shareholders, and it is fulfilling its promises.

Source: Sandstorm Corporate Presentation

The jurisdiction of the mine in the US can't be safer, so the near-term cash flows and a safe location can help to boost the P/NAV multiple that the market is applying to Sandstorm. This would reduce the gap between Sandstorm and the 'three majors,' Franco-Nevada, Wheaton Precious Metals (WPM) and Royal Gold (RGLD), or increase the P/NAV versus its closest rival in market capitalization terms, Osisko Gold Royalties (OR).

Summarizing, in my opinion, it's a great deal for Sandstorm. The company is 'securing' its ROI in 5.5 years. Besides, it could recover a part of its initial equity and/or convertible debt investment in the near term.

The future 4.0% stream plus the 1.4-2.5% NSR could add significant cash flows after the 5.5-year period.

Disclosure: I am/we are long SAND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article does not represent any kind of investment recommendation or advice.

Follow Adri??n Hern??ndez and get email alerts