'Secondary Targets' Looking First Rate for Canadian Gold Explorer

With primary targets still not accessible due to weather, secondary targets are the focus, and analysts Ryan Walker of Echelon Wealth Partners and Adam Melnyk of PI Financial weigh in on the latest results.

In a June 5 press release, Victoria Gold Corp. (VIT:TSX.V) announced assays for its Eagle West zone, a secondary target, directly adjacent to its primary Eagle Gold Deposit. The highlighted Eagle West "results include, 21.3 meters of 2.11 g/t Au in drill hole DG17-805C, 21 meters of 0.88 g/t Au in drill hole DG17-783C and 16.2 meters of 0.85 g/t Au in drill hole DG17-779C."

Following the announcement, Echelon Wealth Partners analyst Ryan Walker released a June 5 report on the Eagle West results confirming that "mineralized sheeted veins were encountered, as well as a higher grade, structurally controlled zone defined on the intrusive northern contact margin. Pervasive sericite alteration and massive sulphides were also encountered, both underscoring the Potato Hills mineralization concept."

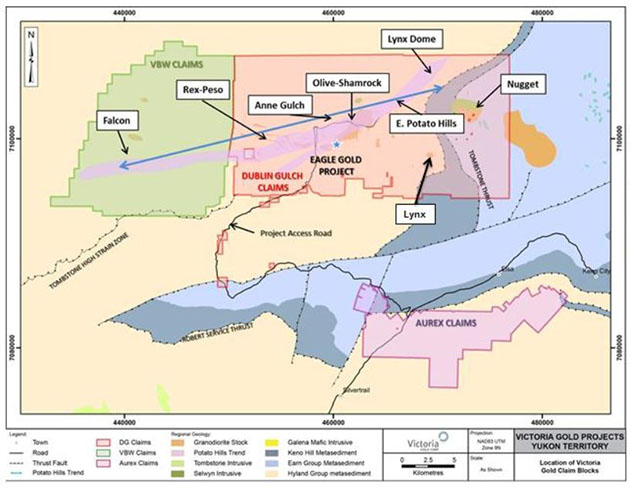

He went on to point out that "the results from Eagle West indicate the potential for relatively quick mine-life additions, while also demonstrating that substantial exploration potential remains at the Dublin Gulch property along the Potato Hills trend mineralization concept, which is a component of our original investment thesis."

Walker concluded that he is maintaining a speculative buy rating with a $0.90/share price target due to the "Eagle project's strategic size, fully permitted status, district-scale land package with substantial exploration potential near excellent infrastructure, and situation in geopolitically stable Canada."

PI Financial analyst Adam Melnyk stated in a June 5 report that "Victoria controls what we consider to be a strategic asset; a sizeable gold development project, which can be developed for a reasonable initial capital expenditure, located in a top-tier political jurisdiction, with full permits for construction in hand."

Melnyk also pointed out "the 2017 drill program will focus largely on further exploration Olive-Shamrock zone, in addition to testing the five other regional targets. . .we expect Victoria will garner interest from a variety of gold producers as an M&A target." He is maintaining a Buy rating with a target price of $1.10. Victoria Gold's shares are currently trading at around $0.66.

Read what other experts are saying about:

Victoria Gold Corp.Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Melissa Farley compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Victoria Gold Corp. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article

Disclosures from Echelon Wealth Partners, Victoria Gold Corp., June 5, 2017

Company: Victoria Gold Corp. | VIT:TSXV: I, Ryan Walker, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that I have not, am not, and will not receive, directly or indirectly, compensation in exchange for expressing the specific recommendations or views in this report.

During the last 12 months, has Echelon Wealth Partners Inc. provided financial advice to and/or, either on its own or as a syndicate member, participated in a public offering, or private placement of securities of this issuer? Yes

During the last 12 months, has Echelon Wealth Partners Inc. received compensation for having provided investment banking or related services to this Issuer? Yes

Has the Analyst had an onsite visit with the Issuer within the last 12 months? (Dublin Gulch Site Visit - July 2016) Yes

Disclosures from PI Financial, Victoria Gold Corp., Corporate Update, June 5, 2017

I, Adam Melnyk, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report.

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is amongst other factors determined by revenue generated directly or indirectly from various departments including Investment Banking. Evaluation is largely on an activity-based system that includes some of the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance, and client feedback. Analysts and all other Research staff are not directly compensated for specific Investment Banking transactions.

PI Financial Corp. and/or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company.

Company has partially funded previous analyst visits to its projects.