Semiconductors: The New Gold Rush

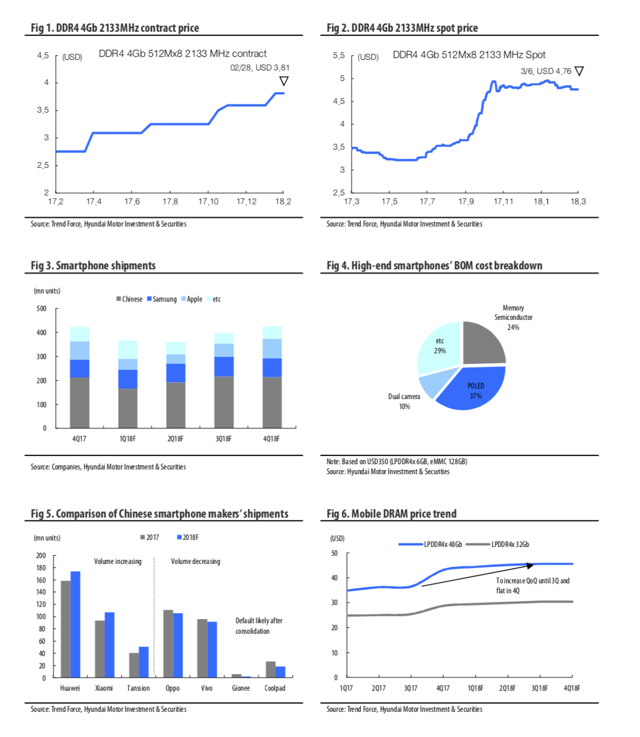

DRAM prices still on the rise in 1Q18: PC DRAM +6.9% QoQ, mobile DRAM +2.9%, server DRAM +3%.

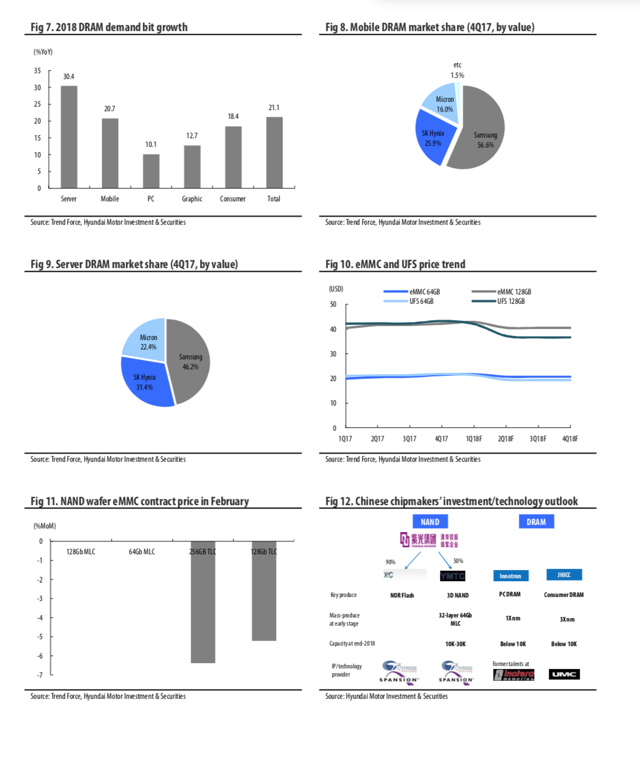

The price of server DRAM to continue to go up by 2-3% QoQ every quarter on robust demand from data centers.

The price of mobile DRAM to continue to increase QoQ until 3Q1, helped by limited supply.

Chinese penetration into memory semiconductor market not a real threat until 2020; maintain Overweight on the semiconductor sector.

1Q18 sees increases in DRAM prices across all segments; mobile/server DRAM prices to increase until 3Q18

We expect the price of PC DRAM to rise 6.9% QoQ, mobile DRAM price 2.9%, and server DRAM price 3% in 1Q18. Despite weak seasonality in 1Q, supply remains tight on growing demand for 32GB/64GB server DRAM modules used in high- performance computing (HPC) servers. At present, nearly 50% of all server DRAM is made by Samsung Electronics (OTC:SSNLF) in the 18nm process. SK Hynix (OTC:HXSCL) and Micron (NASDAQ:MU) are still producing server DRAM in the 21nm/20nm processes and are expected to increase the portion of server DRAM in their total capacity to better capitalize on growing server DRAM demand.

As of now, Micron Taiwan (Inotera-INMMY) has fully migrated to the 20nm process with an estimated yield of 90%. We expect demand for HPC server DRAM to grow further as Intel (INTC) and AMD (AMD) have, or are scheduled to roll out their new products in Dec 2017 and 2Q18, respectively. We especially expect 64GB module's share of sales to rise sharply from the 5% seen in 2017.

While smartphone BOM cost rises amid an increase in memory chip prices and a wider adoption of POLED and dual cameras, smartphone demand has been sliding since 4Q17, which has resulted in the consolidations of smartphone manufacturers, especially Chinese companies. Coolpad, which sold over 4.8mn phones in 2014, went bankrupt in 2017 and another smartphone maker Gionee is unlikely to survive this year. Bigger names such as Oppo and Vivo are also expected to suffer negative growth in 2018.

Faltering demand and hefty raw material costs have made mobile DRAM and eMMC prices more burdensome for smartphone makers. For high-end smartphones, semiconductor parts make up 26% of total raw material cost, next to POLED. Accordingly, in eMMC, the percentage of TLC is increasing, and the price of TLC fell 5-6% MoM in February. However, mobile DRAM is still 20% cheaper than server DRAM, and DRAM makers are increasingly shifting their focus to server DRAM from mobile DRAM, which should provide downside support for mobile DRAM prices. As mobile DRAM and server DRAM prices are likely to move upward QoQ until 3Q18, the earnings momentum of Korean chipmakers should remain intact.

Chinese threat not a real concern until 2020; shipments to pick up in 2Q18

There are concerns over the potential market penetration by Chinese companies such as YMTC, a part of Tsanghua Unigroup, is reportedly in talks with Apple (NASDAQ:AAPL) to supply its smartphone NAND flash. However, one more entrant with unproven technologies into the NAND market already filled with suppliers will not pose a real threat and the entry itself is unlikely to happen until 2020. Things do not look too different in the DRAM space: Innotron is entangled in a patent dispute with Micron, and Jinhwa is not a threat because its products are mostly consumer DRAM.

While Samsung's and Hynix's 1Q18 memory shipments will likely decline QoQ on weak seasonality, we believe earnings momentum will regain steam in 2Q18 on DRAM price hikes and shipment increases. Hynix shares, despite the debate about the semiconductor cycle peak, are outperforming the benchmark index on the back of earnings momentum and an attractive valuation. We expect the stock, as a growth play, to gain momentum further in 2Q as shipments and prices both increase.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Thank you!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.