Shell says break-up of group would not work in real life

LONDON, Oct 28 (Reuters) - Royal Dutch Shell (RDSa.L)hit back on Thursday against an activist fund's call for the company to break up, with top executives saying its businesses operate better together than apart.

Hedge fund Third Point, which has built a large stake in Shell, on Wednesday called for the oil major to split into multiple companies to improve its performance.

The push was the latest broadside against global oil and gas giants, who have faced calls from governments and climate-conscious investors to shift to renewable energy while still meeting current high levels of fossil fuel demand.

Shell, along with other European oil majors, has set targets to slowly move away from oil production while investing in non-fossil energy sources like solar and wind power.

Billionaire Daniel Loeb, who runs Third Point, said on Wednesday that the company is being pushed in "too many different directions," and that it should consider separating its legacy energy production from renewables and liquefied natural gas (LNG) businesses, a notion company officials rejected.

"If you were to split that into component pieces, I think that can sound really interesting from a financial perspective," finance chief Jessica Uhl told reporters on Thursday.

"But in terms of real solutions, I think that breaks down and our ability to integrate and bring these different pieces of the puzzle together will be how we uniquely make a difference in the energy transition."

Shell Chief Executive Ben van Beurden told reporters that Shell's strategy is coherent and well understood by a majority of its shareholders.

Over the past two years, Shell shares have posted a total return of negative 16%, according to Refinitiv Eikon data. Those returns lag U.S. majors Exxon Mobil Corp (XOM.N) and Chevron Corp (CVX.N), though over a longer period, Shell and other European companies have outperformed their U.S. counterparts, who have focused less on emissions reduction and renewable investments.

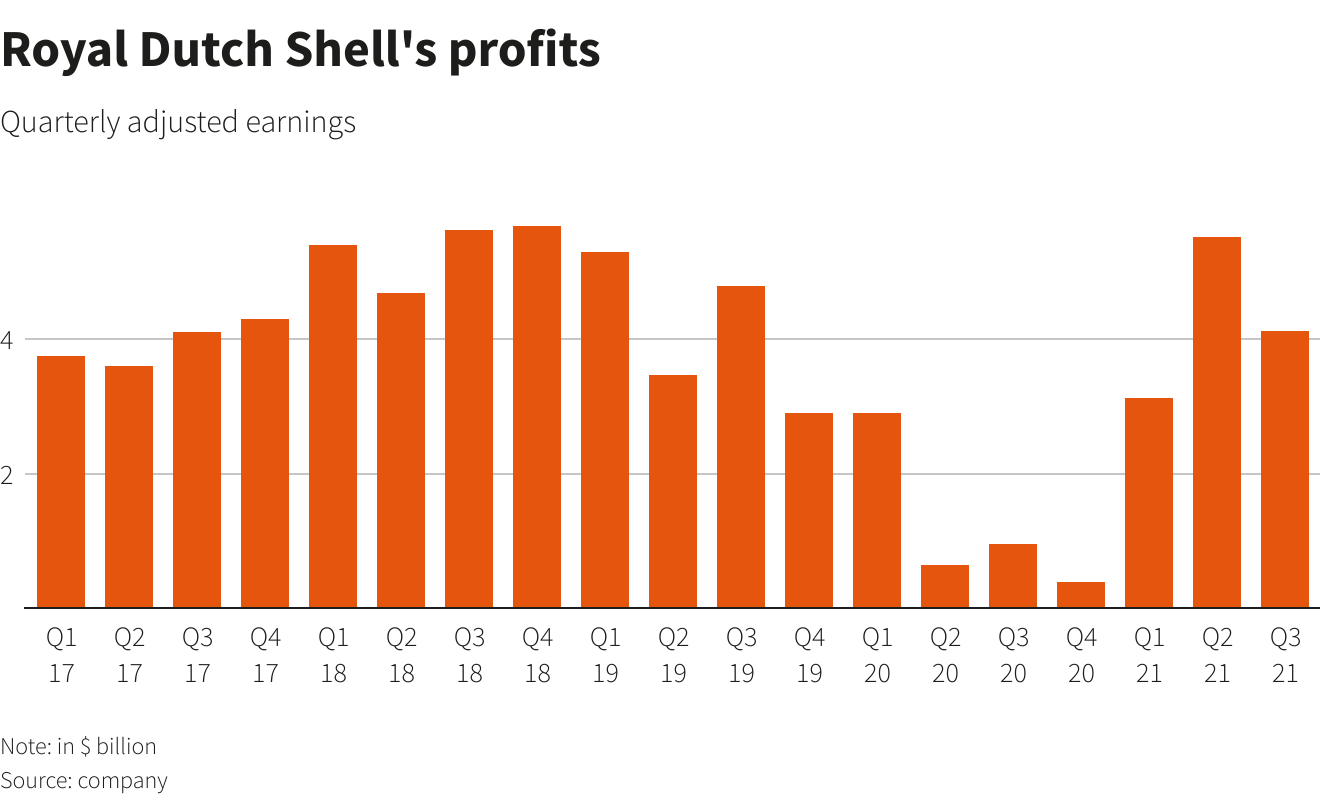

Shell reported third-quarter profit of $4.13 billion on Thursday, below analysts' forecast provided by the company of $5.31 billion. Shares fell 3%.

Some investors on Thursday said they agreed with Shell's approach.

"It's not by splitting that we are going to tackle the climate challenges," said Na??m Abou-Jaoud?(C), chief executive of investment manager Candriam, who said Shell's strategy of investing in new alternative energy over time and gradually phasing out fossil fuels, would be easier as a single company.

Bernstein analyst Oswald Clint, who has an outperform rating on Shell, said in a note that a minority listing of Shell's marketing business might make financial sense, but that a full split of the company would hamper future earnings.

Shell set itself a tougher emissions-cutting targets for its direct emissions, aiming to halve them by 2030 in absolute terms rather than just cutting intensity-based emissions, which leaves open the possibility of an overall increase.

Shell's direct emissions are dwarfed by the emissions caused by the combustion of its products through its customers, known as Scope 3.

The company has pledged to become a net-zero emissions company by 2050, but is under pressure to make faster progress, with a Dutch court ordering it in May to cut all of its emissions - including Scope 3 - by 45% by 2030.

Shell is appealing the court ruling, with van Beurden saying earlier this year that "a court ordering one energy company to reduce its emissions - and the emissions of its customers - is not the answer" to reducing global emissions.

Coal and natural gas demand has already reached new peaks, surpassing pre-pandemic levels, with oil not far behind. Gas and power prices surged this autumn as tight gas supplies have collided with strong demand in economies recovering from the COVID-19 pandemic. ,

Shell's cashflow from operations in the quarter rose by around 54% on the year to $16 billion, which in turn helped it to reduce net debt to $57.5 billion, compared with $65.7 billion in the previous quarter.

The company said its LNG production will rise to 8-8.6 million tonnes in the fourth quarter.

Reuters GraphicsReporting by Shadia Nasralla; Editing by Jason Neely, Mark Potter, Barbara Lewis, Christina Fincher and Marguerita Choy

Reuters GraphicsReporting by Shadia Nasralla; Editing by Jason Neely, Mark Potter, Barbara Lewis, Christina Fincher and Marguerita Choy