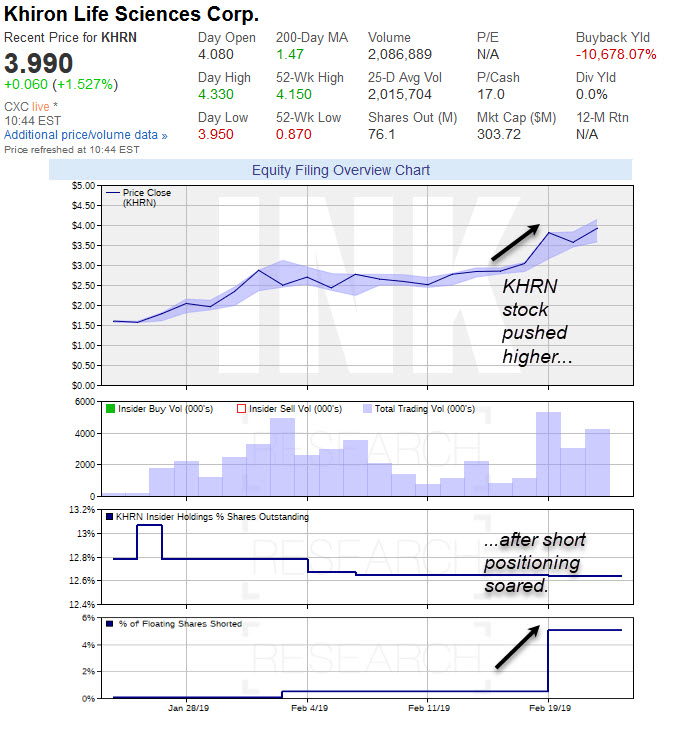

Short bets jumped against Khiron Life Sciences right before stock soared

According to the latest IIROC report, short bets against Khiron Life Sciences (Sunny; KHRN) soared by a whopping 3,076,474 shares in the period between February 1st and 15th. That was right before the stock charged up to its all-time high of $4.33 (CXC trading - click here for latest real-time quote) set earlier today.

Click here for KHRN INK company page (INK subscription required)

While the recent jump may already be a result of a short-squeeze, there could be more upside to come.

According to INK data, Khiron is now one of the 40 most heavily shorted stocks in Canada with almost 5% of the stock's float shorted. Meanwhile, the stock ranks within the top 20% in terms of insider commitment which is based on holdings, net buying and intensity of buying. Generally, we expect short bets to have a better chance of success when insider commitment is low. When shorts and insiders go head-to-head, on average we would put our money on the insiders.

Of course, there will be times when things will not work out as we expect. A key risk right now is whether we are at the top of the latest cannabis stock surge. As we suggested in our market update Monday morning, the marijuana stock rally is nearing exhaustion. Our 30-day Pharmaceuticals Indicator (INK subscription required) subsequently hit 40% on February 19th which could represent a near-term bottom for industry insider sentiment. If that turns out to be the case, it could be time to take profits on the group generally.

We will have more to say on this development in our market update this coming Monday. In the meantime, Khiron Life Sciences bulls and bears a like will have to assess whether the stock is likely to buck any over-all correction in the marijuana stock group.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This post first appeared on INKResearch.com (subscription required).

Disclosure: I hold a long position in KHRN.