Short interest back on the rise at Aphria

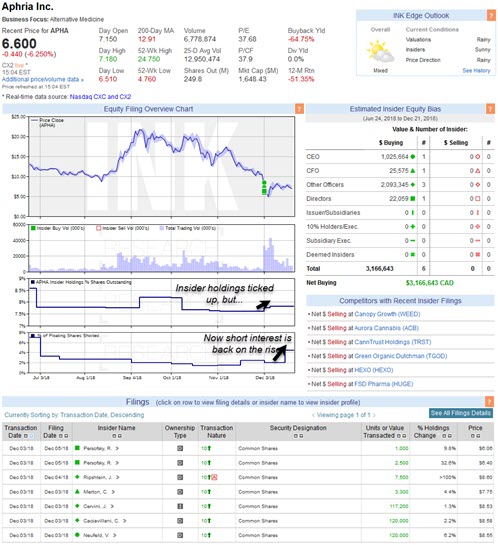

The short interest in Aphria (Mixed; APHA) jumped in mid-December according to data released this morning by IIROC. The number of shares reported shorted jumped by 5,737,929 to reach 10,446,157 as of December 15th.

The short-sellers are tangling with insiders at the company who bought more stock in early December after the release of a short seller's report.

Generally, when we see a stock with high insider commitment being shorted heavily, it sets up the potential for a short squeeze. However, we would have more confidence in that scenario playing out if the overall INK Edge outlook for the stock were positive (mostly sunny, or sunny). That is not the case in Aphria, so we will sit back and watch as the direction could go either way based on our signals.

Our bottom line: a long or short position in Aphria requires a high degree of conviction.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This post first appeared on INKResearch.com