Short Selling Ramps Up as UNFI Flashes Historic Bear Signal

UNFI has been in a long-term downtrend on the charts

UNFI has been in a long-term downtrend on the charts

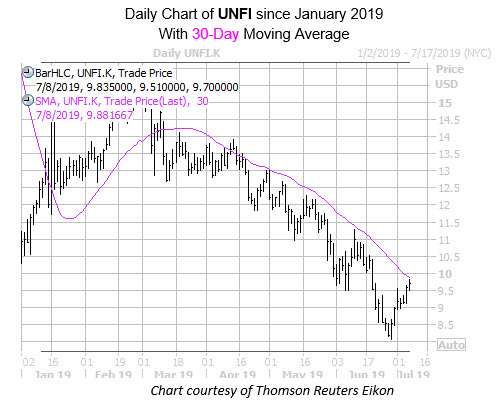

Organic foods distributor United Natural Foods Inc (NYSE:UNFI) has struggled on the charts over the long term. Pressured by its 30-day moving average, UNFI has shed 77% over the past 12 months. United Natural Foods stock also touched a nearly 17-year bottom of $8.07 on June 27, and now, data from Schaeffer's Senior Quantitative Analyst Rocky White suggests UNFI may be preparing to fall even further on the charts.

Specifically, the security is running into resistance at its 30-day moving average after a lengthy stretch below the trendline. This signal has flashed five times in the past few years, per White, resulting in an average 21-day loss of 20.8%, with not one return positive. A similar plunge would put UNFI back near two-decade lows.

On the sentiment front, short selling has ramped up on the food name. Over the past two reporting periods, short interest increased 12.8%, and now accounts for 16.9% of the stock's total available float. The equity could be pressured even lower, should these bearish bettors continue to pile on.