Short-Term Risks To Gold Are Increasing

Stronger dollar is creating a renewed short-term headwind for gold.

Falling short interest and overcrowding also increase gold's risks.

Gold mining stocks, however, will continue outperforming bullion.

Gold's progress since last month's bottom has been nothing less than astounding. The rally over the last three weeks has allowed the metal to claim the distinction of being one of the top percentage gainers for June, easily besting the performance for most commodities and equity market sectors. Although gold's intermediate-term (3-6 month) path of least resistance remains up, there are a growing number of reasons for traders to tighten up stop losses and expect a pullback at some point this month. We'll discuss these risks to gold's short-term outlook in today's report. I'll also provide an update on the still-bullish gold mining stocks, which I expect will continue outperforming the physical metal.

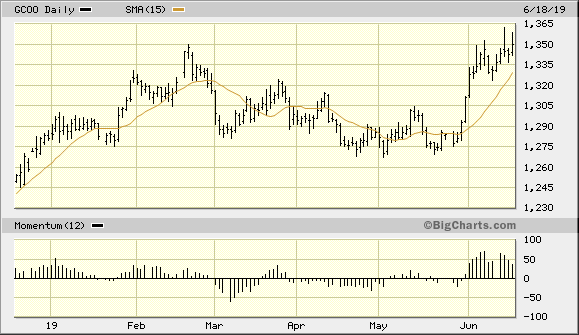

The price of gold hit a 14-month high this week after ECB President Mario Draghi gave investors reason to believe that eurozone interest rates would be cut if needed. Draghi indicated in a speech at the ECB Forum in Sintra, Portugal that economic risks to the eurozone remained high and that additional stimulus might be required to fend off a recession. Investors reacted by upping safe-haven purchases of the metal, despite gold's strong rally over the last three weeks.

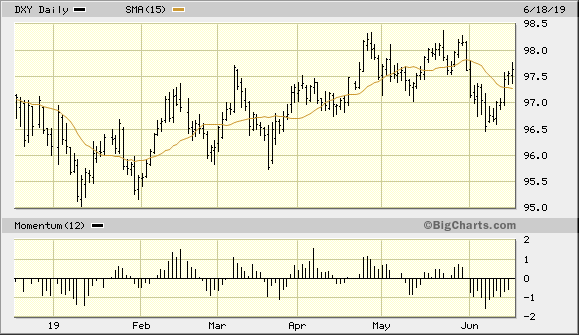

Currency traders reacted to Draghi's comments by temporarily pushing the U.S. dollar lower against the euro. The softer dollar gave gold the extra impetus it needed to clear decisively above its 2-week high at the $1,350 level (below). However, the weakness in the greenback didn't last long and the dollar index (DXY) was inching closer to its April high at mid-week.

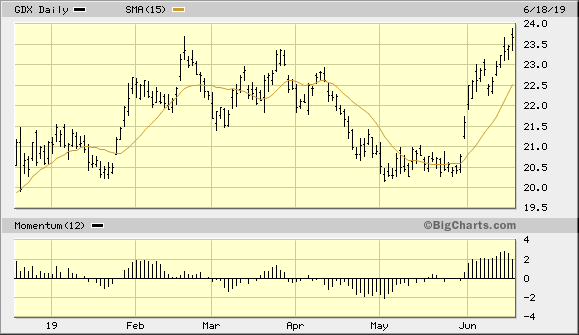

Source: BigCharts

I would note further that the DXY has now closed two days higher above its 15-day moving average as of Jun. 18. In the past, this immediate-term breakout signal has often resulted in the dollar going on to higher levels in the weeks that follow. It's also another reason for gold traders to pull in their horns a bit by raising stop-loss levels on existing long positions in gold and the gold ETFs. A stronger dollar will eventually weaken gold's currency component and make it harder for the metal to rally in an uninhibited fashion like it has done since late May.

Source: BigCharts

Dollar strength notwithstanding, gold remains in a confirmed immediate-term (1-4 week) upward trend. The yellow metal's price is above its rising 15-day MA and also enjoys strong inflows from safety seekers and, increasingly, hedge funds. Indeed, there is ample reason for believing that gold is attracting a growing number of momentum traders.

One sign that the momentum chasers are rushing into gold can be seen in recent fund flow data and Commitments of Traders, which show a sizable increase in speculative long positions. Gold long positions have risen to 78% of retail traders, according to data provided by FXDaily. This is well above the historical mean and is a sign that gold may have attracted a following too big to sustain in the short term. It also implies that gold's short interest may have fallen to a level which is unsustainable.

Meanwhile, a recent report published by Saxo Bank shows that funds have increased bullish bets on several commodities, including gold. Fund managers increased gold longs by a record 85,000 lots to 118,000 lots, the highest amount in 14 months, according to Saxo Bank. As previously indicated, this gives us a contrarian reason to raise stops and remain wary in the near term as there are now too many long positions for comfort in the gold market. A crowded gold bullish trade means the market is becoming vulnerable to a bear raid.

While near-term risks to the gold price have increased, mainly in the form of a strengthening dollar and unsustainably high bullish sentiment, gold still enjoys support from lower bond yields. Falling yields for Treasury and corporate debt mean less competition for the non-yielding metal. And if the Federal Reserve confirms rumors that it might lower its benchmark rate later this summer, gold would likely see even more demand from traders seeking alternatives to increasingly low-yielding bonds.

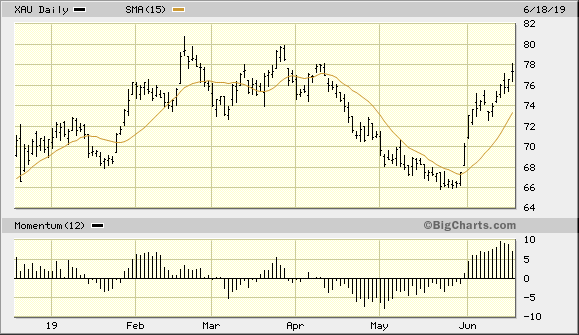

The fear factor and interest rate factor taken together will keep gold's intermediate-term upward trend intact despite the increased short-term risks. Investors with an intermediate-to-long-term orientation can retain long positions in gold and the gold ETFs, but short-term traders should consider raising stops on open long positions at this point. That advice also applies to the gold mining shares, but with a proviso: the near-term outlook for the gold stocks is still positive enough to support the rebound in the PHLX Gold/Silver Index (XAU) in the coming weeks despite a stronger dollar.

Source: BigCharts

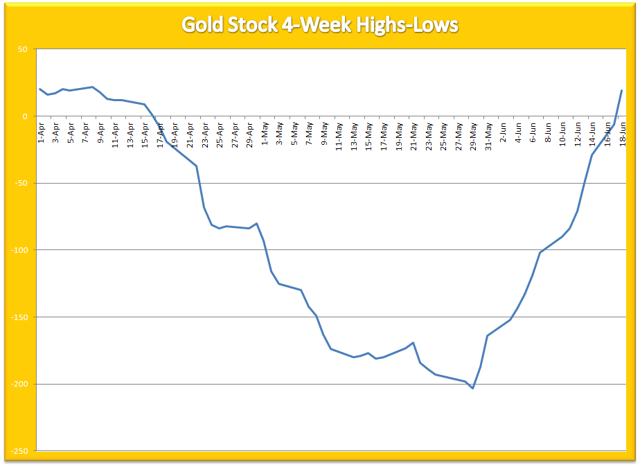

The primary reason for expecting a continued strong relative performance for the gold miners is provided in the indicator shown below. This shows the 4-week rate of change in the new highs and lows for the 50 most actively traded U.S.-listed gold mining shares. As you can see here, the demand for gold stocks has been continuously increasing on a daily basis since last month with no signs of distribution (i.e. informed selling) taking place yet.

Source: NYSE

A selling campaign among "smart" investors nearly always shows up in the form of shrinking new highs among the gold stocks, while new lows gradually increase. This has the effect of pushing the 4-week rate of change indicator lower, which, in turn, means the path of least resistance for gold stocks in the aggregate is to the downside. That clearly isn't the case here, as the momentum behind the new highs and lows is rising in an almost vertical fashion. This suggests that the near-term demand for gold stocks is so strong right now that any downside in the immediate-term (1-4 week) outlook is likely to be minimal and short-lived, while upside potential is still high.

To summarize, while the market for gold bullion is vulnerable to a pullback in the coming weeks due to a strengthening dollar falling short interest levels, gold mining stocks remain in strong hands. Indeed, the gold mining shares still enjoy a strong tailwind in the form of rising internal momentum, which should allow the gold miners to continue rising in the immediate term. As long as the above mentioned new highs-lows indicator is in a rising trend, I recommend that traders maintain long positions in outperforming individual gold stocks and gold mining ETFs.

Source: BigCharts

On a strategic note, I'm currently long the VanEck Vectors Gold Miners ETF (GDX). After the recent rally to the March high in GDX, I recommend raising the stop-loss on this trading position to slightly under the 22.50 level on an intraday basis. This is where the technically significant 15-day moving average can be seen in the daily chart above. Investors can also maintain longer-term investment positions in gold and gold ETFs.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts