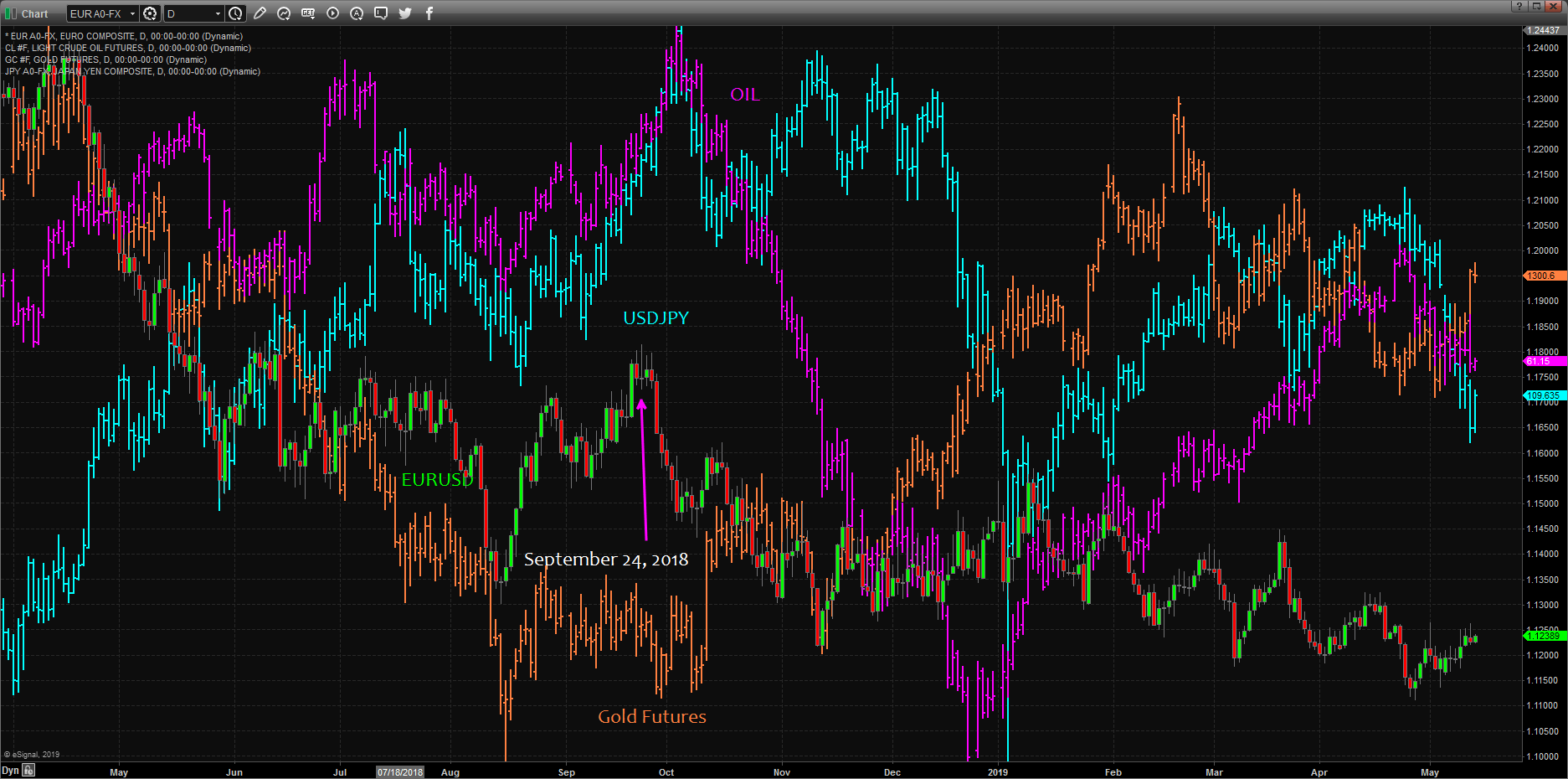

Short term trading opportunities of EUR/USD, USD/JPY, Gold and Oil

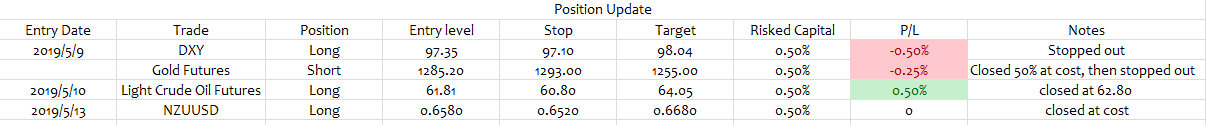

Position update

Yesterday after China raised tariffs to US, the short position of Gold Futures was directly stopped out.Considering the market reaction of September 24, 2018, when US raised tariffs to China, we closed Oil long positions at 62.8 and NZDUSD long position at cost.No new trade idea today.

Click on the image to enlarge

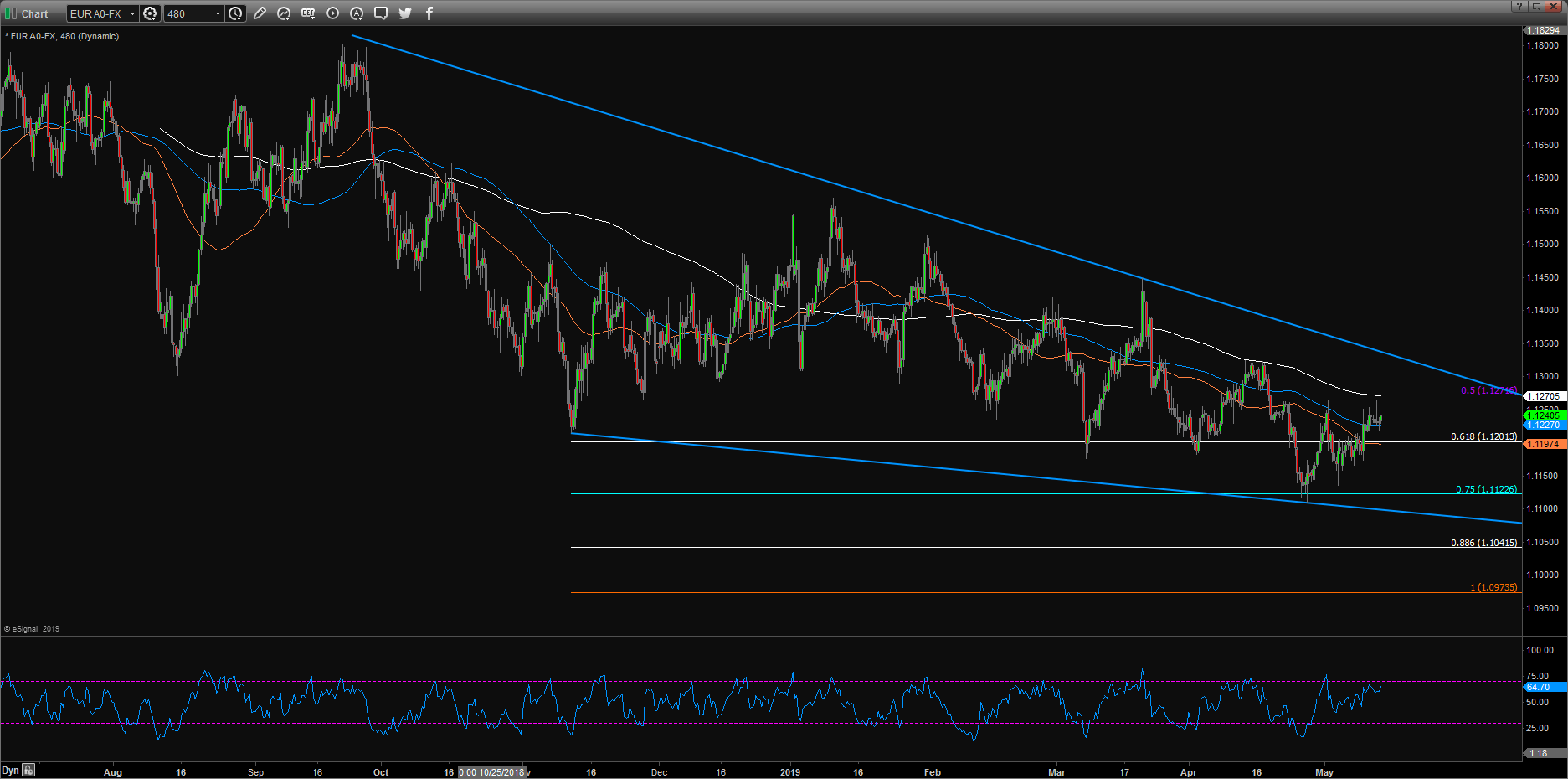

Holding above 1.1215, the trend is still pointing higher.However, due to the past performance in the trade tension, further observation is still needed for the pair.

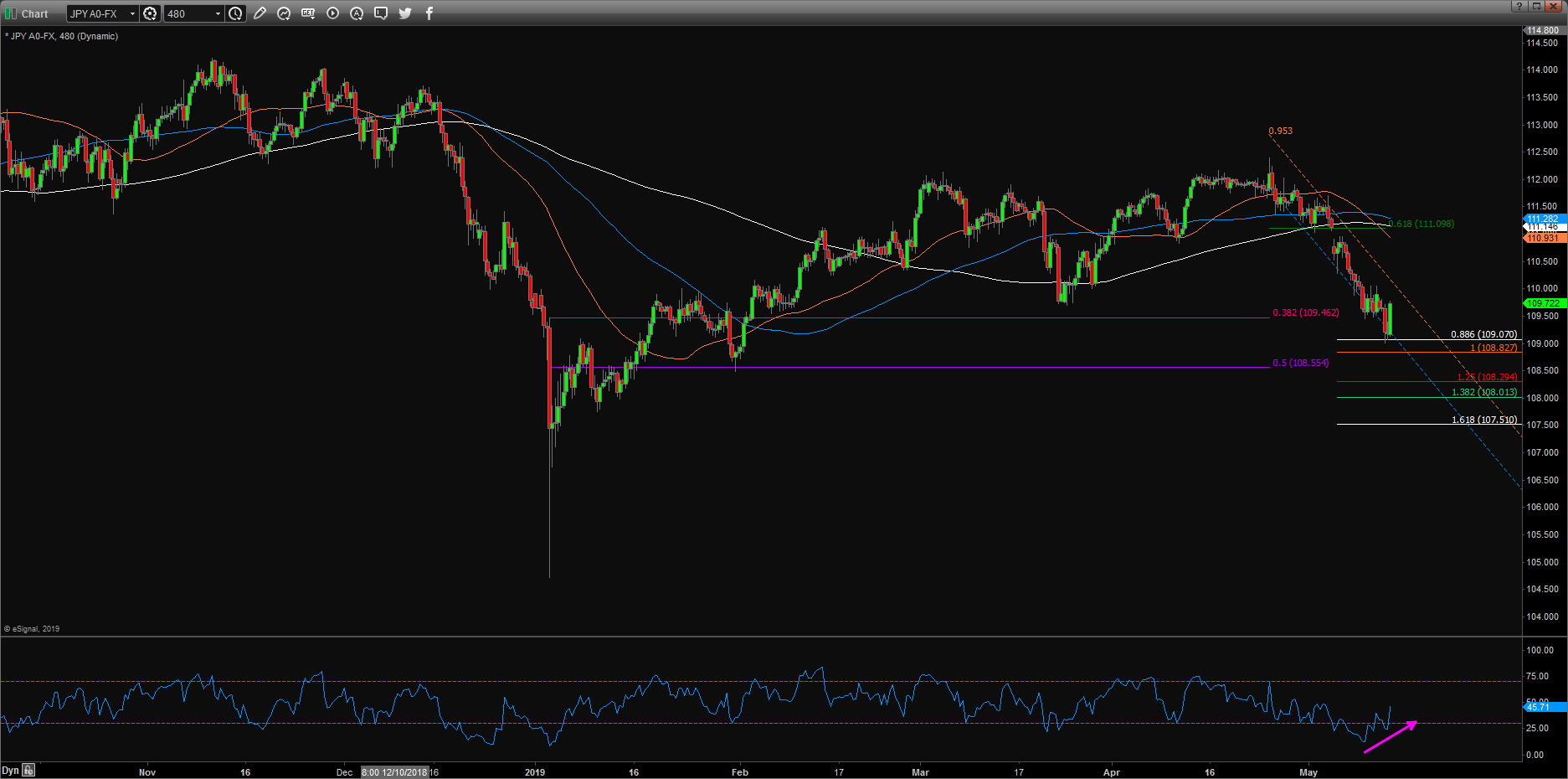

After a strong sell-off, daily close back above 109.46, may indicate a small base sign.

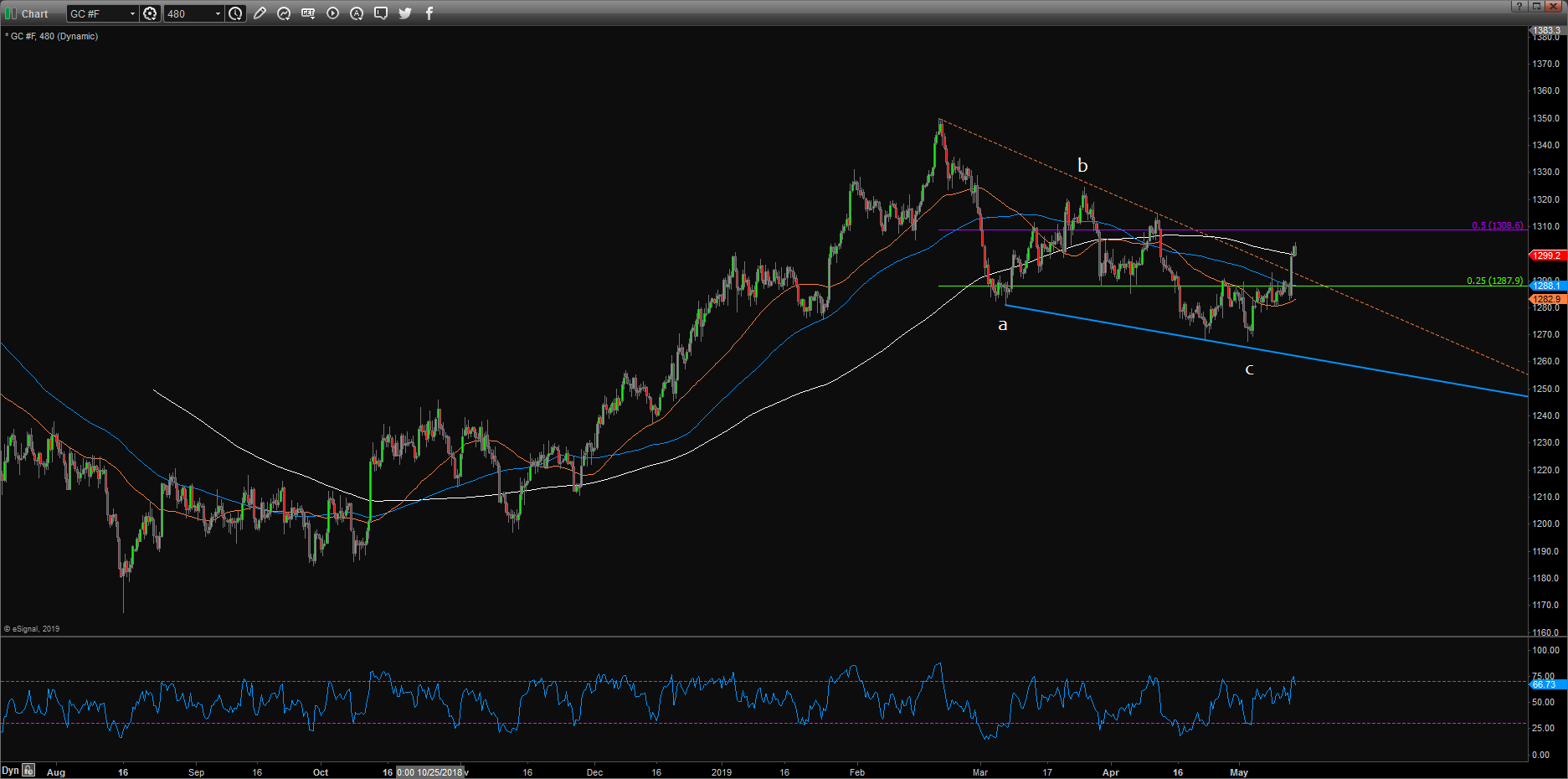

Gold

The price finally break out from a potential falling wedge.However, the former control point and range high is just ahead at 1302 and 1308 respectively.Dips may be shallow. We'll look for some low risk buying opportunities.

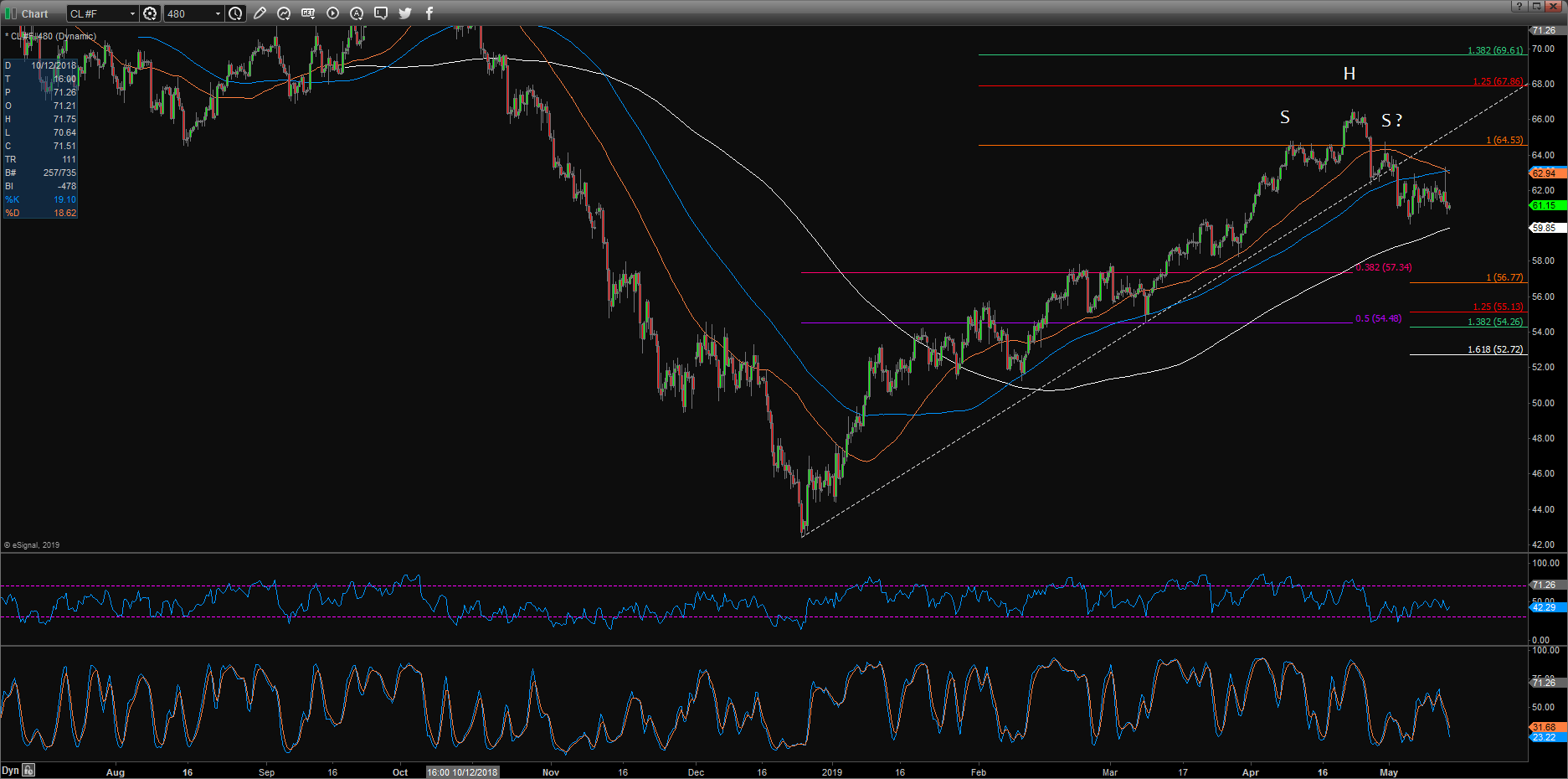

Oil (Light Crude Oil Futures)The price was exactly rejected by the 100% extension of an ABC correction from 60.04.A potential head-shoulder top formation is formed.Further downside toward 57.35 is very likely.We'll look for top signs around 61.95/62.13.

Views are my own, not trading recommendations.