Short the Fed, Buy Gold

Peter Krauth, editor of Gold Resource Investor, explains why corporate America is beginning to see gold as a necessary reserve asset.

Peter Krauth, editor of Gold Resource Investor, explains why corporate America is beginning to see gold as a necessary reserve asset.

Federal Reserve Building

Federal Reserve BuildingYellen is Treasury Secretary. Powell is Fed Chair. And Sanders is head of the Senate Budget Committee.

Most of the time, it's impossible to tell the future. But there are exceptions. Right now, there's no room left to read between the lines. The goals, and outcome, are obvious.

America, along with the rest of the world, is going to try and spend its way out of the pandemic crisis.

This crystal ball is perfectly clear, and Wall Street's been peering into it. That's why stocks are near all-time highs. It's why, increasingly, the savviest managers from corporate America are also catching on, and acting.

It's why Tesla just moved $1.5 billion of its cash into bitcoin. Naturally, that's big news. But what didn't make the Tesla headlines may surprise you.

It's time to manage your cash, with gold.

The Dollar Is Fizzling

Here's what Tesla's latest 10k filing said:

"In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity...we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future." (emphasis mine)

Alternative reserve assets? Gold bullion? Gold exchange-traded funds?

Folks, the writing is now all over the wall. Corporate America is cluing in, but the vast majority of individual investors haven't...yet. It's why gold, silver, and pretty much all commodities have started to run higher.

The dollar is toast.

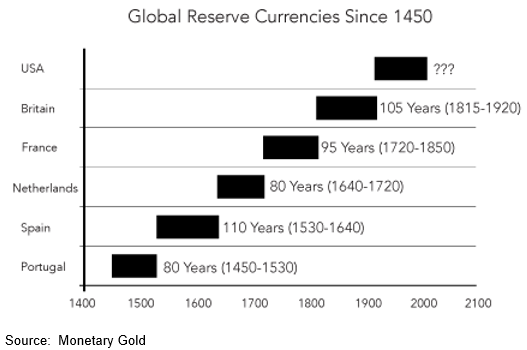

Look, the dollar's been the undisputed reserve currency for nearly a century. But that's the average life span of a reserve currency going back over 500 years.

The dollar enjoyed a short reprieve over the last decade or so, but central bank and government reaction worldwide to the Covid-19 crisis was the final straw. The camel's back is now broken.

Even bond king Jeffrey Gundlach's firm, DoubleLine Capital, via Bill Campbell, recently said:

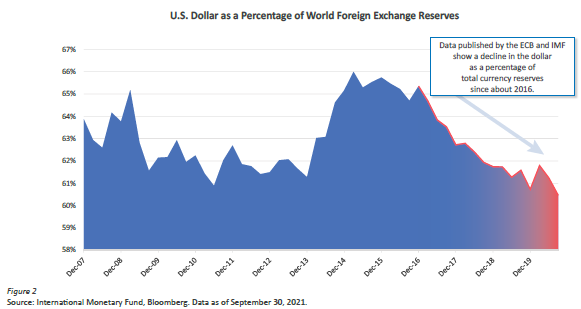

"...a series of equal and opposite reactions are occurring as nations move to remove the role of the U.S. dollar at the center of global trade and finance. This will have long-lasting structural impact in ending the dominance of the dollar as the world's reserve currency."

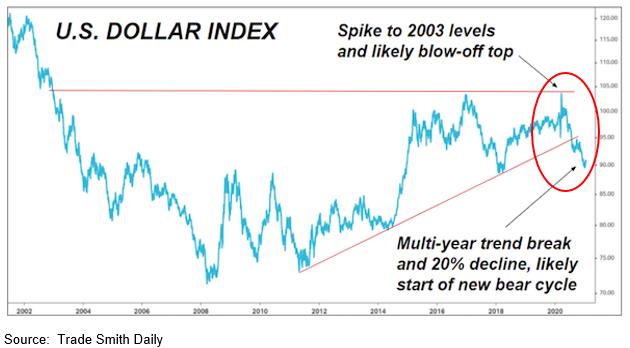

The action in the US dollar index over the past few years tells a similar story.

The dollar has clearly broken down below a rising trend line after peaking near 105 last March. Today, it's trading near 90. By all accounts, it appears the dollar has resumed its long-term downtrend.

Stanley Druckenmiller, once chief portfolio manager at George Soros' Quantum fund, recently said in a Goldman Sachs interview,

"It's possible, in fact probable, that all this stimulus is still going to be in place and frankly increasing just when we release the biggest increase in pent up demand globally that we've had maybe since the 1920s, which could make the world look extremely different than today...I would say that my overriding theme is inflation relative to what the policy makers think."

That makes gold a go-to option not only to preserve, but to grow your cash.

The Future is Golden

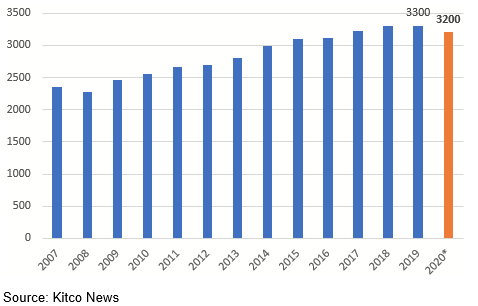

2020 was challenging for everyone, including gold miners.

Annual gold mine production actually dropped about 3% last year, from 3,300 tonnes to 3,200 tonnes, as miners were forced to temporarily shut down their facilities.

Still, most analysts expect gold output to grow over the next decade. A report by Fitch Solutions forecasts about 2.5% annual gold production growth between 2020 and 2029, led by Russia which would overtake China as the largest producer by then. But it's worth noting Russia's drive to grow its gold output is in order to increase its central bank holdings as a buffer against ongoing U.S. sanctions and risks of Russian banks being excluded from dealing in dollar-denominated assets. So a lot of Russia's production may never reach market. (Source: The Northern Miner, Sept. 1, 2020)

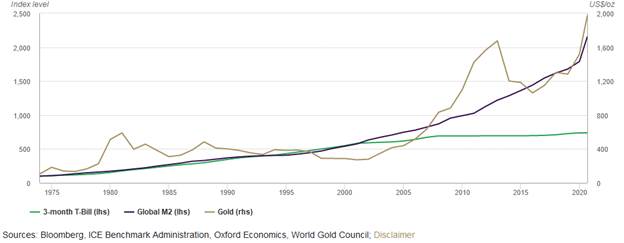

Going all the way back to the mid-1970s, gold has not only kept pace, but surpassed global M2 money supply growth.

Overall, I expect demand drivers to hold up. According to the World Gold Council, central banks are set to remain net buyers again this year. In my view, financial and geopolitical uncertainty, near-zero or negative rates, historic levels of fiscal and monetary stimulus, and massive pent-up demand as pandemic effects subside mean gold is primed to outperform.

Here's the big takeaway.

The dollar has resumed its long-term downtrend, as investors are beginning to realize it's about to be printed into oblivion. You need to take steps now that will help you protect your cash and purchasing power. And that means prioritizing precious metals and commodities.

In the Gold Resource Investor newsletter, I provide my outlook on which gold stocks offer the best prospects as this bull market progresses. I recently added two companies to the portfolio, which I believe have exceptional potential to double or better in the next 12 months.

In the end, it's not just me saying gold's a necessary reserve asset.

Now even Elon Musk likes gold.

--Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.