Sibanye Gold Is Not The Best Stock To Profit From A Rising Gold Price

Currency devaluations from major economies strengthen gold's position as the safe-haven asset, which boosts the price of SBGL.

SBGL's safety incident and ongoing disputes with labor unions make it doubtful if its gold mining and PGM operations will fully go back to normal soon.

Investors are recommended to sell SBGL at the current price.

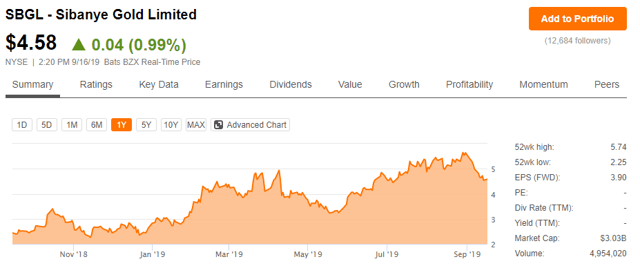

The stock price of Sibanye Gold Limited (SBGL) has climbed up by 90% for the past year, amid investors' enthusiasm for gold as a safe-haven asset. However, having just reported a gigantic operating loss for H1 2019, SBGL is actually in much worse shape than many investors had expected, and its future operations face huge uncertainty due to ongoing labor union disputes. Investors are recommended to sell SBGL at the current price of $4.58.

Source: Seeking Alpha

Source: Seeking Alpha

Gold as a Safe Haven Asset

The trade war between China and the US has become a currency war. In July 2019, the US Federal Reserve cut rates for the first time since the 2008 financial crisis. It is widely anticipated that the Fed will lower its target for the Federal Funds rate by another 25 basis points next week while leaving the door open for further reductions. On the other hand, in August RMB/USD moved beyond 7 per dollar for the first time since 2008, adding to speculation that Beijing is allowing the currency to depreciate to boost exports amid Donald Trump's latest tariff threat. Besides calling China a "currency manipulator," Trump urged on Twitter the "boneheads" in charge of the Fed to adopt the zero or negative interest rate policies.

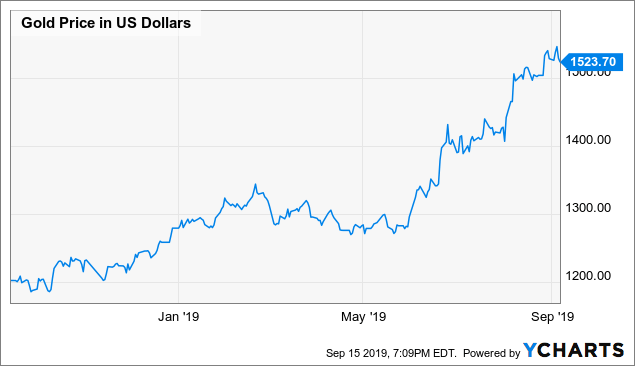

In such an extremely volatile environment, the reliability of the US dollar being a safe-haven currency is diminishing, and global investors anxiously look for alternatives to mitigate the risks of asset depreciation. That is why precious metals such as gold, silver and platinum have been seeing huge price increases for the past year. Shares of gold miners such as SBGL are also chased after by investors in the stock market.

There is too much uncertainty in the trade war as Trump changes his mind every now and then. But given the loose monetary policies from major central banks recently, in the short run, gold will continue to function as an important safe-haven asset and there is great chance its price will further rise, which is good news for gold miners.

Data by YCharts

The Many Troubles that SBGL Faces

In 2012, Gold Fields Limited (NYSE:GFI) unbundled its subsidiary and then renamed it Sibanye Gold Limited. In August 2017, SBGL reorganized its operations by region - Southern Africa and the United States.

Below is SBGL's operations by sector and by region. For H1 2019, SBGL reported an operating loss of $155.5 million, a severe deterioration compared to the $21.8 million operating profits in H1 2018. The profit decline is attributed to the delay in gold production in South Africa. In H1 2018, severe safety incidents occurred in its gold mines in South Africa, causing the tragic loss of 21 SBGL employees in total. After that, the company management has been facing pressure from labor unions for safer working environments and higher wages. Since November 2018, SBGL also had to deal with a strike which extended for five months, further leading to a contraction in gold production.

According to the company report, new rounds of wage negotiations now take place in its platinum operations, which may lead up to legal disputes. It is likely that in H2 2019, not only gold but also SBGL's PGM operations will see disruptions.

| USD, 6 months ended | |||

| KEY STATISTICS | Jun-18 | Dec-18 | Jun-19 |

| US OPERATIONS | |||

| PGM Operations | |||

| PGM production (oz) | 293,959 | 298,649 | 284,773 |

| Average basket price (USD/oz) | 996 | 1016 | 1285 |

| Adjusted EBITDA Margin | 25% | 27% | 26% |

| SOUTH AFRICA OPERATIONS | |||

| PGM Operations | |||

| PGM production (oz) | 569,166 | 606,506 | 627,991 |

| Average basket price (USD/oz) | 1,051 | 1,039 | 1,224 |

| Adjusted EBITDA Margin | 15% | 22% | 33% |

| Gold Operations | |||

| Gold production (oz) | 598,517 | 578,188 | 344,752 |

| Average gold price (USD/oz) | 1,314 | 1,212 | 1,308 |

| Adjusted EBITDA Margin | 10% | 4% | -48% |

Source: Author based on company data

Valuation Analysis and Conclusion

SBGL's share price hike for the past year is irrational in many ways, as it is mostly driven by investors' optimism in gold, when in fact this company has been facing many challenges maintaining the daily operation of its gold mines in South Africa. Investors are recommended to sell SBGL at the current price, and if they want to buy gold, they have many better alternatives out there. Barrick Gold Corporation (GOLD) with a P/E ratio of 49.23 and Newmont Goldcorp (NEM) with a P/E ratio of 28.61 - both are gold miners with healthier performance and more stable outlooks compared to SBGL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Liumin Chen and get email alerts