Sibanye Gold M&As: Synergy Or Waste Of Energy?

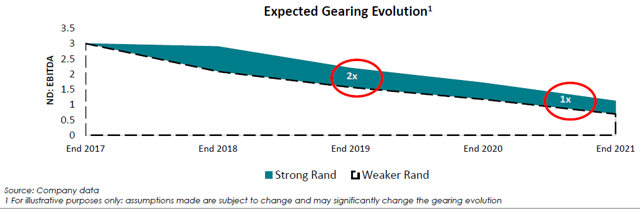

Sibanye Gold is far from achieving the targeted leverage ratio of less than 1X by acquiring Stillwater alone.

Investors see more value in Sibanye after acquiring 38% stake in DRDGold that will oversee operational developments.

Share price fell 65% last year, but a rally in palladium and gold prices, along with declaring scrip dividends, would offset the share price overhang.

Image Source: Company website

Investment Thesis

Sibanye Gold Limited (OTC:SBGLF) [JSE:SGL] operates as an independent precious metal company in Houghton, South Africa. The company produces a diverse mix of precious metals that includes gold and platinum.

The roster of gold projects in South Africa includes Kloof, Driefontein, Beatrix and Cooke. SGL's other projects in the region comprised the Southern Free State (SOFS) project and the West Rand Tailings Retreatment Project (WRTRP).

The company is seen by many analysts as undervalued and has upside potential to improve its stock valuation. Currently, Enterprise Value stands at $4.0 billion while Enterprise Value-to-EBITDA (EV/EBITDA) is booked at 17.69X.

Source: GuruFocus

SGL acquired Stillwater Mining and claimed stock rights at DRDGold (NYSE:DRD). The company is eyeing acquisitions as a way of deleveraging and bringing down its Net Debt to EBITDA ratio to 1X.

In this equity research, we will try to validate that by acquiring another company, or obtaining stock rights from another company would create synergies in SGL. In the process, we will be able to analyze if its strategy will inspire its stock valuation to outperform the market.

Stillwater Mining Acquisition

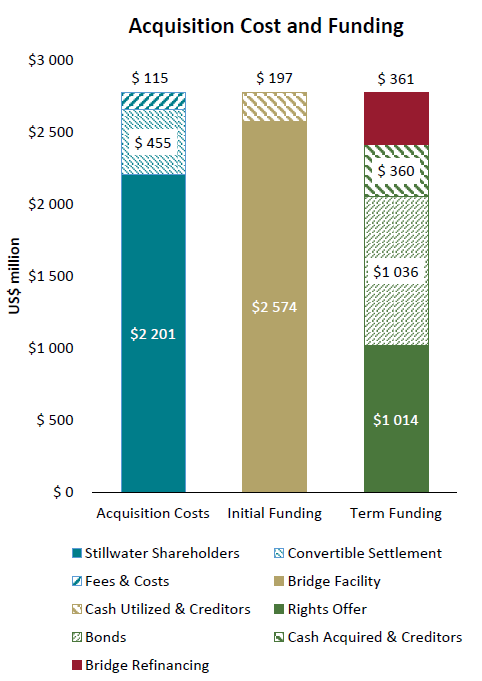

Sibanye Gold raised equity of $1 billion through a rights issue and $1 billion of debt for the Stillwater Mining acquisition. Although investors welcomed this move by Sibanye, share price failed to recover following the final terms of the deal were fully underwritten. Share price fell 34% during the second half of 2017.

The equity issue of $1 billion is less than $1.3 billion that the company guided to earlier. Equity issue is also equivalent to 40% of SGL's market capitalization. The proposed capital raise of $2 billion falls short of the amount needed. Hence, SGL had to secure a bridge loan facility of $2.65 billion.

Furthermore, raising additional capital is being planned out to meet the outstanding amount in the $2.6 bridge loan facility. Capital raising will be done through a combination of equity-like products, such as commodity streaming transactions, convertible bonds, or new equity issued under general authority, as well as debt instruments such as bank loans and bonds.

Source: Company data

The $1 billion debt issuance (on top of the $2.6 billion bridge loan facility) was floated in the US dollar and credit rated sub-investment grade. This deal has put extra pressure on the company's cash generation capacity. SGL had raised additional capital via convertible bonds/equity. Analysts see this move as an overhang on its share price.

Balance sheet also came under pressure following the acquisition. This is especially true given expectations of lower platinum and palladium market prices. It will challenge the company's capacity to generate cash and require it to reduce dividends.

SGL could have implications for its dividend with balance sheet stretching to maximum levels. The company recently shifted to declaring a scrip dividend. It issued two new shares for every 100 shares being held. This translates into annualized dividend yield of 4% (yet dilutive).

Analysts noted that the introduction of a compulsory scrip dividend (in place of cash dividends) could be perceived as a move away from the original strategy. It has been one of the higher dividend payers of global gold companies since its inception in 2013.

The Stillwater acquisition is highly dependent on palladium prices. In the near term, analysts expect a downside risk to palladium prices attributed to sluggish Chinese and US markets. Hence, this acquisition deal took a great amount of pushing to be approved by the majority of shareholders of both companies. Around 75% of shareholders of the company need to approve the rights issue.

Source: Company data

The firm's net debt at the end of the first half of 2017 already reached ZAR 22 billion with Net Debt/EBITDA ratio of 2.6X. It is still a long way to go to arrive at long-term leverage guidance of less than 1X.

DRDGold Rights Offer

Sibanye took a 38% stake in DRDGold, in which West Rand Tailings Retreatment Project (WRTRP) is to be developed. The stake was valued at ZAR 1.3 billion. It includes a feature of options to increase this to 50.1% within 24 months.

This deal was made possible in exchange for selected surface processing assets, two gold processing plants at Driefontein (DP2 and DP3), a pilot plant and a land. All combined, they formed approximately gold reserves of 3.8 million ounces complemented by 42.9 million pounds of uranium reserves.

A phased approach will be undertaken in constructing the WRTRP. Phase 1 will be finished within 24 months upon close of the transaction deal. Commissioning is expected to take 12 months. The construction will also include upgrading relevant pump stations and pipelines.

Similarly, the project would include upgrading Driefontein 2 and 3 (DP2 and DP3) from 315 thousand tonnes per month to 400-600 thousand tonnes per month. Lastly, a refurbishment of carbon-in-leach (CIL) at DP2 and DP3 will also be part of this project. An evaluation of all the tailing storage facilities (TSF) through the pilot plant at DP3 within 24 months will be implemented.

Shareholders view this deal as positive. DRD will take over the development plan and will execute the project using the phased approach. The synergy that would be created will allow SGL to take up less time in overseeing the project while DRD taking over the development of operations.

This deal will also allow for the gold reserves to be exchanged for a marketable security via DRD shares. Hence, the visibility of the market value of surface assets will become clearer to the perception of the investors. This transaction is anticipated to be finalized by the second quarter of this year.

Stock Valuation

During the past six years, the highest P/E ratio was 88.66X. The lowest was 4.55X while the median P/E was 10.08X. During the past 12 months, the average earnings per share (EPS) growth rate was -232.80% per year. During the past three years, however, the average EPS growth rate was 16.30% per year.

Source: GuruFocus

Our Takeaway

SGL has acquired three new mines over the past couple of years. Integration of these mines will take around two to three years more. We have small doubts whether this expansion in pursuit of platinum metals (through Stillwater acquisition) is perhaps the best growth opportunity.

Source: Company data

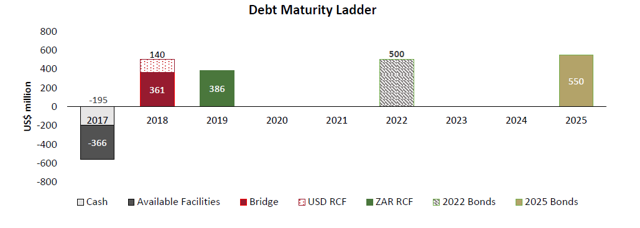

We noted that around $76 million remains available for drawdown under the bridge loan facility. The chart above has already been adjusted for the $218 million July 2017 repayment under the bridge loan facility.

The company has relied on continually issuing shares and taking on hefty amounts of debt to finance its continued operations. In hindsight, these are strategies which are hardly conducive to growing value for shareholders. SGL is unable to generate sufficient organic cash. The terms of the rights offering are a daunting revelation that investors must further scrutinize the company's financials before buying SGL's shares.

Hence, we expect investors to be keenly stalking Stillwater's moves on how much value it is bringing to its new parent company. Investors might ask the question whether the company is moving in the right direction in terms of generating cash from operations. Perhaps this is a more viable solution rather than selling equity and taking on more debt.

Source: Company data

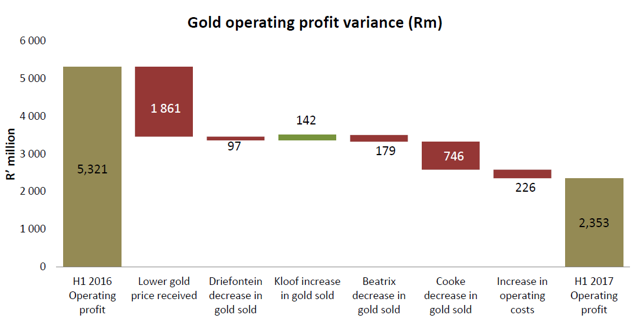

We should not forget that the company struggled in 2017 due to contracting margins. SGL reported an 18% operating margin in 2017, considerably lower than the 38% it yielded in 2016. All-in sustaining costs recorded $1,163 per gold ounce in the third quarter last year compared to $895 generated during the same period in 2016. Capital spending is expected to increase by $115 million.

Lastly, SGL could take advantage of the rally in palladium prices. It could quickly lead to the company's deleveraging if palladium prices are sustained. Added to that, geopolitical risks and depreciation in the South African currency would lead to a rally in gold prices which could take on another positive catalyst for the stock.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, a business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.If you found this article to be informative and would like to hear more about my investment research,please consider hitting the "Follow" button above.