Sibanye, Regulus join efforts to develop Argentina's Altar project

South Africa's Sibanye-Stillwater (JSE:SGL) (NYSE:SBGL), the precious metal miner target of several lawsuits over mounting deaths at its operations, said Friday it has inked an agreement with Canada's Regulus Resources (TSX-V: REG), and its newly formed subsidiary Aldebaran Resources, to jointly unlock value at the Altar copper-gold project, in Argentina.

Under the terms of the deal, Sibanye's wholly-owned branch Stillwater Canada will enter into an option and joint venture with Regulus' newly formed Argentinean subsidiary Aldebaran Resources. This company, in turn, will have the option to earn a maximum 80% interest in a division of Stillwater Canada - Peregrine Metals, which owns Altar.

Vancouver-based Regulus will also spin out its Rio Grande copper-gold project and other early-stage mining assets it has in Argentina to Aldebaran, including the drill-ready Aguas Calientes gold-silver project.

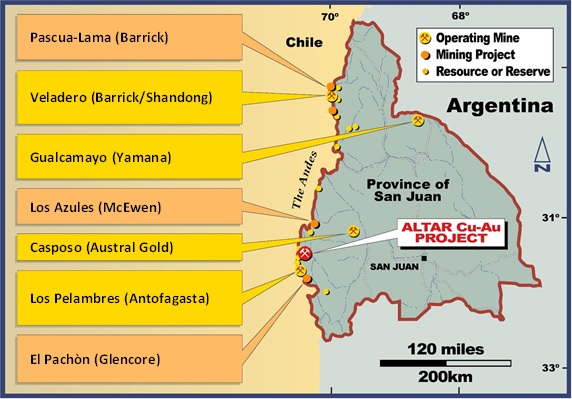

Altar Project location. (Image courtesy of Regulus Resources.)

The Altar project, located in the San Juan province, is about 10km from the border with Chile, the world's No. 1 copper producer. As of December, it contained 2,057 million tonnes of measured and indicated resources at 0.3% copper and 0.1 g/t gold (14.5 billion pounds of copper and 5.2 million ounces of gold) and 557 million tonnes of inferred resources at 0.3% copper and 0.1 g/t gold (3.4 billion pounds of copper and 1.1 million ounces of gold)

The Rio Grande project, in the north western Salta province, is located along the NW-trending Archibarca Lineament, which also controls the location of the BHP's Escondida copper mine in Chile, the world's largest.