Signal Says General Mills Stock Could Stay Hot

And options are attractively priced at the moment

And options are attractively priced at the moment

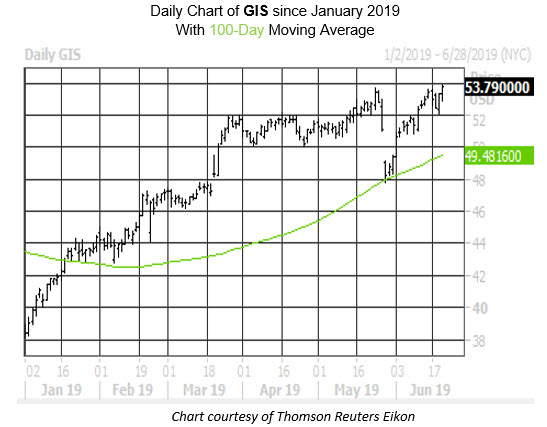

Cereal maker General Mills, Inc. (NYSE:GIS) will step into the earnings confessional n before the open next Wednesday, June 26. At last check, GIS is up 0.8% to trade at $53.79 today, and earlier nabbed a new annual high of $53.89. Ahead of the event next week, there is a reliable signal flashing that indicates GIS' hot streak is far from over.

Specifically, the stock's Schaeffer's Volatility Index (SVI) of 27% ranks in the 5th percentile of its annual range. This indicates short-term options are cheap, from a volatility perspective. Per data from Schaeffer's Senior Quantitative Analyst Chris Prybal, the four other times since 2008 that GIS was trading within 2% of a new 52-week high while its SVI was ranked in the bottom 20th percentile of its annual range, the equity averaged a one-month gain of 6.4%, and was positive three times.

A move of similar magnitude would put the equity near $57.23 for the first time since January 2018. General Mills stock gapped lower in late May, but the pullback was contained by ts 100-day moving average. Since then, GIS has only turned in three negative sessions,extending its year-to-date lead 38%.

Looking at the company's earnings history, the stock has only closed higher the day after earnings in four of the last eight quarters -- including a 5% pop back in December . Over the past two years, the shares have swung an average of 4.2% the day after earnings, regardless of direction. But today, option traders are pricing in an even wider swing of 6.5% for the stock, based on near-term at-the-money straddle data.

Calls have reigned in the options pits in recent weeks, despite limited absolute volume. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 2,082 calls were bought to open in the past two weeks, compared to just 270 puts. The resultant call/put volume ratio of 7.71 ranks in the 100th percentile of its annual range.

The good news for options traders is that GIS has already shown a tendency to make bigger moves than options traders were expecting in the past year, based on its Schaeffer's Volatility Scorecard (SVS) of 86 out of a possible 100.