SILJ - A Safer Way To Play Silver At This Time

The spot price of silver is currently trading at $14.83/oz, collapsing back down after briefly eclipsing $16/oz back in February.

In a sub $15/oz silver environment, it will be tough for silver producers to turn profits, so risks are elevated, and thus for speculators, diversification is key for survival.

SILJ provides speculators looking for silver exposure the added protection of diversification via an ETF (30 total holdings) to reduce individual company risk.

SILJ is not a perfect silver ETF; the fund has some questionable holdings that arguably may be better suited in a gold ETF, and the expense ratio of 0.69% is not cheap for an ETF product.

In the last silver bull market of 2016, shares of SILJ rose 330.6% (from essentially trough to peak).

For anyone who has ever speculated on mining stocks before in the past, you probably know full well how potent having even just a select few silver stocks handy can be for overall portfolio returns whenever sentiment flips to positive for the precious metals sector.

However, to the dismay of precious metals bulls, the spot price of silver has been mired in sideways/downward channel over the last few years, and thus far every interim rally that has ensued (and showed brief signs of life) has turned out to be nothing more than a false bull trap. Each time there has been a brief run-up in price, silver has thus far inevitably failed to break out, instead reversing course back down, time and time again. Currently, the spot price of silver is trading at ~$14.94/oz, which is a far cry removed from the ~$50/oz high set way back in 2011.

Source: Silverprice.org

Source: Silverprice.org

Silver Looks Relatively "Cheap"

Now, with the gold-to-silver ratio currently sitting at 84.27 (essentially at 20 year highs), though, it does make logical sense why some speculators continue to feel the desire to own at least some silver stocks in their portfolio, since the preferred contrarian strategy of "buying low" would seem to apply here.

Source: Goldprice.org

In other words, if a speculator believes that gold is priced cheaply today, the gold-to-silver ratio is basically telling us that silver hasn't been this undervalued relative to gold in ~20 years.

Picking Out Individual Silver Stocks

Unfortunately, for speculators looking to establish positions via individual silver mining stocks (for the inherent leverage built in, no doubt), the universe of "purer" silver plays really isn't all that vast, and even then, because silver is primarily produced as a byproduct of base metals mines (e.g. lead, zinc, copper, etc.) and gold mines, it's pretty much impossible to locate a silver mining company that earns the bulk/vast majority of its revenue from selling silver alone.

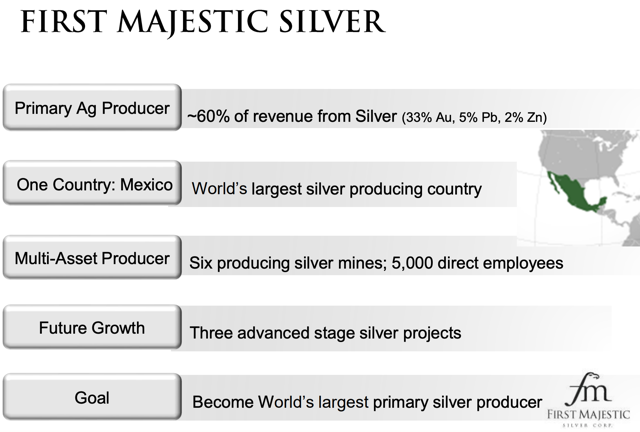

For instance, First Majestic Silver (AG), which is an industry darling and "go to" silver stock for many speculators, can still only manage to garner ~60% of its revenue from silver.

Source: First Majestic Silver Corporate Presentation

Source: First Majestic Silver Corporate Presentation

As an alternative, in the universe of royalty and streaming companies (R&S), even a company such as Wheaton Precious Metals (WPM) has had to rebrand itself in recent years (formerly known as Silver Wheaton), realizing how tough it is to build a business that is centrally focused on silver.

Source: Wheaton Precious Metals May 2017 Press Release

Source: Wheaton Precious Metals May 2017 Press Release

From Wheaton Precious Metals:

"Changing our name to Wheaton Precious Metals marks our evolution from a pure silver streaming company to a diversified precious metals streaming company. Since 2004, the company has focused on building the best portfolio of precious metals streams underpinned by low-cost mining operations. Starting in 2013, the opportunities have been more focused on gold, and thus, our portfolio is now relatively balanced between silver and gold. We are excited about this new identity, which better reflects our underlying operations and still respects our history," said Randy Smallwood, President and Chief Executive Officer of Silver Wheaton.

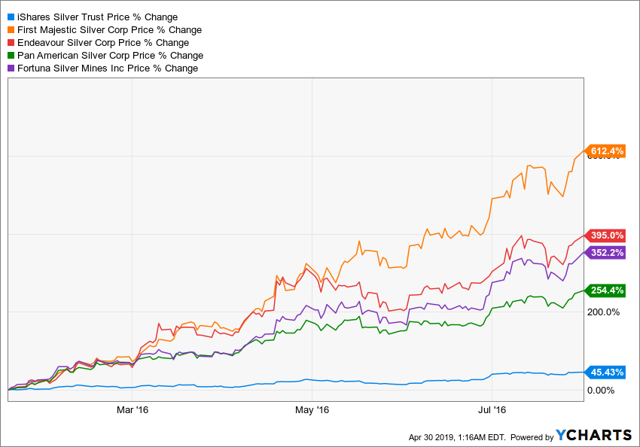

Of course, speculators can always just pick up shares of iShares Silver Trust (SLV), which in theory ought to only provide direct exposure to silver, but as the following chart clearly illustrates (showing the last bull market run in silver beginning on January 19, 2016 up to August 1, 2016), in a bull market, the "lack of leverage" can be a detriment to overall performance returns.

In the selected timeframe shown in the chart above, the following silver stocks produced the following gains:

In the selected timeframe shown in the chart above, the following silver stocks produced the following gains:

That's quite the contrast between SLV and the cherry-picked "silver stocks", indeed (which, ironically enough as it turns out, even if companies are by the strictest definition "non-pure" silver plays, but can nevertheless provide significant exposure to silver, the upside potential/gains can still be explosive to the upside).

As noted earlier, the underperformance experienced by SLV relative to its mining group peers (in the midst of a raging bull market in silver) is due to the inherent leverage found in mining stocks, which again, is the primary reason why speculators have interest in owning shares of individual mining companies.

Silver Producers Can't Make (Much/Any) Money At $15/oz

With that said, it should be worth pointing out that mining is an inherently risky business (for one, it's extremely capital intensive, so major mistakes made can have a devastating impact on a company's share price), and in the environment of sub $15/oz silver, speculators need to be extra careful when picking out individual companies because the market is giving you literally zero margin for error to work with.

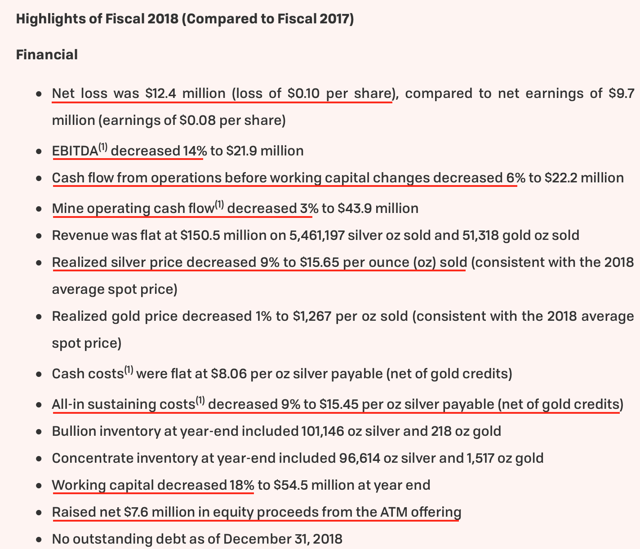

For example, if we take just a quick look into the 2018 financial results for silver producer Endeavour Silver, we will witness the following (relative to 2017):

Source: Endeavour Silver February Press Release

Source: Endeavour Silver February Press Release

The above underlined bullet points don't do much to inspire confidence that your "typical" silver producer will be able to tread water year/year without having to turn to the equity markets (i.e. dilution) for assistance (in the case of Endeavour Silver, they raised $7.6 million, as shown above), much less be in position to generate ample amounts of free cash flow from operations.

No, I'm not trying to pick on Endeavour Silver, per se; actually, this company represents more the rule than the exception in the silver sector, since negative investor sentiment and overall malaise in the silver sector is so bearish at the moment that it's impacted all participants. More succinctly, no silver company has been immune to the pain of a prolonged low price environment.

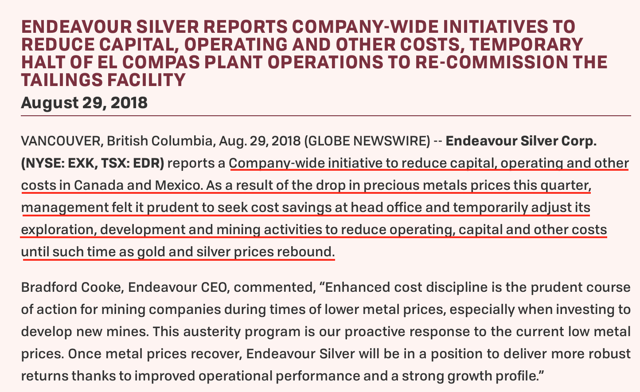

With that said, it's still concerning to note that a company like Endeavour Silver already announced plans to initiate a company-wide effort to reduce costs/expenses in August 2018, and now eight months later, the price of silver is still languishing down in the dumps, below $15/oz.

Source: Endeavour Silver August 2018 Press Release

Source: Endeavour Silver August 2018 Press Release

From the perspective of risk vs. reward, in my own humble opinion, when the spot price of silver is stuck languishing below $15/oz (or even $16/oz), the strategy needs to shift to one prioritizing defense (fear) as opposed to looking for ways to maximize offensive leverage (greed).

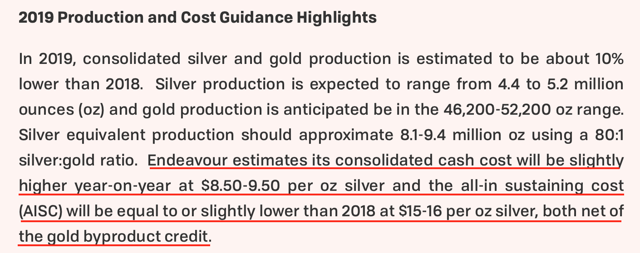

Turning back to Endeavour Silver, again, for an additional datapoint, we can see from the company's 2019 guidance that All-in Sustaining Costs (AISC) are projected to range between $15-16/oz (net of gold byproduct credits), which in effect means that if silver can't stage a meaningful recovery anytime soon, don't expect much good news to be reported from any quarterly financial reports in the near future.

Source: Endeavour Silver January 2019 Press Release

Source: Endeavour Silver January 2019 Press Release

Also, don't forget, in the context of a negative/bear market, good news (e.g. exceeding production guidance, better than projected free cash flow, accretive acquisitions, etc.) from mining companies is typically met with a muted response from the market, while bad news (e.g. missed production guidance, costs overrun, the need to raise more working capital, etc.) will likely lead to (further) merciless punishing to a company's share price.

An Alternative Way to Play Silver

Fortunately for silver bulls who wish to retain some exposure to the more leveraged mining stocks (despite lingering bearish/negative sentiment and all), while at the same time hedging their bets across different stocks to reduce individual company risks, there are ETF products on the market that can help one accomplish this objective.

The ETFMG Prime Junior Silver ETF (SILJ) is one possible solution, which is an ETF that is comprised of large cap/mid cap/junior silver mining companies (30 companies, in total) that, according to the fund manager:

Seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Junior Silver Miners & Explorers Index.

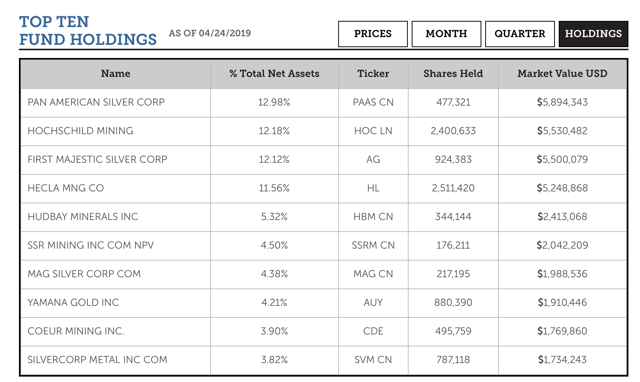

The top ten holdings of SILJ include the following silver companies:

Source: etfmg

Source: etfmg

As seen from the table above, many industry leading silver producers are included as core holdings in the SILJ ETF:

PAAS AG Coeur Mining (CDE) Silvercorp Metal (SVM)Also worth highlighting, SILJ does provide speculators with additional exposure to smaller cap, non-producing silver junior companies as well, which include (but are not limited to the following names):

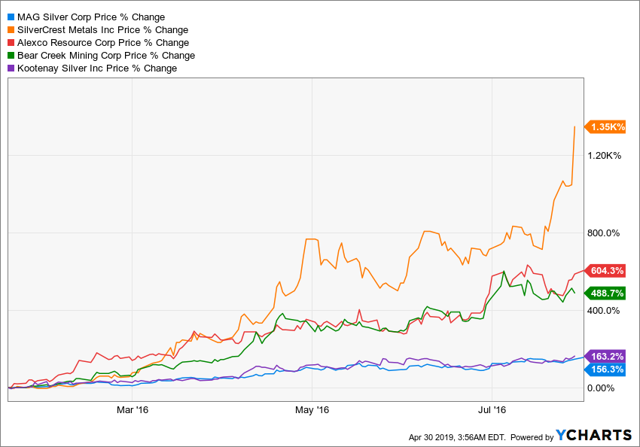

MAG Silver (MAG) Silvercrest Metals (OTCQX:SVCMF) Alexco Resource (AXU) Bear Creek Mining (OTCPK:BCEKF) Kootenay Silver (OTC:KOOYF)Although overall ETF exposure towards non-producing silver juniors in SILJ is arguably tilted more in the direction of being "underweight", nevertheless it still exists, and this leverage could come in handy should a bull market in silver ever resume course in the future.

Last time around (from January 19, 2016 up to August 1, 2016), the above silver juniors produced the following type of performance gains.

MAG was up 156.3%. SVCMF was up 1,350%. AXU was up 604.3%. BCEKF was up 488.7%. KOOYF was up 163.2%.In contrast, over the same timeframe (from January 19, 2016 up to August 1, 2016) SILJ delivered the following returns.

SILJ was up 330.6%.Clearly, as shown in the two charts above, there can be a lot of added potency gained for speculators who are fortunate enough to be holding the right "lottery ticket(s)" during a major inflection point up in the silver market, albeit the task of picking out the top outperformers is easier said than done.

As mentioned earlier, though, when the spot price of silver is only $15/oz (which is the current environment the silver sector is operating in), it makes it that much more difficult, even for the best run companies, to produce a positive return, let alone anything close to the triple digits which was commonly found across the board of silver stocks during the euphoric run-up experienced back in 2016.

Because of the circumstances, avoiding "landmines" (e.g. Tahoe Resources fiasco prior to the company's merger with Pan American Silver) is imperative, and although it is the very nature of ETF products to forsake maximum outperformance to the upside, the inherent nature of offering speculators a well diversified product also provides built-in protection from catastrophic failures, as well.

The following chart depicts the share price performance decline of various silver stocks (from August 1, 2016 to present day).

BCEKF is down -58.56%. KOOYF is down -79.66%. Hecla Mining (HL) is down -67.27%. AG is down -65.66%. SILJ is down -56.26%.From the above chart, it's readily apparent that in the midst of a bear market in silver stocks, even an ETF product such as SILJ cannot shield speculators from losses (in this case, SILJ being down -56.26% from the summer 2016 highs could constitute as being massive losses for any unfortunate shareholders who bought at/near the top), but alas, a more diversified portfolio, such as SILJ, can still stand up reasonably well, relative to the worst performers of the sector.

Exposure to Gold

Although SILJ is primarily geared with the intent of providing silver exposure for speculators, when combing through its total portfolio holdings, there are a few "non primary silver" companies in its holdings that stand out.

First off, Yamana Gold (AUY) currently makes up a 4.21% weighing in the SILJ ETF, and with a 2019 production guidance of: 940k oz of gold, 10 million oz of silver, 120 million pounds of copper, and given current prices of: $1,282/oz gold, $14.94/oz silver, $2.89/lb copper, it's clear that Yamana's primary source of revenue is from gold, first and foremost.

In addition, Sabina Gold and Silver (OTCQX:SGSVF), is arguably better known for attracting speculator interest for their flagship gold project (i.e. Back River) as opposed to drawing attention for their non-core silver asset (i.e. Hackett River royalty). SGSVF is a non-core holding included in the SILJ ETF, albeit Sabina Gold and Silver makes up just 1.1% of total net assets.

Another name, McEwen Mining (MUX), is one that is commonly associated with being a gold company, but it does in fact possess an overall production profile that currently makes it well suited to being included in a silver ETF, such as SILJ.

Historically, silver has often been classified as being a "hybrid" metal, part industrial and part precious metals. If, however, we are to use recent history as a guide, during the 2016 bull market/rally in gold, silver not only tagged along for the ride, but in many instances, silver stocks outperformed gold stocks substantially to the upside.

Certainly, there are no guarantees that history will always repeat itself again in the same exact manner, so for silver bulls who are interested in an ETF such as SILJ, they will have to determine for themselves if the "added" exposure to gold is one that is more of a positive, negative, or even negligible attribute for their own speculation goals.

Expense Ratio

The SILJ ETF has an expense ratio of 0.69%, which in the broader world of ETFs/index funds could be seen as being relatively high (since expense ratios of less than 0.1% can commonly be found in many total market funds). However, when considering the fact that regularly trading in/out of mining stocks (particularly some of the more illiquid OTC holdings contained within SILJ, e.g. BCEKF, SGSVF, Excellon Resources [EXLLF], etc.) can quickly cause transaction fees to add up in a hurry, the "one stop shop" solution that SILJ offers may easily justify the expense ratio of 0.69% for certain speculators.

However, for certain speculators, if the primary focus is to only trade silver stocks listed on the more liquid/accessible/cheaper NYSE stock market, then developing a personal silver ETF comprised of one's own hand-crafted selection of companies may make more sense than to have to pay the 0.69% expense ratio going the SILJ ETF route.

Conclusion

The spot price of silver continues to be mired below $15/oz, which has created a most challenging operating environment for all silver companies, particularly producers.

Further, in a market where sentiment towards precious metals (and silver in particular) is mostly bearish (to neutral, at best), the risk vs. reward proposition is likely more heavily skewed to the risk side of the spectrum at this time. In other words, bad news reported from individual companies will likely lead to more punishing of share prices, while any positive news will likely be met with a continued apathetic response, leading to not much (if any) upside in share prices.

As such, in the current landscape for silver, speculators looking for exposure but who prefer more portfolio diversification to protect from individual company catastrophes may be interested at this time to turn their attention to ETF products, such as SILJ.

SILJ is comprised of 30 total holdings, including leading silver producer names such as PAAS, AG, CDE, SVM, and also junior silver developers such as MAG, BCEKF, SVCMF, AXU.

By no means is SILJ the perfect silver ETF, since it does contain some questionable holdings (such as shares of AUY and SGSVF) which may be argued provide more direct exposure to gold than silver, and the expense ratio of 0.69% is not cheap. Ultimately, for speculators who want more control over the selection process of their holdings, building a personalized handcrafted ETF may still be the preferred route to go.

Nevertheless, SILJ provides a "one stop shop" alternative option for silver bulls and as demonstrated during the speculator melt up experienced by silver stocks in 2016, should market sentiment flip from bearish back to bullish, even shares of a diversified ETF product can still stand to produce some impressive leveraged returns (SILJ was up 330.6% from January 1, 2016 to August 1, 2016).

In the depths of a bear market, though, such as the current one that has taken hold of the silver sector, it may be prudent to shift one's strategy of seeking maximum outperformance to one where diversification (i.e. defense) is the name of the game; in that regard, owning shares of SILJ may be what the doctor ordered.

Disclosure: I am/we are long SILJ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow FI Fighter and get email alerts