Silver - 'Poor Person's Gold' Is At A Level That Offers Incredible Value

Gold blasts off to the upside.

Silver rallies, but lags.

The ratio is almost at the all-time high.

Volatility remains low in the silver market.

USLV could go parabolic.

Gold made a move; now, it should be silver's turn. The silver market can be an enigma wrapped in a riddle. While many market participants are suspicious of the price action in the silver market, I always assume that the current market price of any asset is always the correct price because it is where buyers and sellers meet in the marketplace. That view has kept me sane and disciplined over the years. Manipulation occurs in all markets at times, and silver is no exception. Some of the allegations when it comes to silver can divert attention from what I believe is most important, and that is the next move that will result in a profitable trade or investment.

A long time ago, when I was first getting my feet wet in the precious metals market in the early 1980s, a boss told me what I thought was nothing more than common sense at the time. He said that markets move higher when there is more buying than selling and lower when selling overwhelms buying. Remembering that over the years has saved me more than a few bucks in the silver market. Silver moves on market sentiment, and right now, it is sentiment that drove the price of gold to the highest level in more than half a decade. Silver is gold's little brother as they are both precious metals and have thousands of years of history as hard assets or real money. I have far more faith in gold and silver than any of the currencies that governments print and control. I believe it is just a matter of time before we get a dose of shock and awe in the silver market that will take the price of the metal appreciably higher than its current level at the $15.15 level on June 27.

For those like me that believe silver is a bullish rocket ship that is sitting on a launchpad, the VelocityShares 3X Long Silver ETN product (USLV) magnifies the price action in the silver market on the upside and offers an attractive risk-reward profile in the current environment.

Gold blasts off to the upside

In the aftermath of the June meeting of the Federal Market Open Committee of the US central bank, the price of gold broke to the upside on the short, medium, and long-term charts as the price surpassed the July 2016 high and moved out of the $331.30 trading range that had defined the high and low since 2013. The prospects for lower interest rates which weigh on the value of the US dollar against other world currencies and a technical move that signals a significant shift in the market's sentiment sent the yellow metal above $1400 per ounce.

Source: CQG

As the monthly chart highlights, the price of the precious metal reached a high at $1433.30 on the continuous contract, and the next level of technical resistance is at the 2012 peak at $1794.80 per ounce.

Gold took off to the upside in the immediate aftermath of the June Federal Reserve meeting and blew through the 2018 and 2016 highs like a hot knife through butter. Gold also rose a bit above the August 2013 high at $1428 per ounce. Silver also rallied, but its ascent was nothing compared to what occurred in the gold market, so far.

Silver rallies, but lags

There was no hot knife in the silver market as the price lumbered to the upside above the $15 per ounce level and a high at $15.555 before pulling back to $15.15. Considering that gold has left the July 2016 post-Brexit peak at $1377.50 in the dust, silver has been snoozing. When gold reached the high in 2016, silver rallied to its peak at $21.095 per ounce, $5.54 per ounce or 35.6% above the most recent peak in the active month silver futures contract on COMEX.

Source: CQG

The weekly silver chart shows that while gold is at multiyear highs, silver has not even broken to a new peak for 2019 which would require the price to rise above the $16.20 per ounce level and break a long string of lower highs.

The silver market is starting to feel a lot like platinum these days, which has lagged the price action in gold since 2014 when it fell to a discount to the yellow metal. Platinum moved to a new modern-day record low against gold at over a $600 discount to the bullish beast over the recent sessions. Meanwhile, silver looks like it is about to suffer the same fate as the silver-gold ratio knocking on the door at a record level.

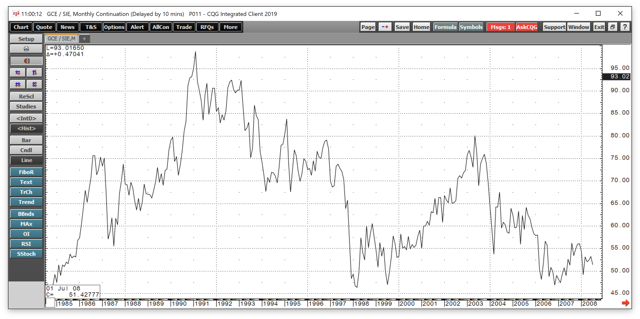

The ratio is almost at the all-time high

The last time that the silver-gold ratio traded to its all-time high was back in February 1991 when it rose to a high at 98.72:1 or 98.72 ounces of silver value in each ounce of gold value. On the quarterly chart, the high was at 93.1849:1 in 1990.

Source: CQG

The monthly chart shows the high at 98.72:1, but on the weekly chart, the level was even higher.

Source: CQG

The weekly chart zeros in on the more exact high which occurred during the week of February 19, 1991, at 101.42248:1. During that week, the high in gold was at $365.60 per ounce, and silver's peak that week was at $3.76 per ounce. The last time the ratio was at such an elevated level, the prices were close to lows; this time, they are significantly higher.

Volatility remains low in the silver market

The price of an option is a function of market volatility. While the chief determinate of an option premium is implied volatility, which is the market's perception of the future level of price variance, historical volatility plays a significant role. Even though gold has broken out to the upside, historical volatility in the silver market remains at low levels.

Source: CQG

As the daily chart shows, daily historical volatility stood at 14.23% on June 27, which is a lot closer to the lows than the highs. The metric on the weekly chart was at 13.50%, while monthly historical volatility was at 14.69%. Even the quarterly metric was at a depressed level at under 13.85%.

Since silver can be a highly volatile metal when it comes to price action, the current level of the metric that measures price variance means that option prices in the silver futures market remain at low levels. It is possible that the break to the upside in the gold market and the historically high level of the silver-gold ratio will eventually lead to a significant and powerful rally in silver. Therefore, since volatility is the critical component when it comes to option premiums, call options on silver futures currently offer a highly attractive risk-reward profile. When you purchase an option, all that is at risk is the premium. A call option in silver offers market participants, who believe the price of metal is going higher, the opportunity to invest a little to make a lot. The call option provides the opportunity to participate in a rally on a 100% basis with the only risk being the cost of the option.

USLV could go parabolic

If silver is going to move higher and follow the price of gold, eventually, there is lots of room on the upside considering that the July 2016 peak in the silver futures market was at $21.095 and the price of July silver only traded to a high at $15.555 on June 21. Gold traded to a peak at $1442.90 on June 25, and its July 2016 peak was at $1377.50 per ounce. If silver is going higher over the coming days or weeks, the VelocityShares 3X Long Silver ETN product could become explosive. The fund summary for USLV states:

The investment seeks to replicate, net of expenses, three times the S&P GSCI Silver index ER. The index comprises futures contracts on a single commodity. The fluctuations in the values of it are intended generally to correlate with changes in the price of silver in global markets.

The price of silver rose from $14.63 on June 11 to a high at $15.555 on June 21 on the July COMEX silver futures contract, a rise of 6.32%.

Source: CQG

Over the same period, USLV rose from a low at $58.69 to a high at $68.91 or 17.4%. USLV has net assets of $216.36 million and trades an average of 215,573 shares each day. USLV charges an expense ratio of 1.65%. The triple-leverage in USLV comes at a price, which is time decay. Like an option, the value of the ETN product will deteriorate over time if the price of silver moved lower or remains in a narrow range.

USLV or call options on the price of silver are instruments that could provide explosive percentage returns if the price of silver decides to play catch-up with gold. I am bullish on the silver market and believe that a significant recovery will come sooner, rather than later. Compared to gold, silver offers incredible value at its current price level.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls, directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.The author is long silver

Follow Andrew Hecht and get email alerts