Silver: A Conceivable Dead-Cat-Bounce on the Cards / Commodities / Gold & Silver 2020

Silver is not just any industrial metal. Used as money for centuries, much longerthan the fiatcurrencies have been used, with its specific properties that arealso widely used in many industries (best conductor of heat and electricity),with crude oil, it is perhaps one of the most versatile commodities.

As far as the white metal is concerned,on September24 th , we have warned you about the possible temporaryrebound.

Silver is after a major breakdown, and itjust moved slightly below the recent intraday lows, which could serve asshort-term support. This support is not significant enough to trigger anysignificant rally, but it could be enough to trigger a dead-cat bounce,especially if gold does the same thing.

That’s exactly what happened.

So, is the counter-trend rally over?That’s entirely possible, particularly if we consider the USDX breakouts.However, given the possibility of higher stock market moves, silver could movesomewhat higher before it slides once again.

In early March, silver moved higherbefore indeed plunging, so the current move up doesn’t invalidate thissimilarity, especially that the coronavirus cases are rising in a quite similar way (this similarity is most visible inEurope).

Technically, silver moved as high as itdid on July 28th, on an intraday basis. The corrective rally is not as littleas one might think while focusing on just Friday's upswing. But that is not thecritical thing here. The key thing is that the breakdown below the risingsupport line was more than confirmed.

At this point, one might ask how do weknow if that really is just a dead-cat bounce, and not a beginning of a newstrong upleg in the precious metals sector. The reply would be that whilenobody can say anything for sure in any market, the dead-cat-bounce scenario isvery likely because of multiple factors, and the clearest of them are theconfirmed breakdowns in gold and silver, and – most importantly – the confirmedbreakout in the USD Index.

Now, since silver has already broken below its rising short-term support line , the corrective upswing might already be over.

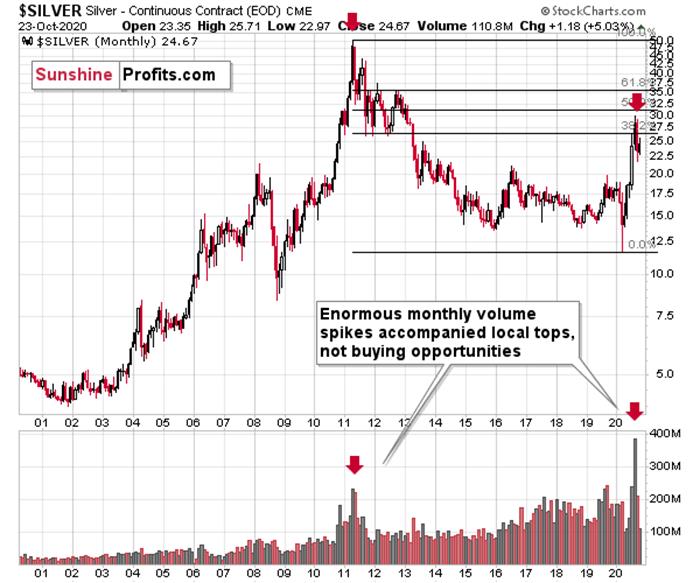

Moreover, please note that from thelong-term point of view, silver is not that strong.

While gold moved to new highs, silver –despite its powerful short-term upswing – didn’t manage to correct more thanhalf of its 2011 – 2020 decline.

Silver has already invalidated its moveabove the lowest of the classic Fibonacci retracement levels (38.2%), which isnot something that characterizes extraordinarily strong markets.

Silver is likely to move well above its2011 highs, but it’s unlikely to do it without another sizable downswing first.

If you look at the monthly silver volumelevels, it seems likely that the next sizable downswing has already begun. Theprevious substantial monthly volume in silver accompanied the 2011 top. The analogy doesn’t get more bearish thanthis. Ok, it would, if there were multiple key tops confirmed by huge monthlyvolume. But the 2011 top was so significant that other tops are not comparable,except for the most recent one. Thus, the implications are bearish.

Thank you for reading our free analysistoday. Please note that the following is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the downsidetarget for gold that could be reached in the next few weeks.

If you’d like to read those premiumdetails, we have good news for you. As soon as you sign up for our free goldnewsletter, you’ll get a free 7-day no-obligation trial access to our premiumGold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.