Silver and Gold: Balancing More Than 100 Years Of Debt Abuse / Commodities / Gold & Silver 2020

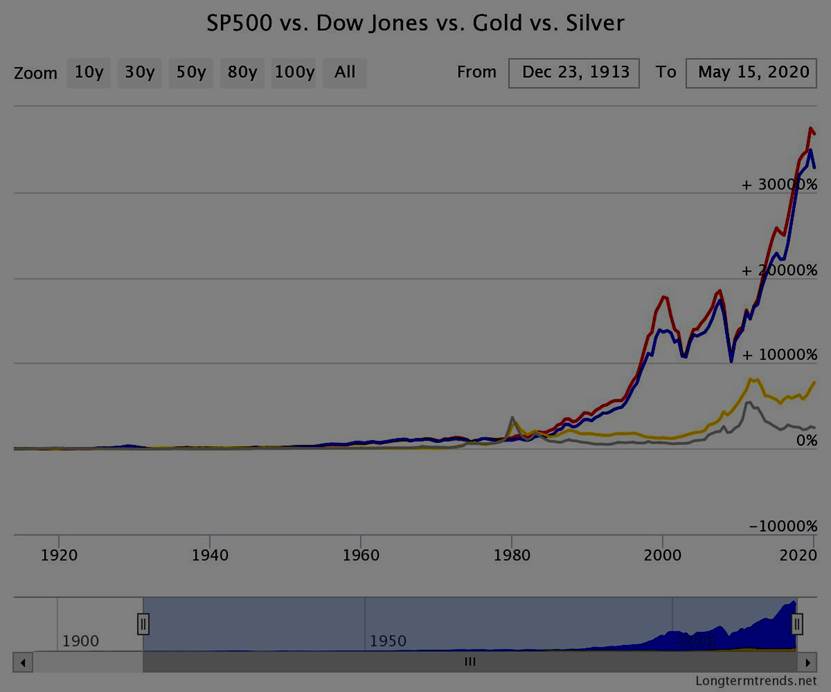

Since the creation of the Federal Reserve in1913, the stock market has outperformed Gold and Silver significantly. Here isa great chart (from longtermtrends.net) that proves this:

The S&P 500 is in red, the Dow in blueand Gold and Silver in their native colours. The outperformance is huge.Through the debt-based monetary system, the Fed facilitates the extension ofcredit which disproportionately benefits assets like general stocks and bonds.

During each credit cycle, Silver and Goldprices mostly loses relative value to assets like general stocks andcommodities. In other words, inflating the currency supply (inflation) does notbenefit Gold and Silver relative to most other significant assets like stocks(the chart above is really the proof of this).

It is only after a certain point in thatinflating credit cycle that Gold and Silver are able to catch up. That isnormally after significant stock market peaks. This was the case after the 1929Dow peak, the 1966 and the 2007 Dow peak.

Those stock market declines (from all-timehighs) are often the trigger for the deflation of debt (which is the other sideof the “balance sheet” for the those inflated assets that are now declining).

Debt is virtually the opposite of Gold andSilver. When debt is deflated, it provides the fuel for Gold and Silver to risesignificantly in order to catch up. It is really the balancing of amathematical formula; the balancing of debt-based monetary system abuse. We arestill early in this “catch up”, and Silver and Gold is really still at a bottomwhen it comes to debt.

How can we know this? Just look at debtlevels; it is at or near all-time highs. When debt (bonds) is priced high, thenSilver and Gold is low. Or put another way, when interest rates are low (thatmeans debts or bonds are high) then Gold and Silver is low.

In terms of interest rates (or debt) Silverand Gold are at real lows. Here is a Silver chart that proves this:

It features the Silver price multiplied bythe interest rate on the 10-year US Treasury. It has just recently hit a newlow, even lower than the 1971 low. It is still a long way before Silver is atrelatively high prices, and debts at lows (or interest rates at highs), whichmeans this chart will then likely be at all-time highs.

If the February 2020 Dow top is the peak,then we are likely in another catch up phase. Catching up to more than a100-years of credit abuse that has kept Silver and Gold prices artificiallylow.

For Silver, it makes the completion of thesepatterns imminent:

For more on this, andsimilar analysis you are welcome to subscribe to my premium service. Ihave also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert

“And it shall come to pass, that whosoevershall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2020 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.