Silver and Mining Stocks Fresh New 2018 Lows / Commodities / Gold and Silver 2018

Silverwas just breaking to new highs, gold stocks (HUI) were above the 205 level andgold was at levels not seen since August 2016. Gold and silver bulls werecheering. They are not cheering anymore. Even though the above was the casejust several days ago, it was all invalidated, just like we expected it to be.Based on what happened on Friday, silver and mining stocks are at their new2018 lows and their entire 2018 performance is a one huge bearish reversal.Where will precious metals in the following weeks?

Silverwas just breaking to new highs, gold stocks (HUI) were above the 205 level andgold was at levels not seen since August 2016. Gold and silver bulls werecheering. They are not cheering anymore. Even though the above was the casejust several days ago, it was all invalidated, just like we expected it to be.Based on what happened on Friday, silver and mining stocks are at their new2018 lows and their entire 2018 performance is a one huge bearish reversal.Where will precious metals in the following weeks?

Lower.Likely much lower.

Why?Let’s see, starting with the short-term charts (charts courtesy of http://stockcharts.com).

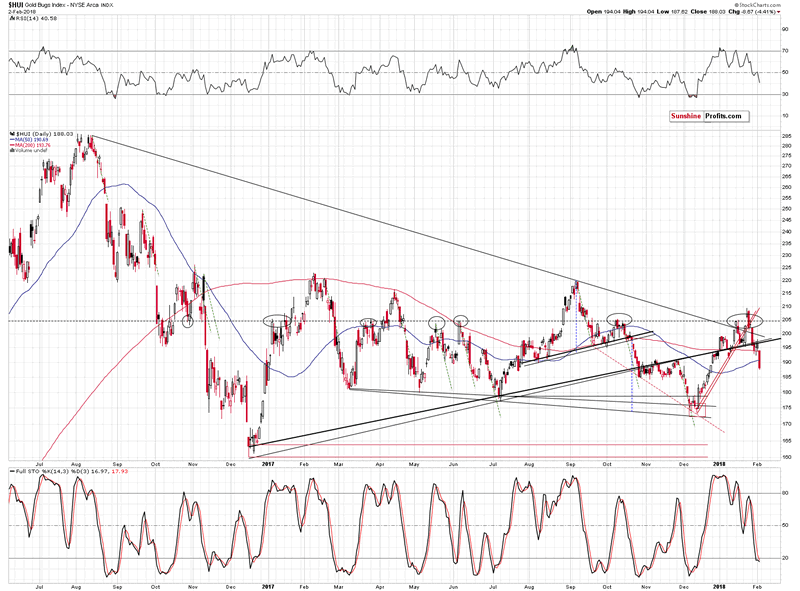

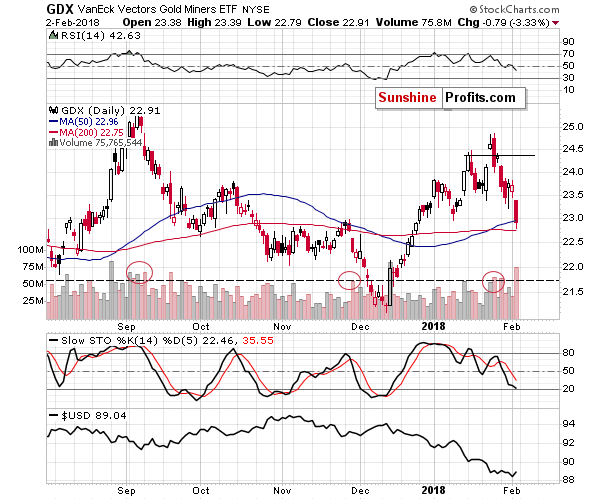

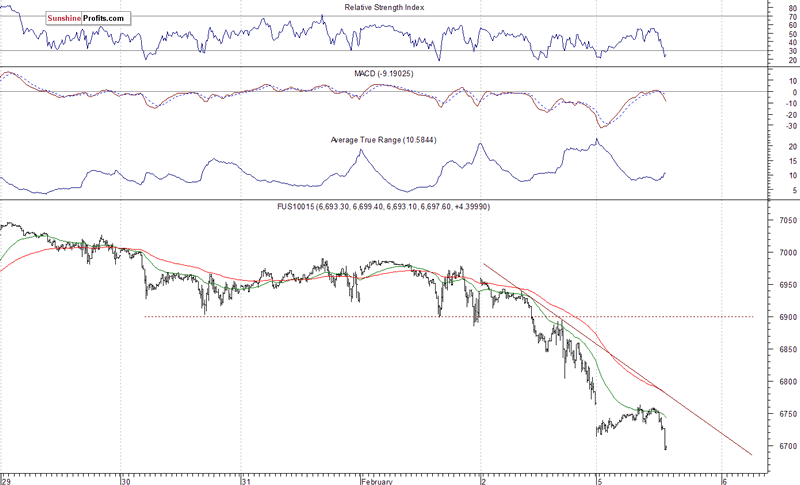

Inour previousanalyses we emphasized that the small 2-day consolidation didn’t change anything becausegold miners have recently broken below all important nearby support levels thatcould be broken and none of these breakdowns was invalidated:

The mid-January high.The early January high.The late January low.The 205 level (invalidating the breakout).The declining, medium-term resistance line (invalidating the breakout).The rising, medium-term resistance / support line.The rising short-term (red) resistance / support line.Consequently,the bearish implications remained in place and during Friday’s session, we sawtheir result. Gold stocks took a dive and closed at levels not seen sinceDecember 22, 2017. The HUI Index also closebelow the 50-day and 200-day moving averages. Both MAs served as importantsupport and resistance lines (especially the latter), so this move issignificant.

Thevery high reading of volume during the declineseems to confirm that this is really the direction in which the market wants togo.

The gold stocks to gold ratio isindicating the same thing. The miners underperformed gold to a great extent andare on the verge of breaking below the 2017 lows. They are already below the2016 lows at this moment, which is yet another bearish sign.

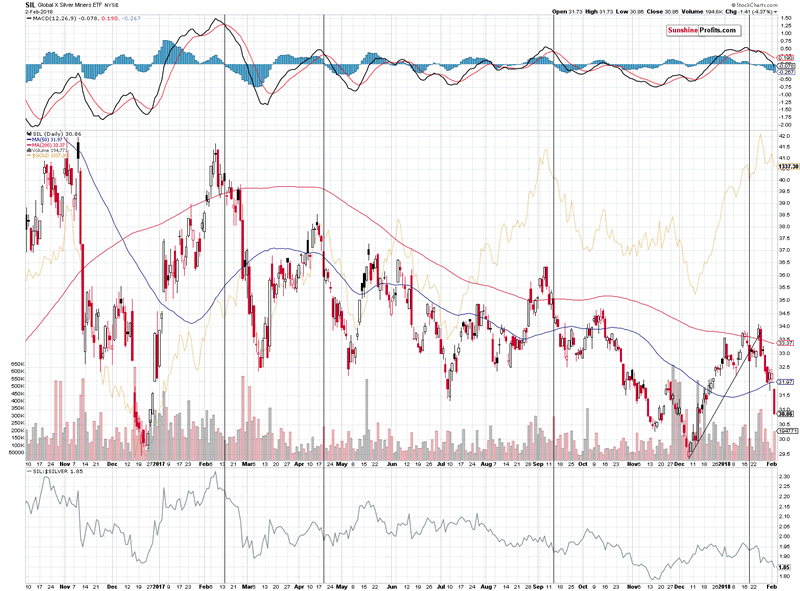

Meanwhile,since we posted our bearishcomments on the above chart, silverstocks declined sharply and moved quite close to the late 2016 and 2017 lows. If thismomentum continues for a few more days, we’ll see another major breakdown thatwill open the door to even bigger – and more volatile – declines.

Overall,the outlook for the mining stocks is bearish for the short and medium term.Having discussed the above, let’s check the situation in the white metal.

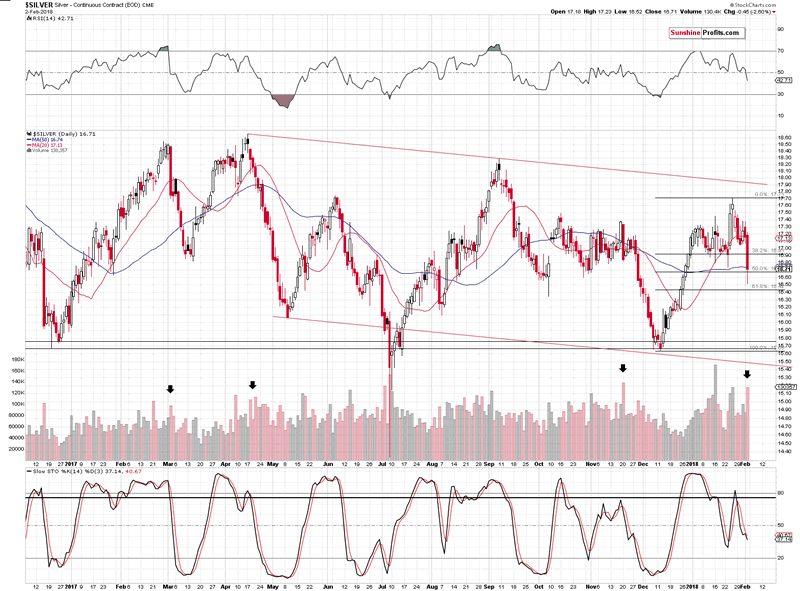

Silverdeclined profoundly during Friday’s trading on huge volume. This serves as agood indication that the main part of the decline is beginning. We markedsimilar situations (with regard to volume) with black arrows. The previouscases were followed by additional $1-$2 declines, so the analogy to them isdefinitely bearish.

Thevolume analogy is particularly bearish not only because of the above, but alsobecause of what preceded it: epicvolume that was as big as the one seen in April 2013.

Silvermoved higher in today’s pre-market trading, but it remains well below the $17level and below the previous low of this year in terms of the closing prices,so the bearish outlook remains in place.

Tobe clear, we don’t think that silver is going to decline by only $1-$2, but bymuch more, but a decline of this magnitude will be a good start.

Infact, we expect silver to move lower very substantially before bottoming. Thewhite metal’s decline should scare precious metals investors away from themarket and the investors’ sentiment should be extremely unfavorable before thehuge bull market in silver can resume. That’s the factor that was missing inlate 2015 – people were not scared or very bearish – as they should have beenat a key bottom. Consequently, it doesn’t seem that late 2015 was indeed thefinal bottom.

Ifthe 2015 bottom was not the final one, then silver is going below it. Let’scheck how much below the $14 level the silver price could go.

Inorder to do this, we’ll apply two techniques that we’re using in the case ofother charts and we’ll remind you about something that we discovered a longtime ago, but that remains to be very up-to-date also today. We get the feelingthat you are most interested in the latter, so let’s start with it.

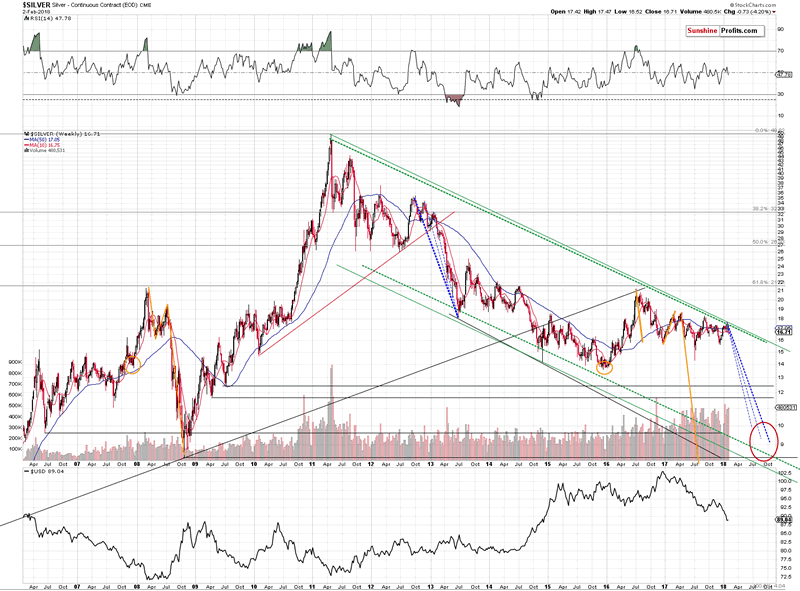

Pleasenote the orange ellipses and lines on the above chart. You can see them in late2007, in 2008, 2015, 2016 and 2017. You see, starting from the bottoms markedwith orange ellipses, the price moves that are marked with the lines arepractically identical – at least so far. The price moves are not identical onlyin the case of their range. The starting and ending points are extremelysimilar as well.

Inboth cases, silver bottomed a bit below $14 and quickly soared above $21. Thenit declined to about $16 (in both cases). Then it rallied to about $19 (again,in both cases). Then it moved lower once again and declined very fardramatically before moving above the previous highs. Back in 2008, the declinewas seen quickly. In this case, silver is taking its time. Does this invalidatethe analogy or does it make it any less valid?

No.Back in 2008 silver’s decline got help from a strong rally in the USD and now,silver gets a boost from a huge decline in the USD. A decline that seems to beending, but let’s stay with silver for a while. The important observation isthat silver should have rallied given the decline in the USD from about 100 tobelow 90 over the last year. It didn’t. It’s actually even lower than it wasduring the 2017 top.

Theanalogy to 2008 wasn’t invalidated – it was just significantly delayed. Whenthe circumstances are analogous, and the USD starts a rally, the silver marketis likely to perform just as it did in 2008 or at least similarly. This meansthat we can expect silver to move to $10 or perhaps even temporarily below itbefore the final bottom is reached.

Aswe wrote above, that’s only one technique that points to these levels. Theother two ones are the analogy to the 2013 decline and the lower border of thedeclining trend channel.

Wemarked the former with the declining dashed lines. The boldest of them marksthe most likely analogy – if the top that we are – most likely – currentlyseeing is indeed the start of the final decline, then it is precisely thisanalogy that we should be focusing on.

Thelower border of the trend channel is parallel to the line based on the key topsof the 2011 – today decline. That’s a classic way to create a support line, soit doesn’t seem to require a lot of commentary. Trend channels work in mostmarkets and silver is one of them, so adding this kind of support is useful.

Whatdoes it all leave us with? Silver is likely to slide much lower before thedecline is completely over. In fact, it could go to levels that appear shockingor unbelievable at this time. Before dismissing the above, please note that amove from the current levels to single-digit prices already took place lessthan ten years ago. Why wouldn’t it be possible for history to repeat itself?After all, that’s the thing that it tends to do.

Ona side note, please note that our bearish comments on the precious metalssector doesn’t make us an enemy of gold and silver investors – it makes us atrue (!) friend. If you ask your friends how you look before going to animportant meeting, everyone will tell you that you look great regardless of thetruth as they will prefer not to be the ones that ruin your mood by sayingsomething unpleasant. But, a true friend will tell you how things really are,so that you can fix something before your leave. This may be unpleasant, butultimately, it’s the second approach that benefits you. Most gold promoterswill want you to think that gold is going to go higher no matter what happensand all you should do is buy, buy, buy. And then buy some more. They don’t wantto risk upsetting you. But not us. We’re that true friend that tells you whatthey think and why regardless of the possibility of being unpleasant – so thatyou can benefit more. In this case, if we’re correct about the bearish outlookfor the precious metals, it will be much more profitable to be buying at lowerprices than at the current ones.

So,in our view, the outlook for the precious metals market is friendly bearish.The precious metals market is likely to move much higher in the coming years,but if we’re correct about the medium-term decline first, then the best buyingopportunity is still ahead of us.

If you enjoyed the above analysis and would like toreceive free follow-ups, we encourage you to sign up for our gold newsletter –it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. Ifyou sign up today, you’ll also get 7 days of free access to our premium dailyGold & Silver Trading Alerts. Signup now.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.