Silver As Strategic Metal: Why Its Price Will Soar / Commodities / Gold and Silver 2018

The arguments in favor of silver as aninvestment asset are growing rapidly. In the opinion of the Jackass, silver isthe most under-valued hard asset in existence, with the highest potential forprice appreciation on the globe. To begin with, central banks own no silver,but do own huge tracts of gold. Industry has huge demand for silver, but atrifling amount for gold demand. The investment demand is another key factor infavor of silver, but also for gold. Ever since the tech telecom bust in 2000,the precious metals growth curve has been evident. Ever since the subprime bonddisaster in 2007, followed by the Lehman strangulation in 2008, the preciousmetals growth curve has continued. It is suppressed like holding back a team ofsix stagecoach Clydesdale horses by simple leather straps held by mere men withcomputers on their backs. Ever since the QE inflation policy of monetizing theUSGovt debt, the monetary role of Gold & Silver has never been more acutein modern history. But silver offers much more.

The arguments in favor of silver as aninvestment asset are growing rapidly. In the opinion of the Jackass, silver isthe most under-valued hard asset in existence, with the highest potential forprice appreciation on the globe. To begin with, central banks own no silver,but do own huge tracts of gold. Industry has huge demand for silver, but atrifling amount for gold demand. The investment demand is another key factor infavor of silver, but also for gold. Ever since the tech telecom bust in 2000,the precious metals growth curve has been evident. Ever since the subprime bonddisaster in 2007, followed by the Lehman strangulation in 2008, the preciousmetals growth curve has continued. It is suppressed like holding back a team ofsix stagecoach Clydesdale horses by simple leather straps held by mere men withcomputers on their backs. Ever since the QE inflation policy of monetizing theUSGovt debt, the monetary role of Gold & Silver has never been more acutein modern history. But silver offers much more.

MONETARYABUSE

Since 2012 with the African style monetarypolicy, also shared at times by South American nations, the US Federal Reservehas been forced to succumb to hyper monetary inflation of the unsterilizedvariety. It is the most dangerous form of monetary policy to adopt, a sign ofutter desperation. With the desperation has come astonishing price capping ofthe precious metals market, while at the same time reliance upon isolated warsto steal central bank gold at vaults of defenseless nations. The effect uponeconomies, hardly ever spoken of by the devoted lapdog financial press, repletewith their drone message of a fake sluggish recovery, is for profound capitaldestruction after seven full years of liquidity spew. The economic stimuluswill find even more monetary abuse from greater deficit spending, thus moremotive to own precious metals. To be sure, the QE bond purchase initiative is keptwithin the financial sector for service to the banker masters who have capturedthe USGovt. This is self-dealing on its face. However, hyper monetary inflationalways causes capital ruin in an assured sequence, which cannot be averted,even by Fascist Business Model dictums and propaganda.

The response to monetary abuse has alwaysbeen a return to honest money and viable sound monetary systems. This time willbe no different, in its return to Gold & Silver as foundation, except thatthe movement will come from the East, led by a global insurrection. The Westcan join the strong sturdy secure movement, or be left behind. Even Englandrecognizes the shift in global winds, eager to build the RMB Trading Hub inLondon. The Chinese are leading the global reform movement, and are likely toencourage the growth of the German RMB Hub in Frankfurt. The Germans havesignificantly more trade with Russia & China than the fascist core inLondon Centre, offering excellent leading edge product lines and world classengineering which the British cannot ever match.

BROKENMETERS

If QE were indeed stimulus, then theUSEconomy would have responded after a couple years of the wretched cursedpolicy at work. It serves Wall Street and the banking sector, and nothing else.The capital ruin and damage are evident in the constant negative GDP (withproper inflation adjustment), the high jobless rate, and the hopelessly riggedfinancial markets. The USFed has no business propping up the stock market orthe corporate bond market, nor the crude oil market. But they have seen fit toconsider stocks and crude oil as critical assets, and thus in need of support(to be read as price rigs). The effect of seven years of QE has been a bloatedbalance sheet at the USFed with $4.5 trillion in toxic assets. The leadingtoxic asset is the pristine AAA subprime USTreasury Bond. In the last week,China has just downgraded the USGovt debt to a B type grade, which meansnon-investment grade. In order to keep it all in check, all under control, theUSFed must resort to coordinated efforts. They use QE to purchase bonds thatare being dumped for foreign creditors. They also use Interest Rate Swapcontracts to fabricate fake bond demand, with the levers held at the ExchangeStabilization Fund operated by the dutiful corrupted USDept Treasury. TheESFund is multi-$trillion machinery.

If the entire QE process were stimulus, thenthe resulting Money Velocity would not be in such dire condition. It was indecline until the Lehman subprime events in 2008, and it continues in declinesince QE was put into force in 2012. Perhaps it creates stimulus to the bondmarket, but nothing but a gigantic wet blanket on Main Street and the tangibleUSEconomy.

No single graph demonstrates the failure ofmonetary policy more than this Money Velocity horrendous decline. That is whyit never appears in the Wall Street Journal or New York Times, but the GoldenJackass site shows it periodically as a measure of failure. When the toxic vatof the USFed balance sheet reverses, along with those of other central banks,the flow will be from sovereign bonds (like the USTBond) into gold bullion. Thetrend will be to replace the global banking reserves with hard assets like goldbullion. Both Gold & Silver will become monetary metals. However, a whiffof something very new and refreshing is in the wind. Silver might insteadbecome a core strategic asset for the energy sector, thus binding with themonetary role of Gold. The Paradigm Shift is to have an energy angle, andsilver is at its core. Note the parallel from the Petro-Dollar, where theUSDollar was intricately linked to the energy sector.

FRACTURESAND REBELLION

Ten years of tremendous monetary expansionshould have been accompanied by ten years of gold price appreciation to keeppace. Instead profound price suppression has been enforced. It is breaking downwith the bust of the Petro-Dollar, and the dismantled derivative structuresthat have held the USDollar, the USTBond, and crude oil together. Both Japanand China have halted USTBond purchases. Now Germany is shedding USTBonds infavor of RMB-based sovereign bonds. They talk little of adding gold bullion, sincesuch news cannot be cited in the Western press by fascist fiat rules. Suchmight be deemed financial terrorism by the Washington fascists. The straw dogargument should always be noted, then dismissed as absurd. Critics claim thatthere is inadequate Gold & Silver supply to match the rising money supply,the monetary aggregate. They claim the money growth was necessary and urgent inorder to manage the global financial crisis that they created in 2007 and 2008.Hokum! There is plenty of Gold & Silver to cover the huge amount of moneygrowth in the last several years, provided the precious metals prices aremultiples higher. It is coming like day follows night, as the banker cabalcannot hold back the coiled spring.

The rise of the non-USD platforms is very powerful and gaining enormousmomentum. While the United States is busy igniting wars like in Ukraine, Syria,Djibouti, Yemen, with furtive efforts to engage armed conflict in more nations likeIran, North Korea, and the South China Sea, the Eastern Hemisphere has gone onstrike with respect to the King Dollar Court and its not so hidden war ofterror in the currency defense. The lost global currency reserve is near, themovement having gained momentum in the last two years. It seems the easternresponse to the Ukraine War plus the Iran squabbles, has been to build non-USDplatforms and to construct workarounds for the feeble sanctions. See theJackass article from December on the topic, entitled “The Integrated Non-DollarPlatforms” (HERE).Clearly the United States is using war to defend the USDollar, a developmentwhich will not stand and cannot continue. When the Jackass made the war defenseforecast back in 2005, it was considered foolish and silly. Not anymore! Therebellion from the East will be coordinated, broadbased, and severe in itseffect. The paper mache armor constructed by the fascist tagteam of the USFedand USDept Treasury cannot stop a bullet, cannot avoid fire, and cannot servein the financial war. The rise of non-USD platforms is the battle cry wagedagainst the King Dollar, whose financial war takes place in the global seas offalse liquidity poured out by the banker cabal and subservient central bankfranchise system.

With a weak economy, gaping $trilliondeficits, rigged financial markets, permitted sovereign bond fraud, dependenceupon QE inflation, rejected global trade unions, the Eastern resistance isclear. Furthermore, the Belt & Road Initiative, combined with numerousnon-USD platforms, signals the united rebellion. The global system will endurefractures with the broader trade payments done outside the USDollar, the riseof the RMB-Oil-Gold contracts in Shanghai, and the upcoming China-Saudi oilpurchases in RMB terms. Next on tap is the introduction of the Gold Trade Note,expected to be built atop the Shanghai integrated contracts. The RMB TradingHubs will also feature Panda Bonds, where foreign entities like the ItalianGovt can issue bonds to finance deficits in RMB terms, thus attracting Chineseinvestment with no currency risk.

Two extremely important developments havecaptured global attention in the last couple weeks. US allies are buying crudeoil in Euro terms, which should enrage Washington. The effect is to bring abouta USD index decline and rise of the Euro. It is almost comical, since theEuropean Economy generally is not chugging along with any gusto whatsoever,outside the German border. But the effect is on financial markets, not the economy.The EU will suffer on its export trade, just like in 2009 before the EuroCentral Bank caved in to reduce interest rates (a correct Jackass forecast).The second important development is more psychological in its financialwarfare. The exposure of gold vaults by Russia and China serves as a challengeto the Untied Socialist States to match the challenge. The USGovt gold reservesare vacant, as Fort Knox serves as a nerve gas warehouse with a couple barrelsof old gold coins in the dusty corner. To be sure, the Gold Standard is comingfrom the Eastern corridor. The Global Paradigm Shift is well along in the greattransition. The Gold Trade Note will supplant the USTreasury Bill in tradepayment. The CIPS bank transaction system will work around the abused SWIFTsystem. The vast multi-$trillion cornucopia of Eastern infra-structure projectslinked to the Belt & Road Initiative will continue unabated, uninterrupted,and unrivaled in human history.

The globalrebellion will take place in the form of trade payment done outside theUSDollar, and sharp reductions in USTreasury Bonds held in banking systems. When the USDollar loses the bulkof its global currency reserve status, its privileges and deep advantages willfall away. The people will not recognize the lost reserve factor, but they willsurely notice the powerful profound pervasive effects. They will come in theform of price inflation entering the room from the imported channels. They willcome in the form of supply shortage from rejection of USTBills in trade paymentat port facilities. They will come in the form of social disorder as a resultof inflation and shortage. The public response will be a vast torrent topurchase silver in protection, which could become a matter of survival. Themore wealthy will prefer to protect their fortunes with gold. In times of greatcrisis, expect silver to be used to purchase the standard items like food,fuel, and rent. Expect gold to be used to purchase cars, homes, and businesses.The coming crisis from the lost USDollar reserve status is inevitable. Itdemands preparation. It will mark an important turning point in US history.

PEPTALK ON PRECIOUS METALS

For thoselosing faith from multiple years of suppressed Gold & Silver prices, takeheart. The Voice responded to a sequence of probing Jackass questions with afirm statement founded in hope, confidence, pointing to a new dawn in financialstructures. It is next to impossible to explain to people how things are goingto unfold if they do not understand the concept of mal-investment and thedifference between currency and money. The ZIRP exhibits the distortions infaulty investments from zero percent money, while QE exhibits the distortionsin pure bold rabid inflation. Precious metals are unique, serving as the onlytrue store of value, standard of value and measure of value, besides being amedium of exchange. If one has physical metal stored and understands theinherent control with its direct access at any given moment, it has been andremains the safest way to protect wealth from the current powerful debasement. Whilepeople rush into crypto-currencies, they need to realize that crypto-currenciesare not crypto-money yet. Once hard asset backed crypto-money is issued, itwill be backed by primarily precious metals, structured on the blockchaintechnology. Crypto-money will wipe the floor with crypto-currencies and$billions will be lost in the process.

The Voice gaveemphasis as follows. “Let me tell yousomething that you can take to the bank and the vault. The day is close when you will not be able to get any physical metal,and furthermore, its price will go into the stratosphere. Blockchain andcrypto-currencies are here to stay. However, crypto-currencies will fall to thewayside, pushed out by crypto-money. There are people who are puttingcrypto-money structures in place that are based on blockchain technology. Theywill make precious metals fungible, along with other valuable commodities. Thismeans a de-facto democratization of money free from government manipulation,but most importantly free from inflationary debasement. This will constitutethe return to sound money. People who do not understand this concept, followingthe herds of whatever hype, will get their clock cleaned bigtime. The Bitcoinadvocates must be careful to secure their exits in converting to spendablemoney. The recent crypto craze is a manifestation of the US$ being debased.What we witness is hyper-inflation. One is forced to spend more and moredollars to acquire the array of alternative currencies.”

The Voiceexpounded on some modern history. His knowledge base is broad and vast, atremendous advantage to the Hat Trick Letter since 2008, for which the Jackassis deeply grateful. “There are some historicallyimportant factors missing in the typical discussions on recent monetaryhistory. The Petro-Dollar issue is certainly important, but it is not theprimary issue of concern in the grand geopolitical picture. The realcentral issue is primarily about the total failure of US foreign policy overmany decades, to be precise ever since 1918. It a very complex issue tocomprehend and to explain since it requires deep and solid knowledge whatreally went on during the days when European monarchies collapsed and verydifferent nation states emerged. This all occurred around 100 years ago, andmost Americans know extremely little about such complex internal dynamicswithin Europe. The big political tipping point was the fudged up outcome andend of WWI, hatched in Versailles. Now the chickens come home to roost and itwill not be pretty. Washington and London are driven by a perception distortedview and false assessment of global matters and key factors. Their erroneousviewpoints on global matters is absolutely stunning, and extremely dangerous.We are seeing it all unfold, during the Global Paradigm Shift. The disordercould go out of control, with wider war, as the Gold Standard in its many partsand several platforms come into view.”

VIEWPOINT ON FUTURE PATH

The return ofthe Gold Standard comes finally after a generation of monetary abuse, whose climaxis centered upon the hyper monetary inflation conducted by the US FederalReserve. They have been the bubble meister supplier of first order since the1980 decade. StephenLeeb shares his opinion on the future path for gold to exceed $15,000 inthe next decade. Gold is gradually being put at the center of trade payment,first with crude oil, then more widely in general trade. Integration within thebanking systems would follow. China is on the verge of delivering gold withinformal contracts, unlike the cash-trade West. When the $2000 price level isexceeded, made possible by the extremely critical Chinese platforms beingrolled out, the Gold Standard will be better understood. Future gold pricegains will be the norm, taking the price an order of magnitude higher. The Westwill require a big nasty learning curve.

Stephen Leeboffered yet another excellent summary of the gold price prospects, itsstructural linkage to the Chinese development of non-USD platforms, the crudeoil market integration, global trade payment systems, and the new monetarysystem in preparation to replace the current corrupted toxic fraudulentUSD-based system. Leeb describes a newly emerging system which will be capableto integrate the Gold Trade Note for global payments. Bear in mind that the ChineseInterbank Payment System (CIPS) is ready, and will supplant the SWIFT paymentsystem in many Eastern locales. Leeb stated the following excerpt three weeksago.

“Last weekend China ran practice sessions on itsprospective oil benchmark. So far, there are no reports on whether theauthorities were satisfied with how they went. But I have no doubt that Chinawill make the benchmark work and that in the near future the country willinitiate an Eastern oil benchmark tradedin Yuan. If that trading is successful, as it surely will be, China will startto allow oil exporters, including Russia and Saudi Arabia, to export gold fromChina, something that currently is forbidden. That is a necessary step tohaving gold backing for the Yuan used to trade gold. The new Easternbenchmark will quickly become more important than Brent crude or West TexasIntermediate. That is because the East’s economy is both larger and fastergrowing than the West’s. Moreover, oil is a bigger component of the East’s GDPthan the West’s. This will make it natural for trading in Yuan to expand fromoil to other commodities and eventually to all trade in the East.

As this processunfolds, Gold will become a central cog in the trading of the world’s mostvital commodity, then a central cog in all commodity trading, and finally acentral cog in all trade. In the final shape of the new order, I expect that trading will beconducted in a basket of currencies, such as the SDR [IMF’s Special DrawingRights], to which gold has been added as a component. And that is when I wouldlook for the truly explosive gains in gold to begin, although the uptrend islikely to start sooner as investors anticipate these changes and their impacton the metal.

Some quick back-of-the-envelope calculations showGold’s potential. A reasonable estimate is that around 50,000 tonnes of goldare available for monetary purposes. The bulk of gold, about 120,000 tonnes, isheld as jewelry or private investments. At current prices the value ofpotential monetary gold is about $2 trillion. The value of world trade is about$20 trillion (the average of exports and imports). If monetary gold is used toback up trade, that would drive gold up 10-fold. If some countries chose to usegold internally, the rise would be substantially more. And as world tradecontinues to grow, gold’s price will keep rising after the initial RESET. Ifyou are betting on gold reaching $15,000 to $20,000 an ounce within the nextdecade, you would get no quarrel from me. I expect the markets will anticipatemuch of the RESET and rally in advance. By the time gold passes its all-timenominal highs of roughly $1900 per ounce, it will be evident the metal isassuming a much more important role in world trade.

There is morereason than ever to believe China is ready to move forward with itslong-planned goal of establishing a new monetary system centered on Gold anddownplaying the USDollar. The point of inflection is at hand. Gold has made a bottom,and as China pursues its Petro/Yuan/Gold plans, Gold will start to fly. I wouldgive odds on new highs by 2020 and on five digits before 2030.”

A Hat Trick Letter client,preferring to remain anonymous in today’s dangerous world where whistleblowerefforts to expose corrupt leadership are labeled as espionage, offered thefollowing excellent perspective. Goldman put out a gold positive articlerecently, but they are missing a very important point. In debate, is the realprice of gold today, with all manipulative pressures from central banks andspeculators aside. Goldman does not address the fact that the global goldmarket, including the LBMA, where over 95% of the trading is in unallocatedpaper gold. It constitutes a fractional reserve system, in which the ratio ofpaper claims to actual physical bullion was estimated by the Reserve Bank ofIndia at 92 to 1. Such a ratio of paper gold to physical bullion means thereis 92 times as many paper contracts outstanding as there is physical gold tocover them. If such manipulative speculation were eliminated, and thesespeculators forced to cover, the gold price would be free shoot upwards of 92times in value. That would make gold close to $120,000 per ounce today! Just athought. Continue on the base end. The USD-based money supply has risen 5-foldsince 2009, given the major central bank monetary expansion without restraint.Use the gold price at that time for the calculation. Therefore napkin mathmeans $1300 x 5 = $6500 per oz gold. Just a rough very conservative baseline.Establish the center by considering a roughly $60 trillion total USGovt debtliability, perhaps 30 times the current money stock. That would indicate a$30,000 gold price. Much higher gold prices are coming, along with silver. Somany critical energy applications will rely upon silver, that it might be takenoff the market for strategic purposes. Its price could be set well over $200per oz.

U.S. LOST CONTROL OF SILVERMARKET

The UnitedStates is fast losing control of the silver market, from a productionstandpoint. The US is a minor silver producer, yielding to Mexico. The US hasyet another example of the paper tail wagging the dog, but where the US is nolonger a major player in the silver global output. Control is shiftingelsewhere, to its producers, and to precious metal advocates. A little morethan a century ago, the United States was the largest silver producer in theworld. In 1915, the US produced 75 million oz (Moz) of silver out of the total189 Moz mined in the world that year. The US had produced 40% of all worldsilver production, a giant in the sector. Mexico came in second that year byproducing 39.3 Moz. In the last century, the US output in silver has been cutin half. The US silver production in 2017 will only be 34 Moz versus theestimated 870 Moz globally. The leading silver producing nation is Mexico,whose annual output has moved from 165 Moz three years ago to an expected 200Moz by year 2020. Thus, US silver production only accounts for 4% of world minesupply versus 40% back in 1915. The US cannot control the price against worldmarket pressures.

Lastly, theUnited States imports approximately 22% of world silver mine production eachyear, a total of 193 Moz of the total 870 Moz in 2017. While domestic minesupply is only 34 Moz, the United States has to import more than a fifth ofglobal mine production to meet its silver market demand. Again, the US cannotcontrol the silver price against world market pressures. See the SRS Rocco researchsite for an abundance of his excellent analysis (HERE). His work isregularly featured on the Hat Trick Letter. His most recent work is on theEastern accumulation of precious metals, while the United States flows into thestock and crypto markets, like deceived sheep. The solution to the unresolvedfinancial crisis is hard assets, not yet more fiat substitutes. Any competentsilver research should include his work. SRS Rocco has done significantanalytic work on the crude oil and shale sector also, bringing reliance to theEROI concept of energy return on investment. It has recently turned negative,thus unproductive.

THE SCRAP SILVER INDICATOR

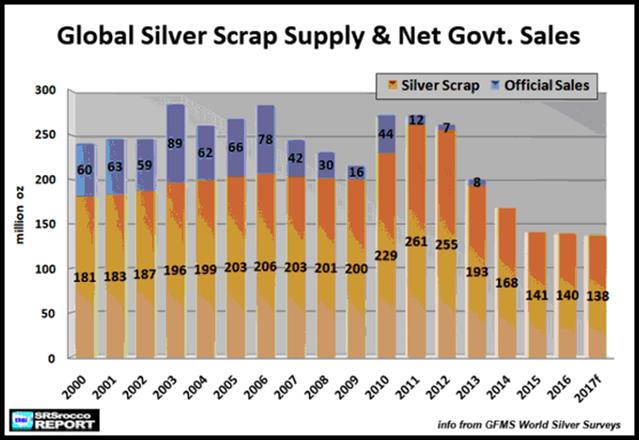

Scrap silverhas vanished, a great indicator at the margin in this highly important market.Industrial demand has been relentless, enduring, and constant. It has drainedthe USGovt silver stockpile, reported to once being six billion ounces silver,acquired by US President Teddy Roosevelt. He had vision, and recognized realmoney and commerce. He built the strategic stockpile for both monetary andmilitary purposes. He acquired and had built the Panama Canal. Today’spresidents are fully committed to predatory wars, fascist political structures,narcotics trafficking, currency pegs, banker privilege, and bond fraud. Whenthe United States and other countries stopped producing official silver coinage,it was not due to any monetary conspiracy. Rather it was based on astraightforward problem framed in terms of Supply vs Demand. Because industrial silver consumption hadskyrocketed after World War II, the silver market would have suffered deficitsif the USTreasury did not sell silver into the market. A silver shortage wasacutely evident, which made clear its strategic importance. In response,governments started to reduce, then to eliminate silver from their coinage inthe 1960’s. Much of this silver, known as junk silver, was either purchased byinvestors or re-melted and sold back as supply into the market as bars. Themajority of it was recycled for much-needed supply, while junk silver supplies havebeen fast vanishing. One can easily see the dwindling down of government stocksand older official silver coinage in the following chart. The margin of thesilver supply is disappearing, thus creating an exacerbated silver shortage. TheJackass prefers to reverse the Rocco color scheme in his excellent chart.Notice the absent blue bar component since 2013, from no more official silversales. The USGovt is heralding a severe silver shortage.

In 2007, totalOfficial Silver Coin sales only totaled 45 million ounces (Moz), but thisnumber surged to 135 Moz in 2015. From 2007 to 2017f (f = forecast), OfficialSilver Coin sales totaled 1045 Moz (over 1 billion oz). If the official coinssold since 2000 were included, the grand total would be nearly 1.3 billion oz. Thekey fact to take away concerning the 1.3 billion oz of Official Silver Coinsales is that this investor inventory will likely never be recycled as scrap tosupply the market. Furthermore, the majority of the 1-oz to 100-oz silver barswill never be recycled as scrap either. While it is true that both officialsilver coins and bars will be sold back into the market, they will berepurchased by other retail investors. Thus,the majority of silver investment inventory is locked out as a future source ofsupply for the global fabrication demand. According to the Metals Focus2015 Report on The Silver Scrap Market, only 3.5% of total scrap supplies in2015 were from recycled coins. Furthermore, the majority of that scrap coinsupply came from older unsold European official silver coins and blanks. Of thetotal supply of silver scrap in 2015, 55% was from recycled industrial scrap,17% from Silverware, 14% from Photography, and 10.5% from Jewelry. The otherimplication is that collector edition coins will rise sharply in value.

What is quiteinteresting is that most silver jewelry is not recycled. The low price ofsilver jewelry does not motivate holders to haul it down to the pawn shop forcash redemption. For example, only 8% of total silver jewelry demand in 2015was recycled. However, industrial silverrecycling amounted to 18% of total industrial silver consumption in 2015. If recycled silver is included from photographic usage, the total amountincreases to 20%. In conclusion, the investor has removed a certain amount ofsilver from the market. A large percentage (95-97%) will likely never berecycled and used as a future supply for global silver fabrication demand. Therefore,any increase in global silver fabrication in the future will be met bystagnating or falling supply as world mine production continues to decreasewhile scrap supply remains subdued. See SRS Rocco article (HERE).He is frequently quoted for his superb work on the Hat Trick Letter reports.

SILVER IS UNIQUE

For well overa century, scientists have strived to find another metal or another compound toreplace silver in many unique applications. It is rare among metals and shortin supply. Silver is mined between 9 and 11 times the volume of gold. Certaincharacteristics include light sensitivity, electrical conductivity, heatconductivity, malleability, contact resistance, and viral resistance. The listis long for its unique applications, like photographic development, electricalcircuits, battery storage, jewelry, cutlery, metal alloys & cements,mirrors, industrial powders, and high-powered explosives. More recent applicationsinclude infection & burn treatments (biocides), lumber anti-insecttreatment, and solar photo-voltaic panels. It seems the rate of new usages faroutpaces the decline in photographic usage, as it yields to digital cameras.However, these cameras contain silver also in their internal circuitry.

Notice in theperiodic table of the elements, the unique and important column of preciousmetals. The lightest metal in the special column is Copper (Cu). Each rowrepresents the heavier elements, noted in a higher atomic number. The nextheavier metal in the special column is Silver (Ag). The heaviest metal in thistruly remarkable column is Gold (Au). All three metals in irreplaceable intheir own right. Nothing is better on a cost-effective basis for electricaldistribution than copper metal. Nothing is better for numerous applicationsthan silver metal. Nothing is better for the timeless fungible, semi-inert,store of value than gold, used as money for thousands of years.

NEXT GENERATION ENERGYSYSTEMS

The stormcentered upon silver is coming. Expect the silver market to undergo vastchanges, whereby the majority of supply will be removed from the market sincetoo valuable. It will before long be considered of strategic importance bynumerous governments. It will be hoarded by nations, kept for energy systems,even weapon systems, and be stored as a national security asset. For instance,the US Cruise missile contains something like 30-31 lbs of silver, required forits guidance system. Stockpiles will be formed with renewed emphasis. Newenergy next generation systems, coupled with data communications networks, willhave silver at their core. They will have silver at the center in almost every display uponrollouts, amidst publicity and national pride for the development. Russia willplay a leading role.

As preface, publicity iswarranted for a new next generation communication line which is likely tosupplant and replace the fiber optic technology which came onto the scene inthe 1980 decade with significant volume. Reports have begun to surface, writtenand otherwise, that silver strands will be capable of passing ten times thebandwidth versus fiber optic. The demand for new global layouts will be in the hightonnage per year. Just as CMOS technology brought about a quantum leap in chipprocessing speeds for computers, the silver strand will bring about a quantumleap in transmission speeds. The hunger for bandwidth will not cease, given the4G demands with streaming.

Nextcomes the revelations and publicity of silver for its unique scientificproperties, within the new energy production systems. Refer to electric fields,its lone isotope, harmonic frequencies, super conductivity, and associatedelectricity production. Gold hasno known isotopes, but silver has one, a lone isotope which makes it extremelyvaluable. Expect next the introduction of implosion technology and single pointenergy output. Field energy through monotonic coating has become highly useful.Electro-harmonic frequencies have been converted to missing electrons, muchlike an osmotic membrane. The result is an electric field that vectors out,thus producing a flow of electrons (electricity). The energy is produced from auniquely formed field. Silver can produce a highly efficient level of superconductivity, not necessarily with accompanied cold temperatures. Silver canproduce similar electric output from its gaseous form. The super conductivityis associated with anti-gravity systems. Expect it to be combined with electricfield-based propulsion systems. Bear in mind that World War II was used to keepsome of this special energy technology protected, where many governments stilltoday keep their science secretive. This trend is changing amidst certainaccords, led by the Russian scientific community. Silver can be applied in agreat many ways, and can be implemented in a broad variety of applications. Thefuture next generation energy systems will have a common ingredient: silver.Please forgive the Jackass in the above explanations. They are being learned onthe go by a person with basic broad scientific knowledge, while my specialty ismathematics, statistics, computing, along with finance and economics, not tomention Victoria Secret.

Dangerous looking TNX yield curve

The Jackass adds a few points, first on the technical chart and then on the pessimistic viewpoint toward the vile banker sector. The above is a severely dangerous looking chart, with a Head & Shoulders reversal pattern evident, and an upward bias in addition. The recent move above 2.60% could continue and push the USTreasury 10-year yield (TNX) above the 3.0% level. That would cause severe problems, and issue loud dire signals. It would pop and pinprick the S&P500 stock index and the Dow Jones Industrial Average. The H&S reversal target is in the neighborhood of 4.0% incredibly, as the great unwind is near, for both stocks and bonds. The fundamentals ride directly beside the dire technicals. The USGovt deficits are rising fast, better described as exploding upwards. The trade gap is rising also to truly dangerous levels. The USGovt stands at risk of shutdown over the debt ceiling issue. Foreign governments are moving away from the USDollar in bank reserves AND in trade payment. The USGovt continues in its sanctions, enforced via SWIFT channels.

Wall Street craves a major pullback to capture big short leveraged positions on the short side, while damaging the US households, as they emit laughter in smoke filled rooms. They are the experts in putting in place leveraged futures short positions for the S&P500. Refer to Robert Rubin in 2000, when he resigned early from his Secretary Treasury post, in order to short the US Stock market. He made $billions, and could not resist the temptation to leave the USGovt post early in order to resume his post at Citigroup trading desks. Much food for thought on USFed actions, combined with hidden ESFund machinations. In no way can they clear up six years of QE with tons of hidden actions, in the biggest QE extravaganza of monetary abuse in modern history. For them to add stocks and crude oil to their list was insane, deadly, and reckless, with huge consequences eventually. The time is like right now!

THE HATTRICK LETTER PROFITS IN THE CURRENT CRISIS.

"As a Golden Jackass subscriber, I greatly enjoylistening to your interviews because it really lends a sense of passion thatlies behind the tremendous body of information and formulation that goes intoyour monthly research. Though I must admit, it scares the hell out of me mostof the time. Still, I will not miss it for the world. I feel that having atruly objective insight from your research, in depth analysis, and accurate forecastsgives me and my family an important life saving advantage. And I mean thatsincerely."

(MichaelS in Ontario)

"I have continued my loyal patronage of yourexcellent commentaries not so much because of my total agreement with yourviewpoints, but because you have proven yourself to be correct so often overthe years. When you are wrong, you have publicly admitted it. You are, Isuppose by nature, an outspoken and irreverent spokesman for TRUTH againstpower, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerlyassimilating any and all free information (articles, interviews, etc) that JimWillie puts out there. Just recently I finally took the plunge and became apaid subscriber. I regret not doing this much sooner, as my expectations wereblown away with the vast amount of sourced information, analysis tied together,and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the onlyclear voice sounding the alarm of the extreme financial crisis facing theWestern nations. He has unique skills of unbiased analysis with synthesis ofinformation from his valuable sources. Since 2007, he has made over 17 correctforecast calls, each at least a year ahead of time. If you read his work orlisten to his interviews, you will see what has been happening, know what toexpect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Yourreports and analysis are historic documents, allowing future generations tohave an accurate account of what and why things went wrong so badly. There isno other written account that strings things along on the timeline, as yourwritings do. I share them with a handful of incredibly influential people whosedecisions are greatly impacted by having the information in the Jackass format.The system is coming apart on such a mega scale that it is difficult to wrapone's head around where all this will end. But then, the universe strives forequilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CBis a statistical analyst in marketing research and retail forecasting. He holdsa PhD in Statistics. His career has stretched over 25 years. He aspires tothrive in the financial editor world, unencumbered by the limitations ofeconomic credentials. Visit his free website to find articles from topflightauthors at www.GoldenJackass.com,which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.