Silver Break Out Confirmed

The silver break out is confirmed, and Ron Struthers of Struthers Resource Stock Report expects a move to $50. He explains why he believes Coeur Mining Inc. (CDE:NYSE) offers good value and shares one biotech stock he believes is currently a sell.

The silver break out is confirmed, and Ron Struthers of Struthers Resource Stock Report expects a move to $50. He explains why he believes Coeur Mining Inc. (CDE:NYSE) offers good value and shares one biotech stock he believes is currently a sell.

Silver is up again today, currently $34.72 up about $0.64.

This confirms yesterdays breakout and if you remember back in April or early May, I highlighted the breakout from a cup and handle formation and that would lead to a major upside move. This is not confirmed and I see $50 as the near term target.

Similar to gold, investor participation is still quite low. Volumes into the silver etf SLF are up some but no where near 2020 volumes. There are all kinds of silver bullion available at the coin dealer I use.

Our silver stocks are not dragging down the average performance of our gold stocks as much now, and I would like to add another one to the list.

Coeur Mining

Shares Outstanding - 399 million

Coeur Mining Inc. (CDE:NYSE) has been a laggard in this bull rally thus far because it is not well understood. Investors seem to remember more of their legacy than who they are today. Many investors know Coeur as a silver company, but for many years now, most of their revenue and profits have come from gold. Around $7.20, the stock is well below its 2021 highs of around $11.50 and 2016 highs of $16

In Q2 2024, gold sales were $154.1 million, and silver sales were $67.9 million. This makes gold sales almost 70% of revenues. The stock should have responded more to the rising gold price, but as I said, I think investors were still viewing Coeur as mostly a silver company.

That said, they do have large leverage to silver because their resource base they are almost 60% silver. The company is maintaining its full-year production guidance ranges of 310,000 - 355,000 gold ounces and 10.7 - 13.3 million silver ounces. Full-year CAS guidance at Palmarejo and Wharf has been reduced to reflect strong cost management efforts, while Rochester's second-half CAS guidance ranges have been increased to reflect the timing of ounces placed under leach.

Other significant news on the silver front was just a couple of weeks ago, on October 4. Coeeur announced that they entered into a definitive agreement to acquire all of the issued and outstanding shares of SilverCrest pursuant to a court-approved plan of arrangement.

Under the terms of the Agreement, SilverCrest shareholders will receive 1.6022 Coeur common shares for each SilverCrest common share. The Exchange Ratio implies a consideration of $11.34 per SilverCrest common share, based on the closing price of Coeur common shares on the New York Stock Exchange ("NYSE") on October 3, 2024. This represents an 18% premium based on 20-day volume-weighted average prices of Coeur and SilverCrest each as of October 3, 2024.

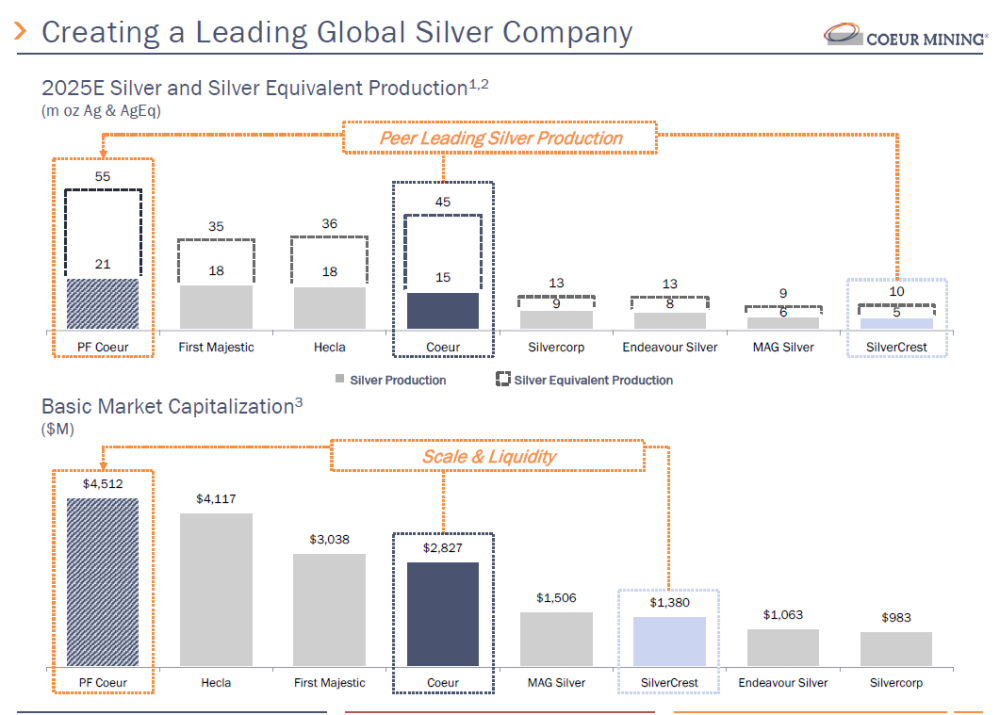

It turns out, this was a very well timed acquisition ahead of the silver price rise and it will make Coeur the world's largest pure silver producer at about 21 million ounces per year. Their silver production should be neck and neck or just a little behind Pan American Silver not shown on this graphic.

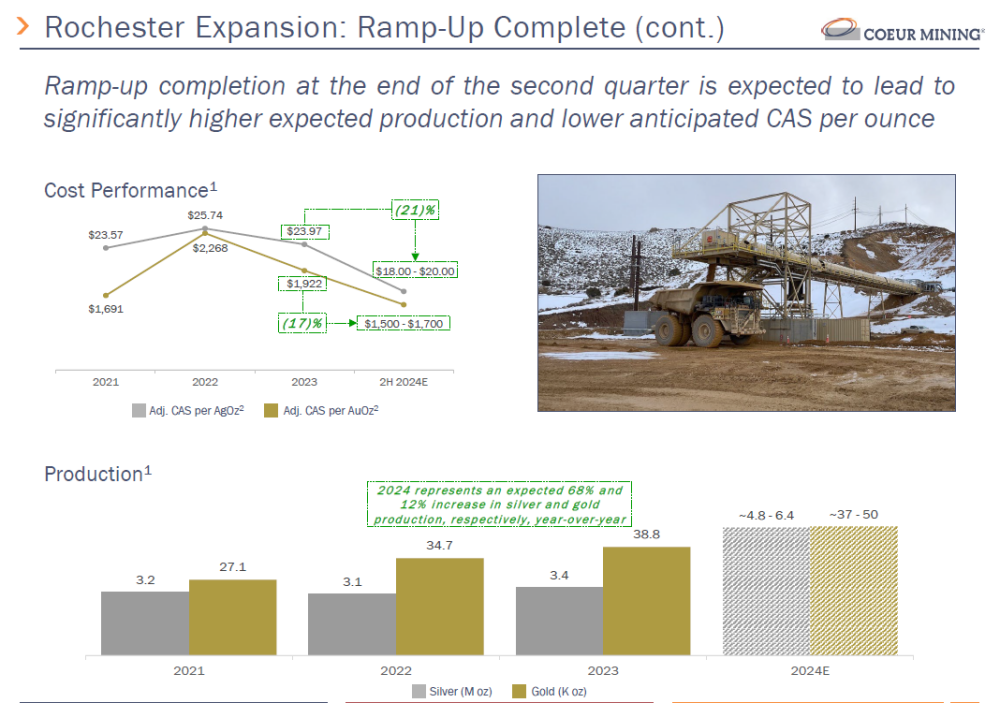

Another key positive fundamental is the expansion of their Rochester Mine this year. In mid-September, they announced that the new three-stage crushing circuit continues to deliver greatly enhanced levels of flexibility to accommodate the full range of mined ore in Rochester.

For the month of August, approximately 2.7 million tons were placed on the new Stage VI leach pad, representing a 39% increase over July placement levels. Rochester remains on track to place 7.0 - 8.0 million tons per quarter during the second half of 2024 and to achieve its full-year 2024 production guidance of 4.8 - 6.6 million ounces of silver and 37,000 - 50,000 ounces of gold.

Rochester is the largest open pit heap leach operation in North America and the largest silver reserve asset in the U.S.

At the end of 2023, Coeur had 3.2 million ounces of proven and probable gold reserves and 243.9 million ounces of silver. At the long-term reference of 60 to 1 ratio, their reserves are 58% silver and 42% gold.

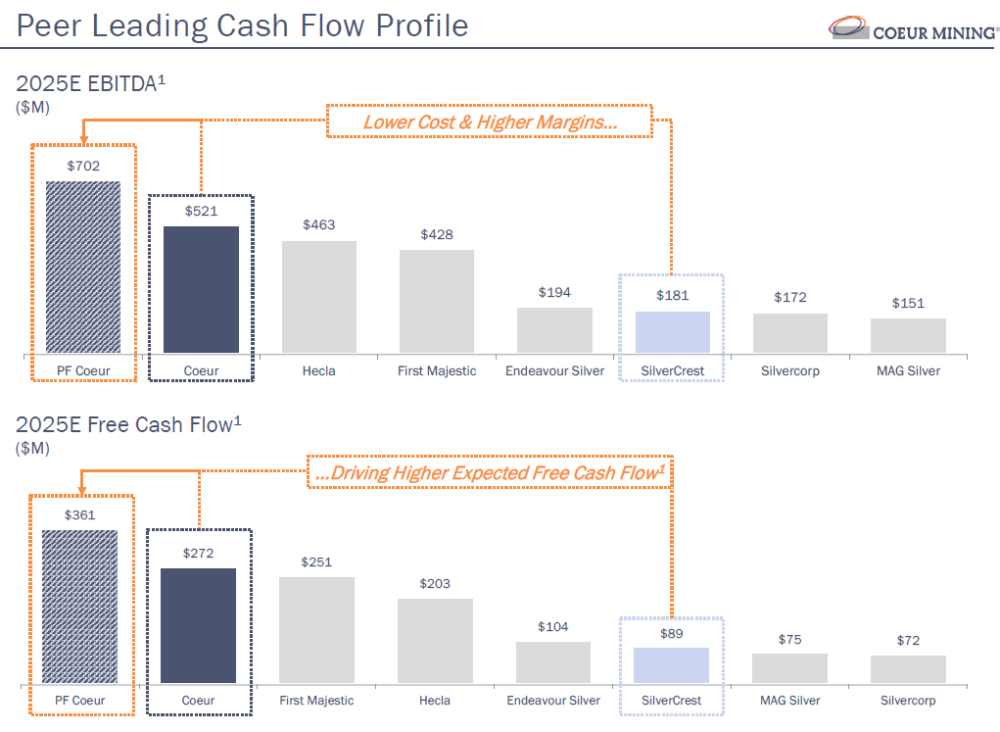

With the significant expansion at Rochester and the acquisition of SilverCrest it will make a significant positive effect to increased profits and cash flow. According to Coeur's presentation, using Factset Street Research data, they will be the leader among peers. The Pro Forma adding SilverCrest is significant. The higher silver price is more gravy on top.

The chart looks good, too. Volume is picking up, and it looks like the stock will break through the resistance area and head to $11.

You can get some more leverage with Call options. Because this is a low-priced stock, I would take advantage of low premiums on long dates. The December 2025 $5.50 Call option is about $2.75 and is $1.87 in the money, so a premium of less than $1.00 for almost 14 months. Nektar Therapeutics (NKTR:NASDAQ)

Nektar Therapeutics

Recent Price - $1.41

Entry Price- $0.68

Opinion - Sell

There is nothing wrong with Nektar Therapeutics (NKTR:NASDAQ), but I am concerned we could get a significant market correction, and I don't like the fact the stock has not done better in a bullish market.

That said, I think this reflects how concentrated this bull market is and does not have good breadth.

The stock is just below cash value but the stock is near resistance on the chart and besides that we have over 100% profits in about 8 months, lets take them.

| Want to be the first to know about interestingSilver,Biotechnology / Pharmaceuticals andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Ron Struthers: I or members of my immediate household or family, own securities of: Couer Mining. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company. This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.