Silver Co. Breaking Out of Large Base to Commence Major Bull Market

Technical Analyst Clive Maund explains why he thinks Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) is a Strong Buy.

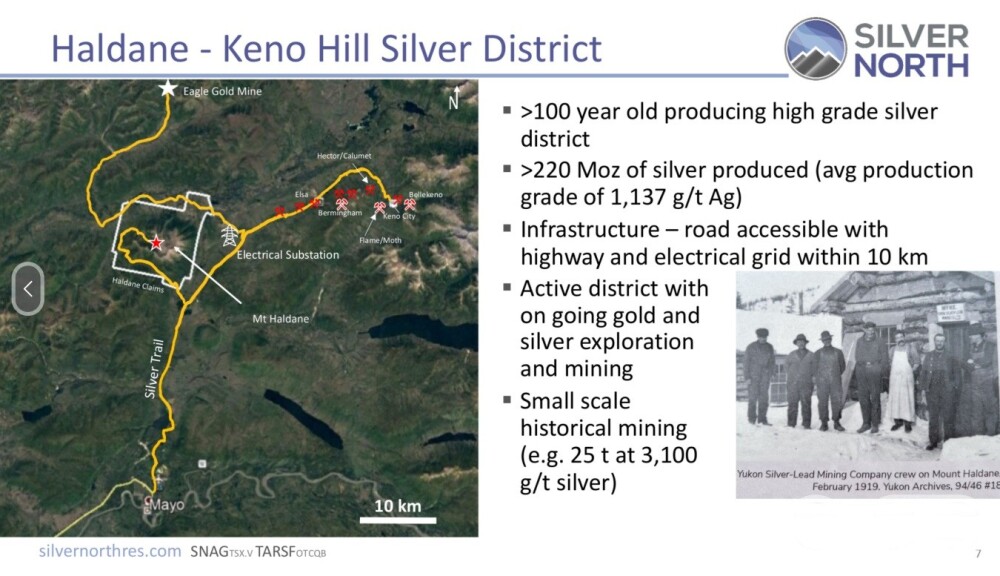

The outlook for Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) could scarcely be better at this time. The company has positioned itself as a leading primary silver explorer in Canada at a time when the silver price is set to explode higher to commence closing the gap with gold. During 2024 a new zone was discovered at the company's flagship Haldane silver project in the Keno District, Yukon Territory, with encouraging drill results being announced in the middle of November, that included 1.83 meters of 1088 grams / tonne silver and this against the background of a 21.5% increase in the silver price (US$23.65 to US$28.90 per ounce) which is now considerably higher.

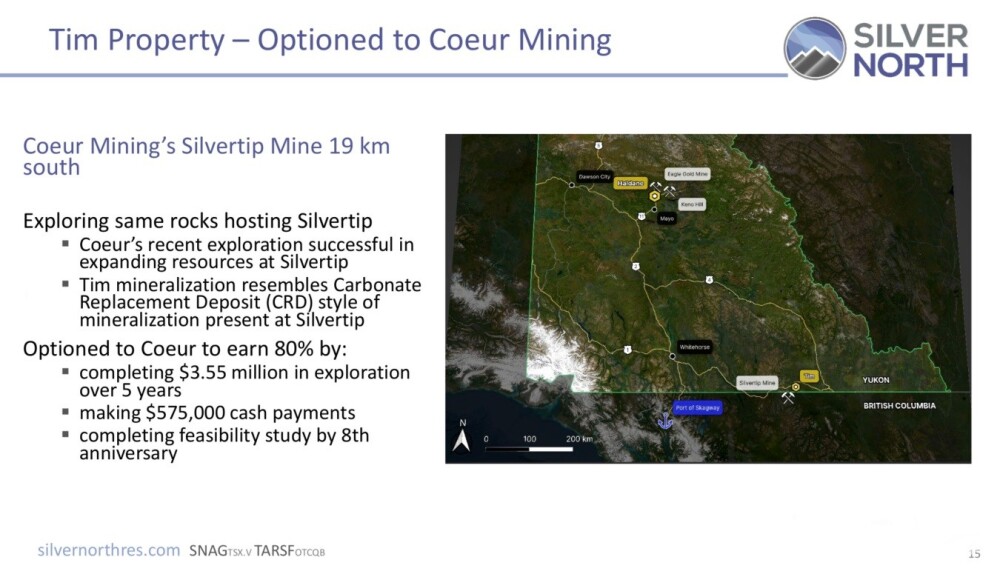

Meanwhile, at the Tim silver project (which is optioned to Coeur Mining), geological evidence observed in drill core has confirmed the presence of a Carbonate Replacement Deposit ("CRD") style system in the emerging Silvertip CRD district of northern BC and southern Yukon. The advantage to the company of major silver company Coeur's involvement is, of course, that Coeur pays for ongoing exploration expenses.

Technically, Silver North Resources' stock is starting to break out from a large base pattern, as we will see when we review its latest charts, at a time when, as mentioned above, the silver price is poised to accelerate dramatically to the upside.

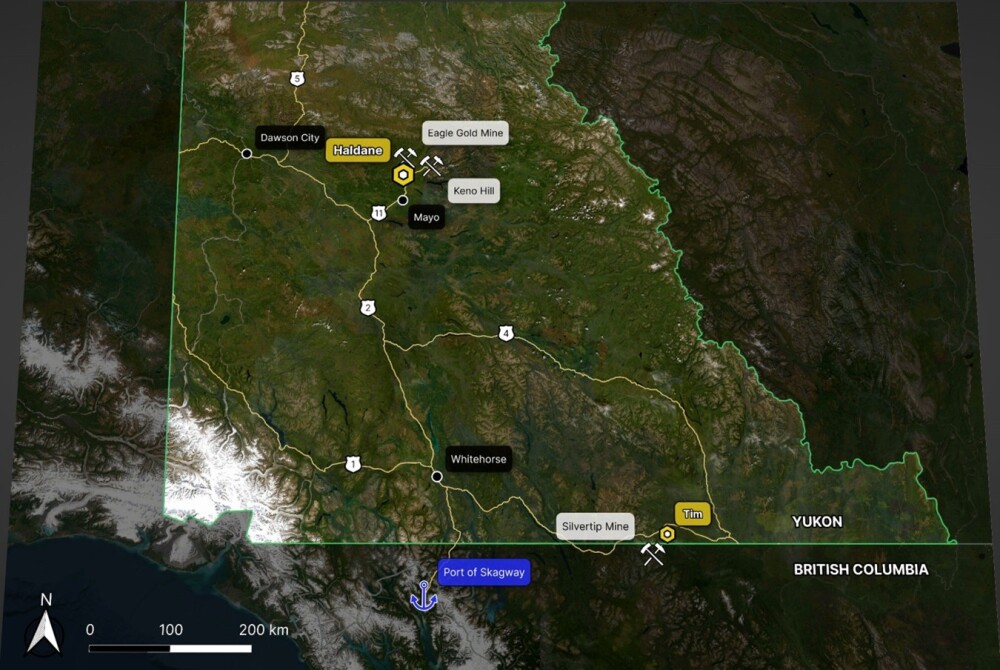

The company's two main properties, Haldane and Tim, are in the Yukon, as shown on the following map from the company's investor deck, with Tim being very close to the border with British Columbia...

This page provides a map and details of the Mt. Haldane - Keno Hill Silver District.

Some details of the Tim Property are below.

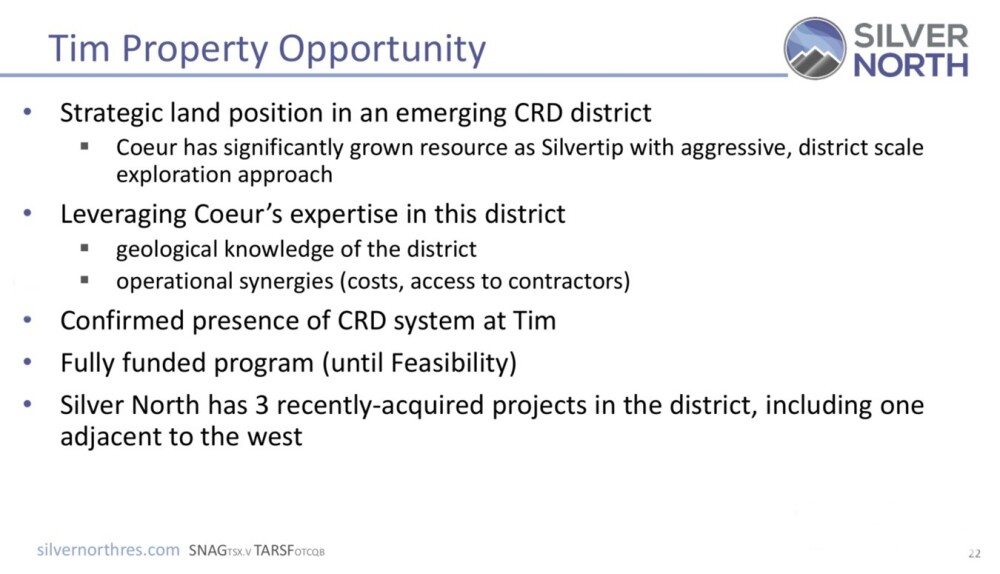

Advantages of the Tim Property are shown here:

Regarding the three recently acquired projects in the district noted at the bottom of the above illustration, during 2024, the company added three claim groups in the Silvertip District, with the addition of the GDR Property. Although at a very early stage of exploration, all three claim groups have characteristics consistent with the presence of CRD-style mineralization.

The Veronica claims adjacent to the Tim Property are host to an untested 450 x 450 meter silver-lead-zinc soil geochemical anomaly with silver values as high as 31 ppm from soil samples. Carbonate rocks have been mapped in the area, making this a promising target for further CRD exploration.

The confidence Coeur Mining has in the potential of the company's Tim Project is demonstrated by the fact that it has been and is funding exploration at the property and it has an option to earn a 51% interest in the Project. The fact that the Tim property is located 19 km northeast of Coeur Mining's Silvertip Project affords logistical advantages.

Coeur will organize follow up drilling this year on the basis of analytical results from the six holes drilled there and using data from the two airborne geophysical surveys (magnetics, radiometrics and mobile MT) carried out last year.

The capital structure of the company is shown below as we can see there are a reasonable 61.2 million shares in issue and as almost half of these are owned by funds, management and large private investors it means that there is a relatively modest 35 million or so shares in the float.

The company has indicated that it will undertake funding exercises in due course to finance further exploration work at Haldane, but given the positive indications to date and the decidedly positive outlook for the silver price this year, these fundings are expected to be well taken up and probably oversubscribed.

Now, we will review the latest charts for Silver North Resources.

In recent weeks, it has become clear that a Head-and-Shoulders bottom is completing in Silver North Resources as shown on its 14-month chart below. This raises the question whether the sharp move up on good volume on the 15th last week constitutes a breakout from this pattern or not, and the answer is that we don't know because it depends on whether the pattern has a downsloping or horizontal "neckline."

If it has a downsloping neckline the black line drawn on the chart - then it did break out last week, but if the neckline is the horizontal band of resistance shown in the CA$0.14 - CA$0.15 zone then it didn't break out, in which case it may spend some more time making more of a Right Shoulder before it does break out.

However, the fact of the matter is that it is not important whether it broke out last week or not, because the positive volume pattern and uptrending Accumulation line indicate that it is only a matter of time, and not much at that, before it does break out and given that we know that silver is headed much higher, that should hardly be surprising. Time is fast running out when it will be possible to buy the stock at this level. The origin of the resistance level shown is selling from some holders who bought above the CA$0.14 level from April through July last year and have sat through a substantial paper loss and now "want out even." Before leaving this chart, note the bullish cross of the major moving averages occurring right now that very often marks the start of a new bull market.

On the 9-year chart, we can see that the 9-month Head-and-Shoulders bottom that we looked at in detail on the 14-month chart has formed at the tail end of a large trading range, which is a base pattern that developed following the severe bear market from the start of 2021 highs above CA$1.20. Breakout from the Head-and-Shoulders bottom should lead to an advance initially to the resistance at the top of this range in the CA$0.24 - CA$0.28 zone, and there is no reason why, once it clears this resistance, it should not run at the 2020 - 2021 highs.

The volume buildup over the past year is viewed as bullish because it means that there has been a high degree of stock rotation that we can reasonably presume is from weaker to stronger hands. The uptrending Accumulation line is bullish, and the neutral MACD shows that there is a lot of upside potential from here.

Lastly, we will take a quick look at the very long-term 14-year chart, which, while technically useless, is interesting as it reveals that the stock has traded at vastly higher prices in the distant past as it did at the end of the great 2000's PM sector bull market and even if it only got a half or a third of the way back to those highs, we are talking about huge percentage gains from the current price.

The conclusion is that Silver North is now starting to break out into a major bull market, and it is rated a Strong Buy for all time horizons. The first target for an advance is CA$0.25 - CA$0.27. The second target is at about CA$1.00 with higher target possible.

Silver North Resources' website.

Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) closed for trading at CA$0.12, US$0.08 on April 24, 2025.

| Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd. Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.