Silver Does it Again! Severe Consequences / Commodities / Gold and Silver 2018

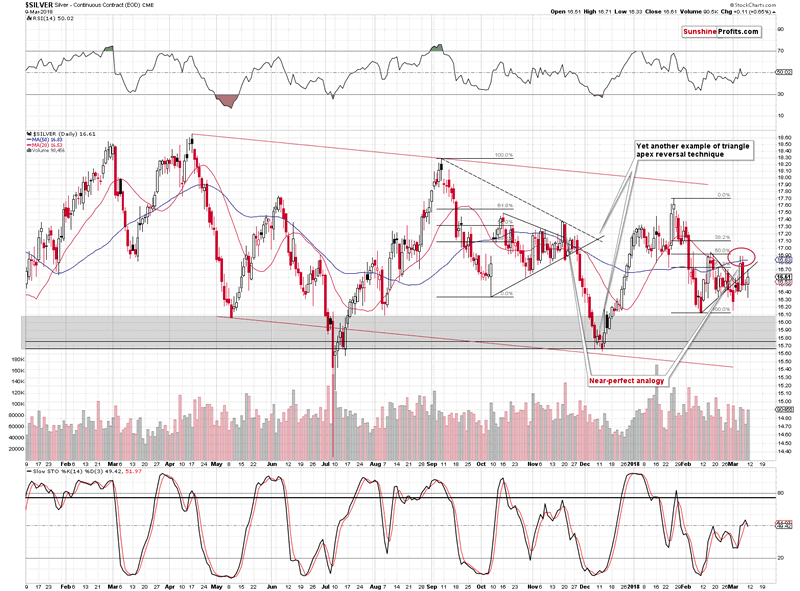

Inthe free analysis that we posted lastMonday,we warned that Friday’s session was likely to be volatile and tricky. Thisseems to have indeed been the case for silver. The white metal declined earlyin the day only to rally almost 40 cents from the initial low. In our previousalert, we discussed the possibility of silver topping at about $16.65 and thislevel was reached. Is silver about to take a dive just like it did in lateNovember 2017?

Inthe free analysis that we posted lastMonday,we warned that Friday’s session was likely to be volatile and tricky. Thisseems to have indeed been the case for silver. The white metal declined earlyin the day only to rally almost 40 cents from the initial low. In our previousalert, we discussed the possibility of silver topping at about $16.65 and thislevel was reached. Is silver about to take a dive just like it did in lateNovember 2017?

Inshort, yes. That seems very likely, especially in light of the multiplelong-term and short-term factors and we have received a strongbearish confirmation earlier this week. However, we need tosupplement the above with a caveat – the decline may not start immediately, butin a few days. Why? Because of the proximity to the triangle apex reversalalong with the lack of a visible rally on Friday suggest that we may still be a day or two away from thetop.

Thekey word from the above paragraph is may.The mentioned combination of bearish signs could be immediately followed by abig slide. That’s how silver performs quite often right after a session duringwhich it outperformed.

SilverRepeats Itself for Those Who Were Not Listening

November 17, 2017 and March 6,2018 serve as good examples.

Consequently, we were and stillare in a situation when the white metal could either decline sharply right awayand move significantly lower or it could move up just a little and then declinesharply anyway. In our opinion, waiting to open a short position for evenbetter prices seems to be a gamble in a game in which the odds are reallyagainst us. If we’re about to profit from the $1+ slide in silver, then thepossibility of seeing another 10-20 cent upswing while risking missing a50-cent initial (or so) decline just doesn’t seem to be worth it.

While we’re discussing the abovechart, please note that the Stochastic indicator just flashed a sell signal,confirming our analysis.

Gold’sSeemingly Bullish Reversal

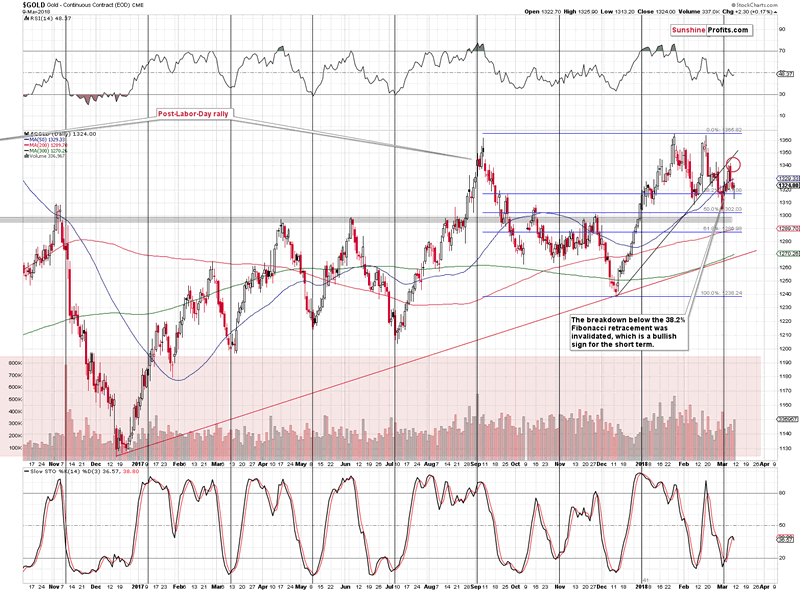

What’sparticularly interesting is that gold formed a bullish reversal after breakingbelow the 50-day moving average. Looks familiar? It should as we saw somethingsimilar not too long ago - on December 1st, 2017. That was the session thatfollowed the breakdown below the 50-day moving average after the final top.Friday was also the day that followed the breakdown below the 50-day movingaverage after (what’s likely to have been) the final top.

Single-dayanalogies are generally not very reliable (more similar cases with a certainoutcome are generally needed for the implications to become important), butit’s something worth keeping in mind anyway. Especially that it fits theperformance that we often see close to the release of important economic data.

Backon December 1st, gold moved higher, erasing most of its recentshort-term downswing, but ended the session only a bit higher, forming a majorreversal. If we see something similar in the next few days, gold could move toapproximately $1,335 before declining. Again, based on silver’s outperformance,it’s a big “perhaps”.

Asa reminder, we expect to see a turnaround based on the very important trianglereversal pattern. Wedescribed it in detail onFebruary 26th. To be precise: theturnaround based on the above has likely happened on Friday or is about to takeplace in the next few trading days. Let’s say that the reversal is highly likely to be seen before the end of Wednesday’ssession.

Aswe emphasized in Friday’s intraday follow-up, the fact that silver moved a fewcents above itstarget level and gold didn’t even move close to it served as a strong bearish sign, as itwas a clear sign of silver’s very short-term outperformance – something thatoften precedes big declines.

Still,we have seen a move back up in gold and a close below the 50-dayMA,which makes the session similar to the above-mentioned December 1st,2017 session. The implications thereof are bearish and they seem to cancel anybullish implications that could result from the reversal itself.

Moreover,please note that just as it is the case in silver, Stochastic based on goldalso flashed a sell signal.

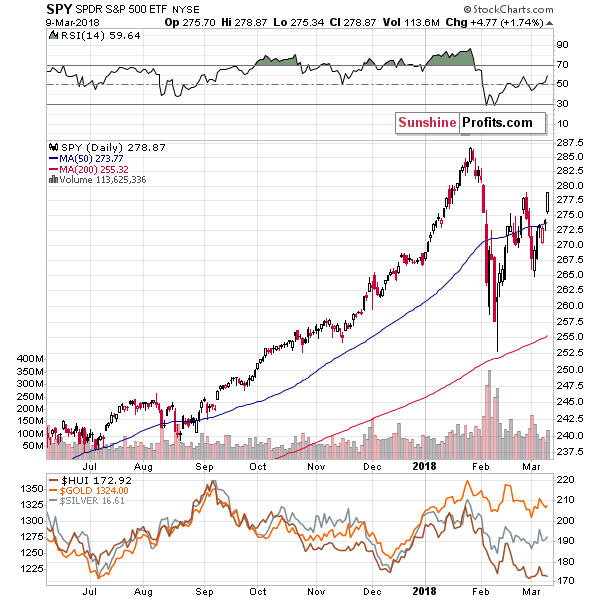

So,gold closed a bit higher and the general stock market moved higher decisively,so one might have expected goldstocks to rally as well. What happened?

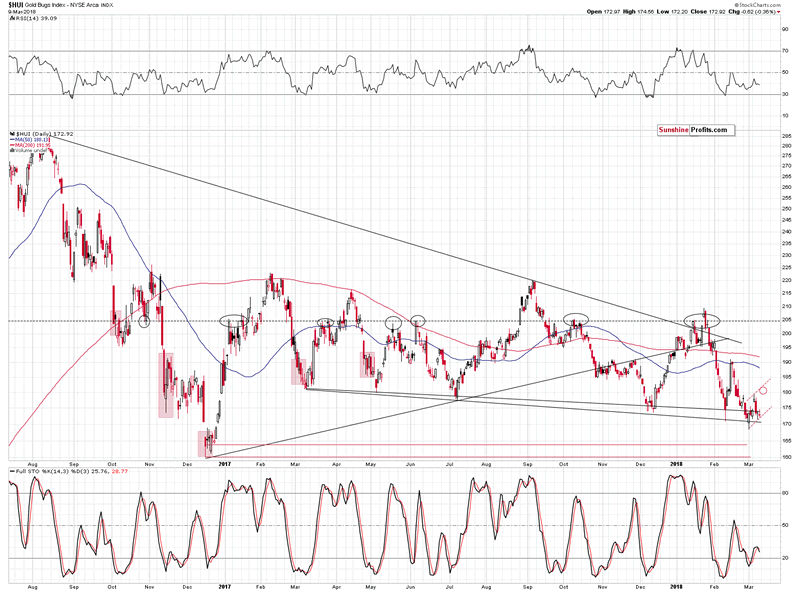

GoldStocks’ Bearish Reversal

Thegeneral stock market moved higher on Friday, so some may say that this is thefactor behind silver's outperformance, nothing else. If this was the case,mining stocks should have been reacting as well, but they were not.

Assumingthat the reason behind silver's and miners' performance was the general stockmarket, we have lagging mining stocks, which is bearish.

Assumingthat the generalstock market was not the reason for silver's and miners' performance, we have outperformingsilver, which is bearish anyway.

Afterthe closing bell, it turned out that goldmining stocks actually moved lower. There was an initial upswing, but itfailed to hold ground despite the strength and the continuation of the rally inthe S&P 500. That’s exactly what weakness looks like – miners only had thestrength for the initial rally. The buying power was gone before the end of thesession and the price fell.

It’skind of funny to see reversals in both: gold and gold stocks but in theopposite directions. Yet, that’s exactly what we saw and this is another reasonnot to take gold’s reversal at face value.

Thesell signal from the Stochastic indicator is present also in the case of the HUIIndex,so it seems that we can view it as confirmed (gold, silver and mining stocksall feature the same signal).

Incase you are wondering, the red ellipse on the above chart doesn’t mark thelikely short-term target for gold stocks, but the maximum likely one in case wesee another small move higher before the bigger slide.

Overall,based on the precious metals’ and mining stocks’ price movement, it seems thatwe should see much lower values shortly (perhaps even immediately).

Thecurrency sector, however, doesn’t provide crystal-clear indications and it’ssomething that could postpone the decline.

TwoHeads, Four Shoulders, One Uncertainty

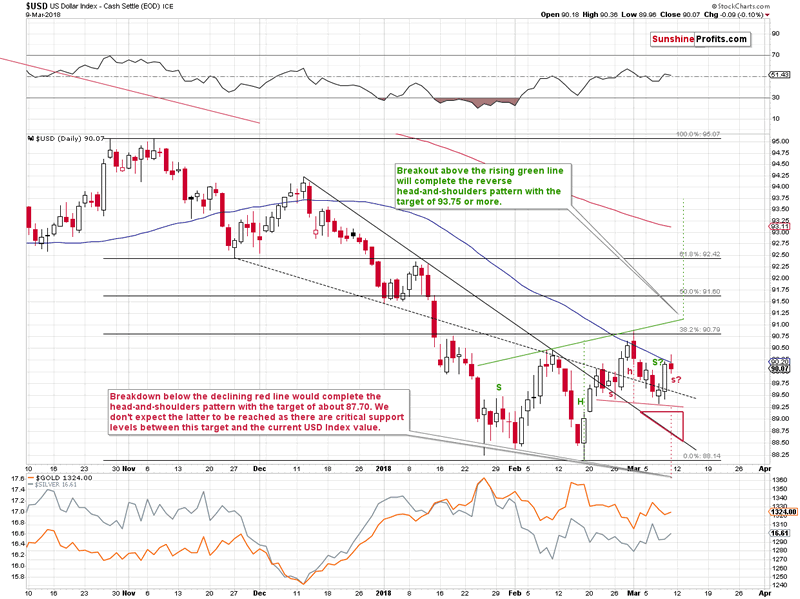

Thebiggest factor determining the prices of precious metals in the near term isusually the USD – after all, how could something move independently from thecurrency that it’s priced in. This observation is critical as the USD Indexitself is in a rather specific place and whichever way the USD Index breaksout/down will determine the next move in the currency and in the preciousmetals market.

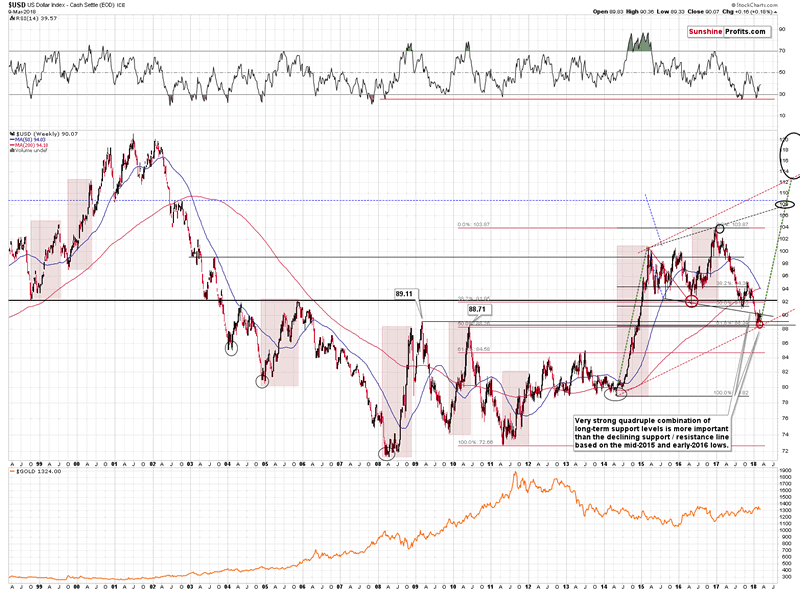

Inour previous analyses, we emphasized that theUSD Index was above a combination of very strong support levels and the bigpicture remained bullish. Consequently, the surprises were likely to be to theupside. Thursday’s price action was indeed a surprise to the upside. TheUSD Index could have declined all the way to our triangle target area, butinstead it moved higher sooner. But, does it mean that the final bottom wasalready formed?

No,there’s still a chance that we’ll see another downswing before the correctivedownswing is over. This chance decreased as the jobs report was alreadyreleased and the uncertainty regarding it is now gone.

Still,let’s keep in mind that a breakdown below the 89.30 level (the red supportline), would complete a short-term head-and-shoulderspattern (marked in red) and this would open a way to a move back to the February lows.Technically, it would mean that 87.70 is the next target, but the strength ofthis technique is much smaller than the strength of the multiple long-termresistance levels that are present around the January and February lows.

Still,on a short-term basis, a move below 89.30 would very likely be followed by adecline to about 88.70 – the declining black support line and the bottom partof our red triangle target area. This is the less likely outcome.

Themore likely outcome is the one in which instead of a decline, we see a rallyabove 91.15 or so (depending on when the USD breaks the rising green resistanceline) is likely to be followed by a big rally to almost 94 (to 93.80 or so).This move will be extremely important and it’s not because it will be the firstbig rally in several months. It will be critical because it will be a crystal-clear sign that the small breakdownbelow the very long-term declining support / resistance line is invalidated. Youcan see this line on the below chart:

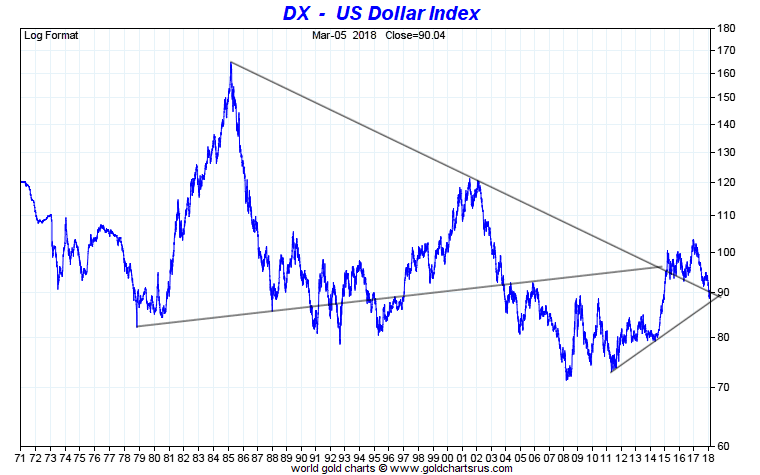

Let’sstart the analysis of the very long-term USD picture with the very long-termdeclining resistance / support line. It served as resistance but was broken inearly 2015 and it has served as support since that time. It was touchedtemporarily and even broken, but all these breakdowns were small and followedby big comebacks shortly. Interestingly, each of the small breakdowns wasfollowed by a bigger upswing than the previous one.

Atthis time the declining support line is at about 90, which is approximatelywhere the USD is currently trading, so it seems that yet another – perhapsfinal – verification of the 2015 breakout is in progress.

Theimplications are already bullish based on the above analogy and they will beextremely bullish once the USD closes visibly above the 90 level for a fewweeks in a row, definitely confirming the comeback. That’s what seems verylikely to be seen later this month, but not necessarily this week.

What’sjust as important, the above USD Index chart features two triangle patternsthat are based on the key, long-term, declining support / resistance line.These are the only two triangles that we can really draw (at least the onesthat make sense) based on it. One has an apex in the past and one in thefuture. The apex from the past took place at the key 2014 bottom – it was thebottom that started the huge rally that took the index above 100.

Theonly time when the triangle apexreversal technique had the chance to prove useful, it did, so we havea good reason to view it’s second indication as very important. After all, it’sbased on major long-term highs and major long-term lows.

Whatdoes the second apex predict? A veryimportant turnaround a few months before the end of the year.

Ifthe USD is currently verifying a long-term breakout and it’s likely to have animportant turnaround in 6 months or so, then we are likely looking at a start of a huge medium-term rally.Naturally, the implications for the precious metals market are bearish for thefollowing months.

Summary

Summingup, a major top in gold, silver and mining stocks is probably in, and based onthe way silver and gold stocks performed on Friday, it seems that the bigdecline is just around the corner. We already saw the key short-term signs:silver’s outperformance and miners’ underperformance on Tuesday, and the factthat they were repeated on Friday makes the bearish outlook even more bearish,especially that our lastweek’s upside targets for gold and silver were alreadyreached.

If you enjoyed the above analysis and would like toreceive free follow-ups, we encourage you to sign up for our gold newsletter –it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. Ifyou sign up today, you’ll also get 7 days of free access to our premium dailyGold & Silver Trading Alerts. Signup now.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.