Silver Doesn't Care, but You Should / Commodities / Gold & Silver 2023

While callingthe top is a process that plays out over time, silver’smomentum has fizzled, and the next major move should be to the downside. Toexplain, we wrote on Apr. 21:

While callingthe top is a process that plays out over time, silver’smomentum has fizzled, and the next major move should be to the downside. Toexplain, we wrote on Apr. 21:

Theblue line above shows how silver often peaks in mid-to-late April, withsubstantial weakness following until the end of June. In a nutshell: May and June are when the white metal hassuffered its worst historical performance.

Also, the first red circle shows howafter a small rally near the end of April, it’s largely downhill until July.Consequently, when you combine theseasonality implications with silver’s ominous technical and fundamentaloutlooks, the bears should feast over the medium term.

On top of that, silver isan attractive pairs trading short.

Please see below:

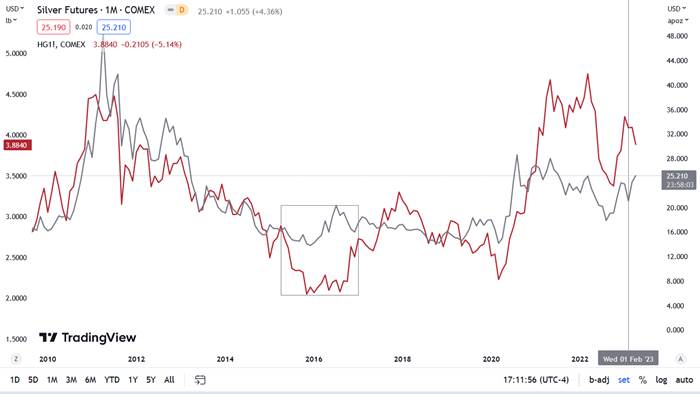

To explain, the red line above tracks thedaily copper futures price, while the gray line above tracks the daily silverfutures price. If you analyze the relationship, you can see that the pair havelargely moved in lockstep since late 2021. And with copper trading near its March lows, silver’s outperformance islikely living on borrowed time.

To further emphasize the point, pleasesee the pair’s relationship on the monthly chart:

To explain, the box in the middle showshow when silver decoupled from copper in 2015-2016, the white metal ralliedfrom ~$16.70 to ~$20.35. Yet, five months later, it declined to ~$16 and gaveit all back. As such, if you analyze the vertical gray line on the right sideof the chart, you can see that the white metal’s strength contrasts copper’sweakness. And with a meaningfulrally already in place, silver’s current price looks more like the 2016 peakthan the beginning of a new bull market.

So, with silver’s tailrisk heavily skewed to the downside, we believe that betting onhigher prices offers much more risk than reward.

Fade the Rate-CutNarrative

In addition, while the crowd expectsrate cuts in the months ahead, the data does not support their dovishdisposition.

Please see below:

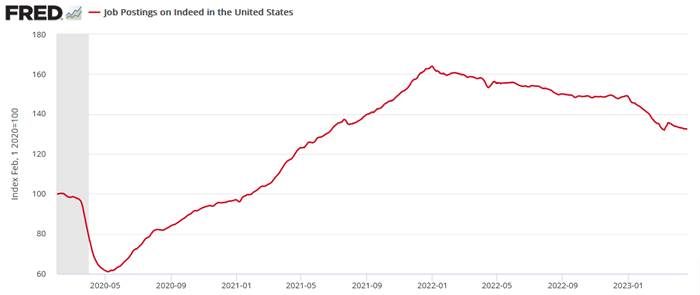

To explain, job postings on Indeed roseslightly last week (updated on Apr. 26), and the current figure remains abovethe Mar. 9 low. And while job openings had declined sharply in early 2023, thedownward momentum has stopped, and the metric is ~33% above its pre-pandemictrend. Consequently, the Fed still has aninflation problem, and wage growth is unlikely to subside until jobopenings decline materially.

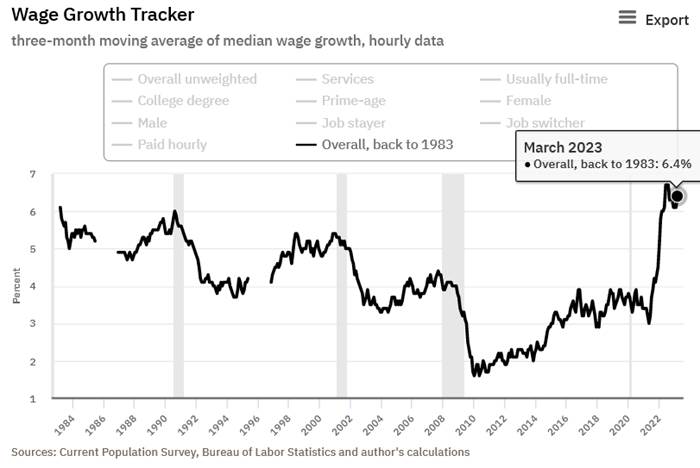

Speaking of which, the Atlanta Fedupdated its Wage Growth Tracker on Apr. 13. And with the metric increasing from6.1% in February to 6.4% in March, it's only 30 basis points away from itsall-time high (dating back to 1983) set in June, July and August 2022.

Please see below:

Furthermore, withearnings season supporting the inflation thesis, companies continueto raise prices at the expense of volume. And with the gambit going on for morethan two years, the trend should continue until interest rates are high enoughto suppress demand.

Please see below:

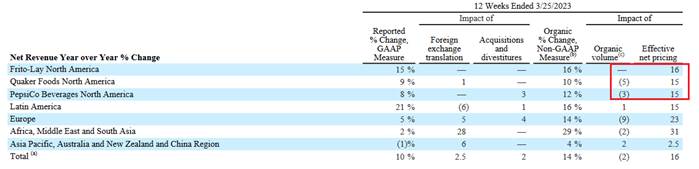

To explain, PepsiCo released itsfirst-quarter earnings on Apr. 25. The beverage giant reported flat, and volumedeclines, in its North American segments, while prices rose by 15% and 16%,respectively.

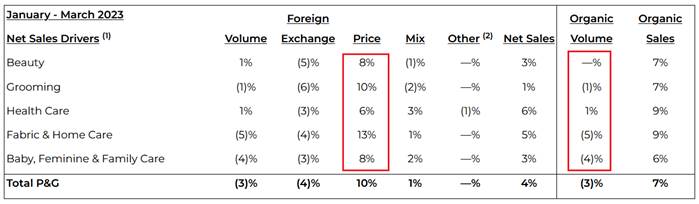

Showcasing similar results, Procter &Gamble (P&G) reported its third-quarter earnings on Apr. 21. And withvolume down across three of its five segments, price increases of 6% to 13%drove its revenue growth.

Please see below:

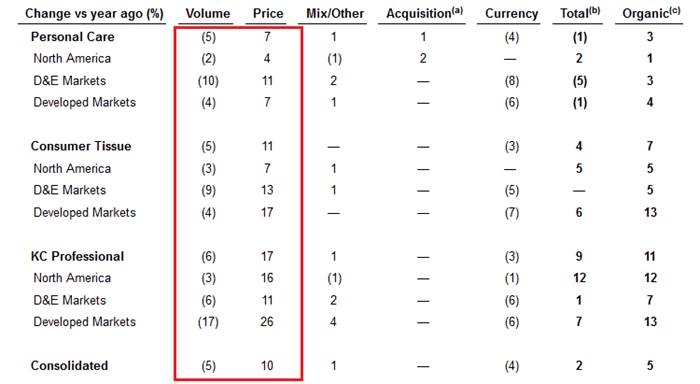

Finally, Kimberly-Clark reported itsfirst-quarter earnings on Apr. 25. And surprise, surprise, volumes declinedacross the board, while price increases of 4% to 16% in North America upliftedthe top line.

Please see below:

Overall, silver confronts a treacherousmedium-term backdrop, as the fundamentals, technicals and seasonality arebearish. What’s more, the crowd ispricing in rate cuts at a time when wage inflation is rising and corporaterevenues are still buoyed by price increases. Consequently, the whitemetal should endure a substantial re-pricing in the months ahead.

Can the CPI fall to 2% if majorcorporations raise their prices by much more?

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.